top story

A 116-page list of FTX creditors was filed by the company’s lawyers on January 25 as part of bankruptcy proceedings. There are names of companies such as Netflix and Apple, and we can see the magnitude of their influence once again. There are also names for media companies, universities, airlines, charities, and more.

At a hearing in early January, the court allowed the names of individual creditors to be withheld for three months, but requested a list of institutional investors.

Media companies such as The Wall Street Journal, Fortune, Fox Broadcasting, and CoinDesk, as well as major cryptocurrency companies such as CoinbaseN and Binance, are included. CoinDesk has virtually no receivables and is on the list for “technical reasons” regarding the failure to run an ad on a podcast it signed in the fall, a CoinDesk spokesperson said.

Other names include American Airlines, Spirit Airlines, Southwest Airlines, Stanford University, its credit union, and even the charity founded by supermodel Gisele Bündchen. Bündchen’s ex-husband, former NFL superstar Tom Brady, is known to have invested in FTX and starred in the company’s Super Bowl commercial.

latest price

● CoinDesk Market Index (CMI): 1,087.49, -1.3%

Bitcoin: $23,020, -0.3%

Ethereum: 1,604, +0.3%

● S&P500: 4,060.43, +1.1%

Gold: $1,930, -0.6%

● US 10-year yield: 3.49%, 0.0

Market trend

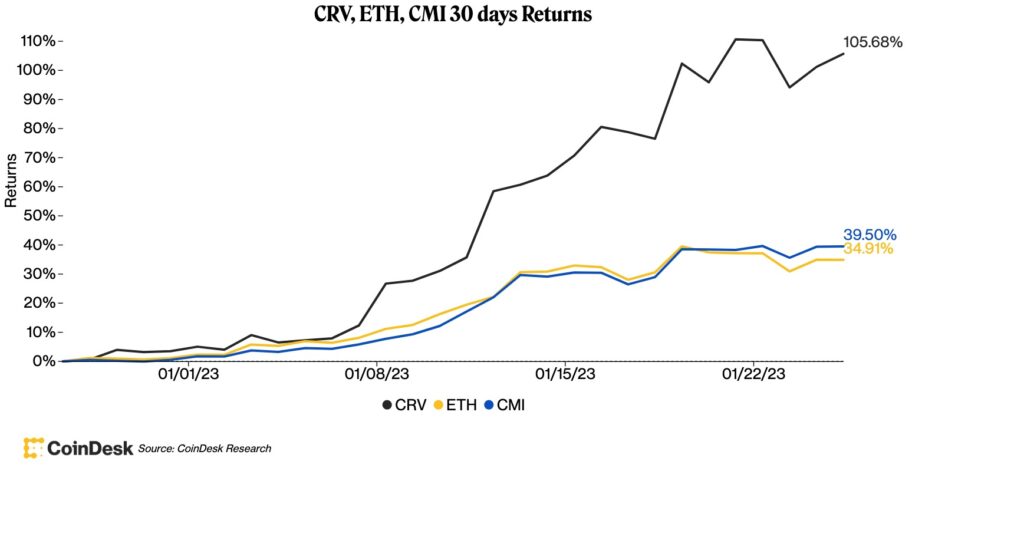

(CoinDesk Research)

(CoinDesk Research)Bitcoin (BTC): Down 0.6% in 24 hours, near $23,000. It’s up about 40% since the start of the year, and if history is any guide, the recent rally is similar to the one in mid-2019 and could be much higher.

Ethereum (ETH): Almost flat in 24 hours, around $1600.

Conflux (CFX): Layer 1 blockchain, Conflux native token surged 106% in 24 hours to near 6 cents after announcing support for China’s version of Instagram, Little Red Book . Xiaohongshu’s 200 million users will be able to display NFTs issued on Conflux on their profile pages.

stock market: Equity markets rallied on solid growth in US GDP. The Nasdaq rose 1.7%, the S&P 500 1.1% and the Dow Jones Industrial Average 0.6%.

market analysis

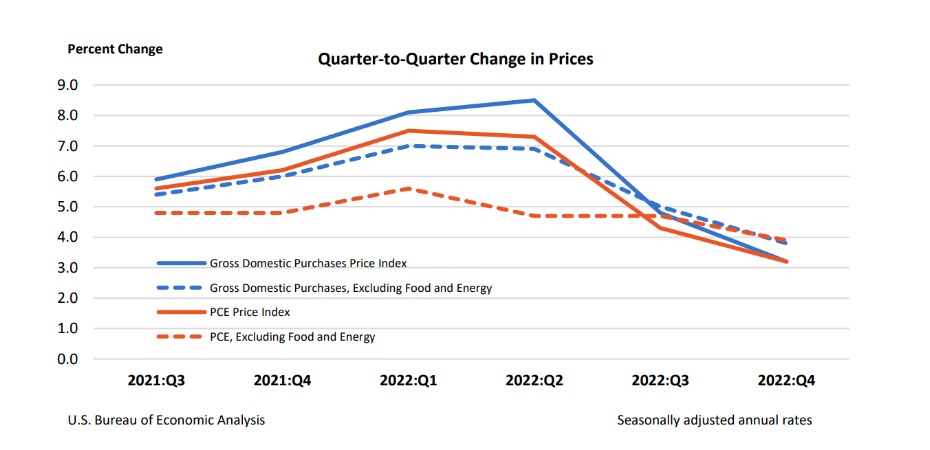

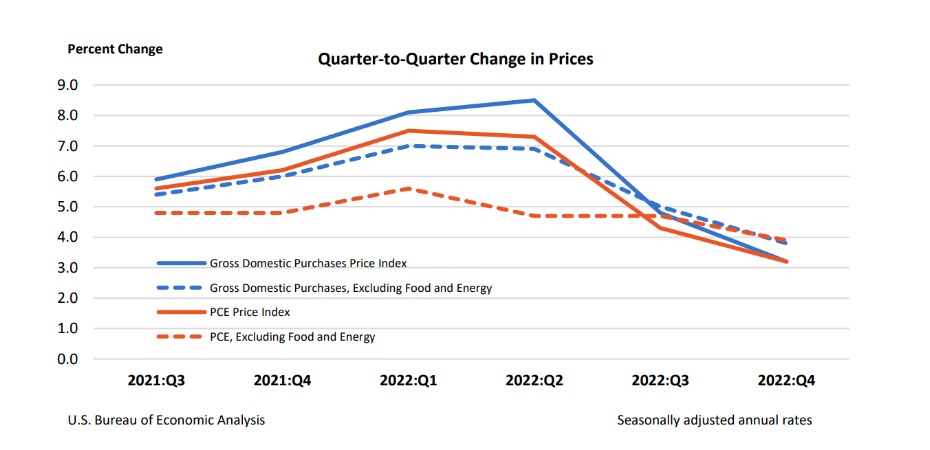

The U.S. Department of Commerce released its Gross Domestic Product (GDP) figures for the fourth quarter of 2022. Although the annual rate of increase was 2.9%, down from 3.2% in the third quarter, it exceeded the previous forecast and supported the rise of the crypto asset market.

Financial markets appear to be reacting positively to the latest data, including lower-than-expected initial unemployment claims. ‘Real disposable income’, which measures personal income, rose 3.3%, while gross domestic purchase prices rose 3.2%, down from 4.8% in the third quarter.

Personal consumption also rose by 2.1%, below the expected 2.5% increase, showing signs of an economic slowdown. With consumer spending accounting for 70% of GDP, risky assets, especially crypto investors, should be wary of market weakness in the coming months.

(U.S. Department of Commerce, Bureau of Economic Analysis)

(U.S. Department of Commerce, Bureau of Economic Analysis)|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: CoinDesk

|Original: Crypto Markets Today: Bitcoin Clings to $23K, FTX’s Creditor List Revealed

The post [US market]Bitcoin near $ 23,000 ─ Netflix, Apple, Binance, etc. on FTX creditor list | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

266

2 years ago

266

English (US) ·

English (US) ·