- The U.S. Treasury Department's Office of Foreign Assets Control (OFAC) has some control and influence over stablecoin issuers' offshore usage.

- Tether’s association with crypto mixer Tornado Cash is one such example.

- International cooperation may hinder the use of USDT.

The dominant position of Tether (USDT), the largest dollar-pegged stablecoin, is vulnerable due to its dependence on the US market and expected regulations, JPMorgan said in a February 15 research report. mentioned in.

Although Tether is not based in the United States, U.S. regulators, through the Treasury Department's Office of Foreign Assets Control (OFAC), can impose certain restrictions on stablecoin issuers' offshore activities, the report said. Says.

In August 2022, OFAC blacklisted a crypto mixer that operates on the Ethereum network for facilitating money laundering.

Analysts led by Nikolaos Panigirtzoglou said: “While direct legal action against offshore and decentralized companies is complex, indirect action and international cooperation could hinder the use of Tether. Yes,” he wrote.

The upcoming regulation of stablecoins will probably be “more transparent and more compliant with new regulatory KYC (Know Your Customer)/AML (Anti-Money Laundering) standards compared to stablecoins”. , there will be indirect pressure on Tether as Tether becomes less attractive,” the report said, adding that this issue is likely to increase in decentralized finance (DeFi), where USDT is used as collateral and a source of liquidity. It added that this also applies.

“Stablecoin regulation, in particular, is to be harmonized globally across the G20 through the Financial Stability Board (FSB), further restricting the use of unregulated stablecoins like Tether. ”, the report added.

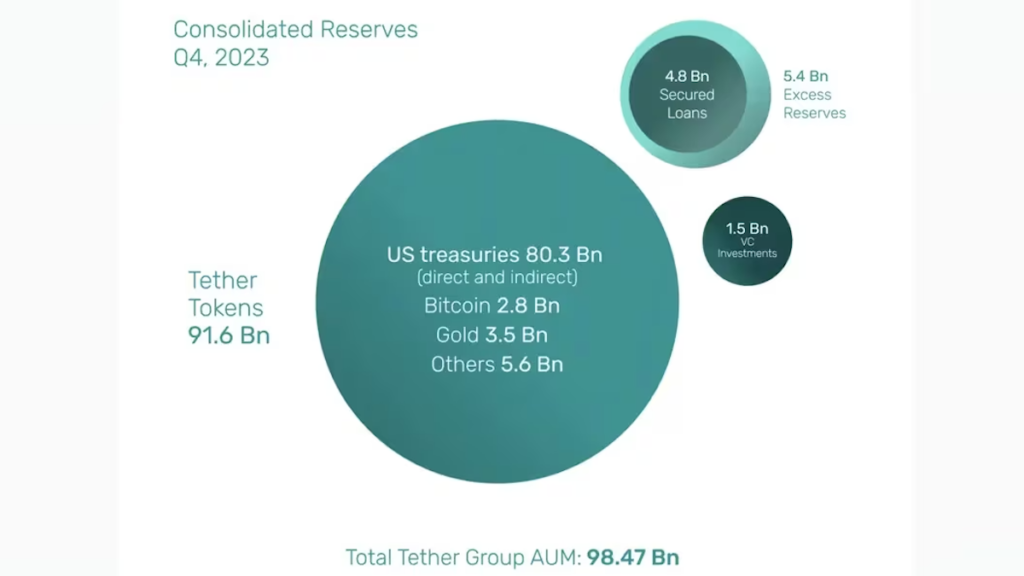

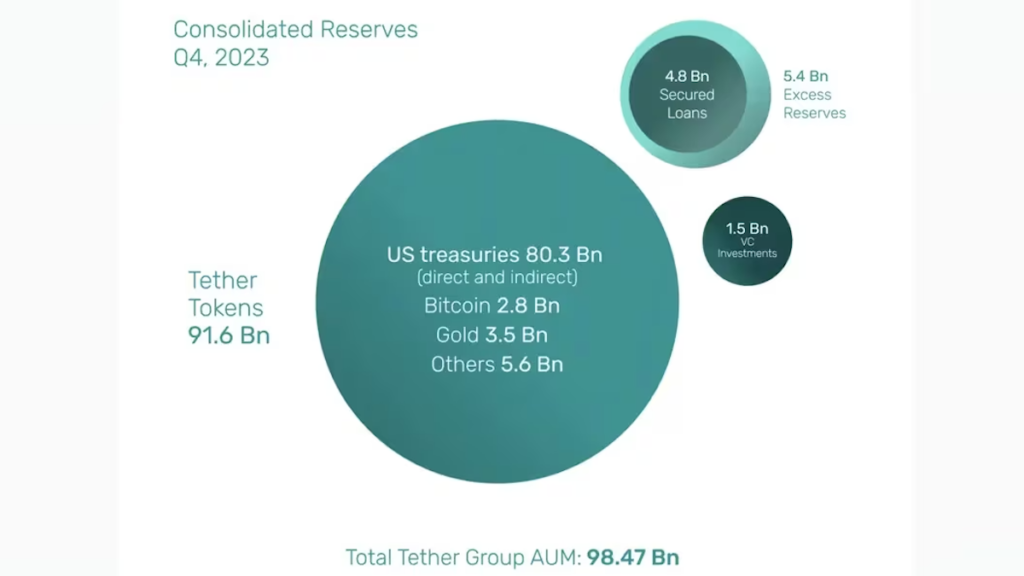

Tether has been under pressure to be more transparent about how its reserves are invested and has been working towards publishing real-time data. Still, JPMorgan says the stablecoin issuer's latest disclosures are not enough to alleviate concerns.

Tether Reserves for Q4 2023 (Tether)

Tether Reserves for Q4 2023 (Tether)JPMorgan has previously argued that USDT's dominance is bad for the broader crypto ecosystem, but Tether CEO Paolo Ardoino said in emailed comments that “the world's largest bank “It seems hypocritical to say you're concerned about concentration.”

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Tether

|Original text: US Regulators Do Have Some Control Over Stablecoin Tether: JPMorgan

The post US regulators can control Tether (USDT): JP Morgan | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

70

1 year ago

70

English (US) ·

English (US) ·