top News

Cryptocurrency exchange Binance mistakenly stored some of the collateral for its own cryptocurrencies in wallets along with customer funds, Bloomberg said on Jan. 24, according to a company spokesperson. quoting the statement of

Binance has issued 94 tokens called “Binance-Peg Tokens” (B Tokens), and reserves for about half of those tokens are stored in a cold wallet called “Binance 8”. It is said that

According to Bloomberg, the wallet contains more assets than needed for issued B tokens. Since B tokens are supposed to be collateralized on a one-to-one basis, the excess represents a mix of customer assets, Bloomberg said.

“Collateral assets were previously mistakenly transferred to this wallet and listed on the B Token Proof of Collateral page. Binance is aware of the mistake and has are in the process of being moved to a dedicated collateral wallet,” a company spokesperson said, adding that assets stored on Binance “have been and will always be collateralized 1:1.”

“Essentially, this means that client assets and collateral are not segregated. Lack of funds or liquidity on exchanges may prevent users from making withdrawals,” said CEC Capital’s cryptocurrency trading advisor. said Laurent Kssis.

Market trend

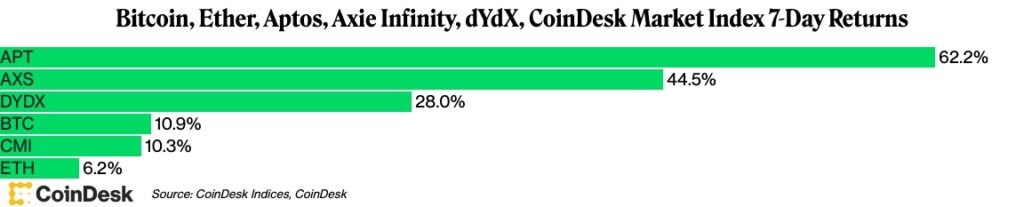

Source: CoinDesk Research

Source: CoinDesk ResearchBitcoin (BTC): Rise by 0.4% in 24 hours, around $ 23,000 (at 13:00 on the 25th of Japan time, it fell slightly to around $ 22,600). Bitcoin options trading volume on cryptocurrency options exchange Deribit soared to $4.25 billion last week, the highest since FTX collapsed in early November.

Ethereum (ETH): Down 0.8% in 24 hours, near $1615. Ethereum has once again become a deflationary asset, with its net issuance rate, or annualized inflation rate, falling to minus 0.07%, according to data from ultrasound.money.

Axie Infinity (AXS), dYdX (DYDX), Aptos (APT): These crypto assets are showing strength against unlocks that are usually perceived as bearish events. Axie Infinity is up 40% ahead of its $64 million worth of unlocks, while DYDX is up 64% despite unlocking on February 2nd. Aptos is also up 262% year-to-date.

stock market: Stock markets are mixed as companies report fourth-quarter earnings. The Dow Jones Industrial Average rose 0.31%, while the S&P 500 dropped 0.07% and the Nasdaq dropped 0.27%.

latest price

● CoinDesk Market Index (CMI): 1,077.84, -1.1%

Bitcoin: $22,874, -0.4%

Ethereum: $1,594, -2.4%

● S&P500: 4,016.95, -0.1%

Gold: $1,939, +0.6%

10-Year US Treasury Yield: 3.47%, -0.1

market analysis

Bitcoin and Ethereum trading ranges are starting to narrow as both try to establish new support ranges. After last week’s gains of 8%, 5%, it has yet to rise above 1% in the last four days.

Bitcoin rose 0.4% on the 21st, fell slightly on the 22nd, rose 1% on the 23rd and 24th, and rose 0.09% on the 24th. Ethereum has made similar moves.

The Bitcoin chart shows a new support level forming near $22,900.

Source: TradingView

Source: TradingView|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: CoinDesk

|Original: Crypto Markets Today: Bitcoin Moves Sideways at $23K

The post [US market]Bitcoin falls slightly below $ 23,000 | coindesk JAPAN | coin desk Japan appeared first on Our Bitcoin News.

2 years ago

105

2 years ago

105

English (US) ·

English (US) ·