top News

Former FTX CEO Sam Bankman-Fried wrote a lengthy statement to newsletter service Substack on the 12th, denying that he hid billions of dollars and offering his views on how FTX collapsed. .

The former CEO denied having obtained the funds illegally, arguing that FTX and sister company Alameda Research collapsed due to a significant downturn in the cryptocurrency market and inadequate hedging strategies on Alameda’s part.

“I’m not stealing money, I’m not hiding billions,” the former CEO said, concluding that “Alameda didn’t hedge well enough and suffered losses when the market crashed.” “I have not been involved in the management of Alameda for several years,” he said.

The former Bankman-Freed CEO faces numerous federal criminal charges, including conspiracy to commit fraud, and is currently out on bail at his parents’ home in California. The former CEO has pleaded not guilty, but his close associate, former Alameda CEO Caroline Ellison, pleaded guilty to fraud and is cooperating with federal prosecutors.

Market trend

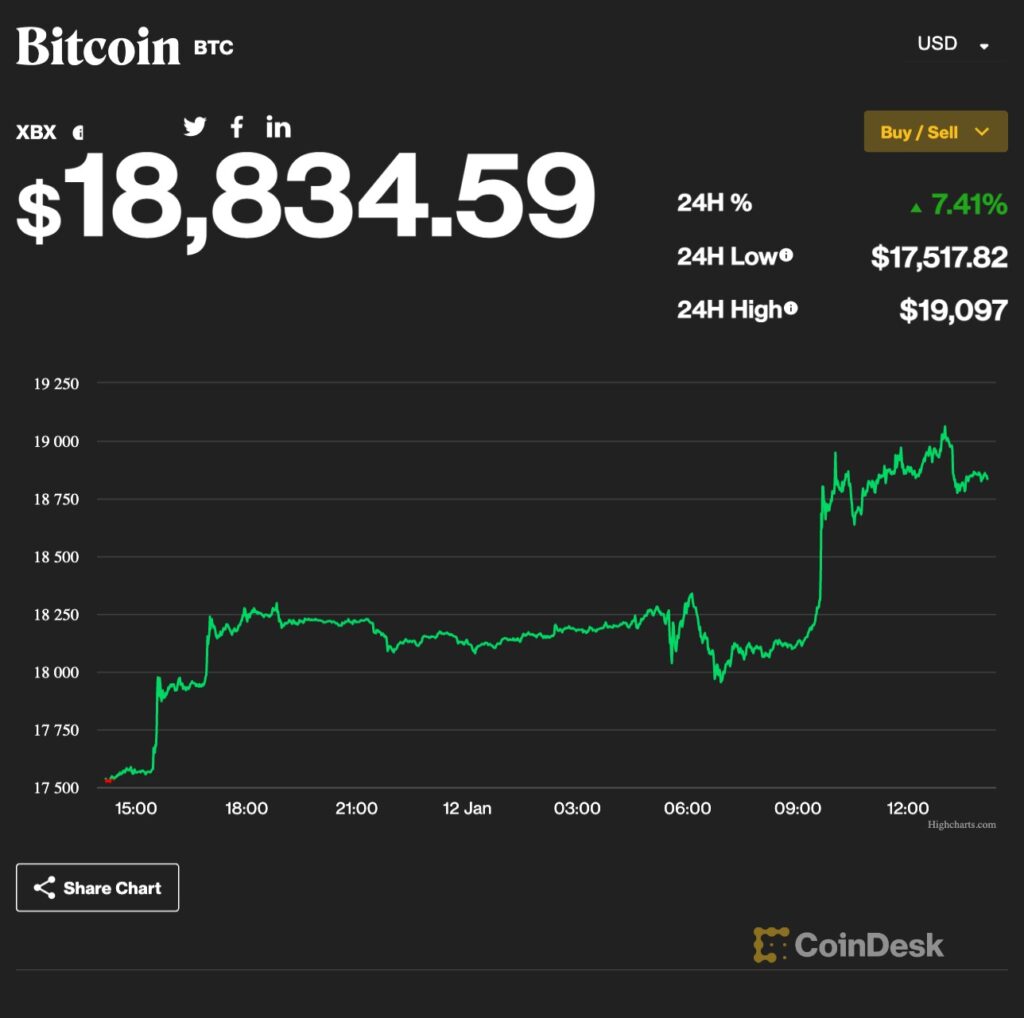

(CoinDesk and highcharts.com)

(CoinDesk and highcharts.com)Bitcoin (BTC): At one point, it climbed 8% in 24 hours, surpassing $19,000, the highest since the market crash caused by the FTX bankruptcy in early November. Around $18,800 at the time of this writing.

Ethereum (ETH): Up 6% in 24 hours, near $1427. With the next major update, Shanghai, coming in the spring, according to Etherscan data, more than 16 million Ethereum (approximately $22 billion, approximately ¥2.8 trillion) was staked on the beacon chain as of the 12th. there is

stock market: The stock market rose after December’s CPI (US Commercial Price Index) announced on the 12th slowed to 6.5% month-on-month from 7.1% in November. The Nasdaq and Dow Jones Industrial Average both rose 0.6%, while the S&P 500 rose 0.3%.

latest price

● CoinDesk Market Index (CMI): 911.03, +6.4%

Bitcoin: $18,832, +7.4%

Ethereum: $1,424, +6.1%

● S&P500: 3,983.17, +0.3%

Gold: $1,900, +1.4%

10-Year US Treasury Yield: 3.45%, -0.1

market analysis

(TradingView)

(TradingView)Inflation has cooled, but hopes of a change in Fed policy may be too hot. Bitcoin and Ethereum reacted positively to the December CPI.

Bitcoin’s hourly chart shows a sharp increase in trading volume in the hour following the CPI announcement. Most notably on the chart, the price fell momentarily, indicating that some traders saw the CPI announcement as a profit-taking opportunity.

Ethereum’s hourly chart is doing much the same, rising slightly at the time of the CPI announcement and then dropping within the hour.

The odds of the Fed raising rates by 0.25% in February rose to 96% from 77% the day before. Meanwhile, Federal Funds (FF) futures show interest rates will rise to nearly 5% before falling in Q2 or Q3 2023. This suggests that the Fed may slow its pace of rate hikes, but will keep them going for the foreseeable future.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: TradingView

|Original: Crypto Markets Today: Bitcoin Tops $19K, Blockchain.com Cuts Jobs, Sam Bankman-Fried Blogs

The post [US market]Bitcoin temporarily exceeds $ 19,000 ── US CPI slows down | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

183

2 years ago

183

English (US) ·

English (US) ·