Emerging from Chapter 11 bankruptcy protection

Core Scientific, a leading US cryptocurrency mining company, announced on the 8th that it has successfully completed a $55 million equity financing round. The raising was done through an “Equity Rights Offering” (ERO), which provides existing shareholders with the right to issue new shares, and as the oversubscription limit has been exceeded, the surplus funds will be returned to investors.

“With the success of this financing and the full repayment of the amount borrowed from DIP Finance, we are in a strong position to emerge from Chapter 11 bankruptcy in January,” said Adam Sullivan, CEO of the company. It has said.

Core Scientific released its 2023 Full Production Report on the 5th, and also announced that it had prepaid the balance of its $35 million DIP (Debtor in Possession) loan.

Core Scientific went public through a deal with a special purpose acquisition company (SPAC) in mid-2021, but filed for bankruptcy in December 2022, had its trading on the NASDAQ suspended, and moved to the over-the-counter market ( OTC, code: CORZQ).

Source: YahooFinance

In its latest financial statements (dated November 2023), the company’s assets are $2.3 billion, liabilities are $559 million, and total equity is $1.8 billion. After completing the bankruptcy procedure, the company aims to be relisted on the NASDAQ market.

The company has been operating data centers in North America since 2017 and has established itself as a major miner. It has data centers in Georgia, Kentucky, North Carolina, North Dakota, and Texas. The company is currently working on debt repayments while continuing its mining business.

Source: Core Scientific

The self-mined amount in 2023 is 13,762 BTC, which is compared to Bitcoin miner Marathon Digital Holdings’ 12,852 BTC.comparabledo. Additionally, Core Scientific co-locates (jointly operates) up to 209,000 Bitcoin miners, with a commissioned mining volume of approximately 5,512 BTC.

connection:What is the background behind the increase in investment in major asset management companies such as BlackRock and Bitcoin mining companies?

Mining profits are on the rise

Core Scientific had bad debts with Celsius, a cryptocurrency financing company that went bankrupt in June 2022, but sold its Cedar Vale mine in Texas to Celsius for approximately 2 billion yen ($14 million). Agreed to do so. It also agreed to waive all claims against Celsius worth approximately 4.4 billion yen ($31 million).

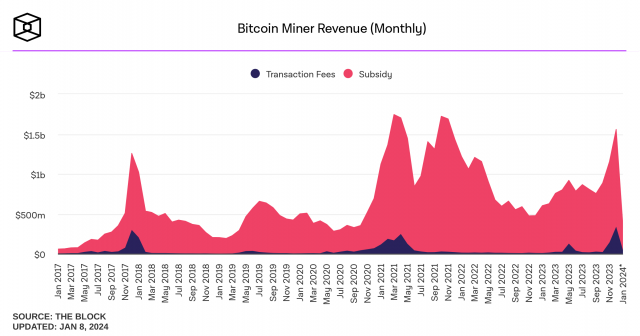

Core Scientific appears to be well-positioned on the back of expectations for the approval of physical ETFs in the Bitcoin market and an optimistic outlook regarding the potential upside in Bitcoin prices. Monthly revenue from Bitcoin mining (including fees) reached $1.56 billion, which is back to its peak level in 2021.

Source: The Block

connection:US cryptocurrency mining company Core Scientific emerges from bankruptcy

What is Chapter 11 of the US Federal Bankruptcy Code?

A restructuring-type bankruptcy law system similar to Japan’s civil rehabilitation law. The company will rebuild the company by reducing debt while continuing to operate the company. After filing the application, debt collection will be suspended, and the debtor will work to sort out their debts and, in principle, formulate a restructuring plan within 120 days.

Virtual currency glossary

Virtual currency glossary

The post US mining giant Core Scientific completes $55 million funding appeared first on Our Bitcoin News.

1 year ago

141

1 year ago

141

English (US) ·

English (US) ·