Guidelines for financial institutions

For the first time, US financial regulator FINRA has included a section on crypto assets in its annual report. This document provides comprehensive guidelines on regulatory, compliance, and oversight practices and policies regarding the handling of cryptoassets in the financial industry.

Source: FINRA

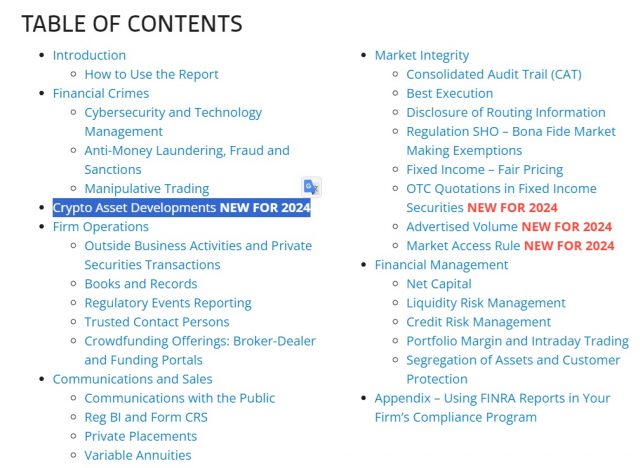

The 2024 FINRA Annual Regulatory Oversight Report will include a total of 26 topics. This is an annual event that provides member companies with advice on how to avoid problems.

While the SEC (U.S. Securities and Exchange Commission) has not yet established clear guidelines regarding crypto assets, FINRA provides its member companies with compliance advice based on the SEC’s existing rules and guidelines. providing.

This includes private placement of crypto-asset securities, operation of alternative trading systems (ATS) for crypto-asset securities, and custody services for crypto-asset securities under special purpose broker-dealer (SPBD) policies. ing.

connection:US FINRA considers updating virtual currency regulations

Trend of compliance violations in crypto asset advertising

The report specifically focused on retail communications, noting that “crypto-asset-related retail communications reviewed by FINRA’s Advertising Regulation Division have higher non-compliance rates than other products.”

In addition, the section on market abuse of crypto-asset markets notes that differences in the market structure of crypto-assets may give rise to further forms of market abuse. This may be related to the structural differences between centralized and decentralized exchanges.

Additionally, FINRA emphasized that malicious hackers and fraudsters continue to be involved in the crypto asset space, stating that “malicious actors are using manipulative schemes such as those found in low-value securities to “It is exploiting investor interest in crypto assets and blockchain technology.”

The Crypto Section is aimed at companies that are currently engaged in, or intend to engage in, crypto-related business, and member companies are interested in non-securities crypto assets, crypto-related external business activities of related persons, private securities transactions, and crypto mining operations. FINRA requires them to notify FINRA if they engage in such activities.

The US government has begun to become more actively involved in digital assets and their regulation. On the 8th, the U.S. Commodity Futures Trading Commission (CFTC) Digital Assets/Blockchain Technology Subcommittee released a comprehensive report on DeFi (decentralized finance).

The report called on Congress, state legislatures, and the CFTC to engage with industry to develop appropriate policies for digital assets.

connection:US CFTC releases comprehensive report on DeFi, calls for policymakers and industry dialogue

The post US FINRA adds virtual currency section to annual report appeared first on Our Bitcoin News.

1 year ago

79

1 year ago

79

English (US) ·

English (US) ·