4/12 (Wednesday) morning market trends (compared to the previous day)

- NY Dow: $33,684 +0.2%

- Nasdaq: $12,031 -0.4%

- Nikkei Average: ¥27,923 +1%

- USD/JPY: 133.6 +0.02

- USD Index: 102.1 +0.07%

- 10-year US Treasury yield: 3.43 +0.4% per annum

- Gold Futures: $2,019 +0.7%

- Crude oil futures: $81.4 +2.1%

- Bitcoin: $30,220 +3.3%

- Ethereum: $1,896 +0.3%

traditional finance

crypto assets

The NY Dow closed slightly at +98.2 dollars today. The Nasdaq was -$52.4. With the US March CPI (consumer price index) release coming up tonight, investors have stepped up the wait-and-see mood.

connection: Bitcoin reaches $30,000 milestone with significant rise

US March CPI

- Overall month-on-month change: Forecast 0.3% Last time 0.4%

- Overall year-on-year change: Forecast 5.2% Last time 6.0%

- Core/M/M: Forecast 0.4% Previous 0.5%

- Core YoY: Forecast 5.6% Previous 5.5%

While last weekend’s March jobs report showed a still-robust labor market and expected another 0.25% rate hike at the US Federal Open Market Committee (FOMC) meeting in May, the market is already on the verge of halting rate hikes thereafter. Weaving in.

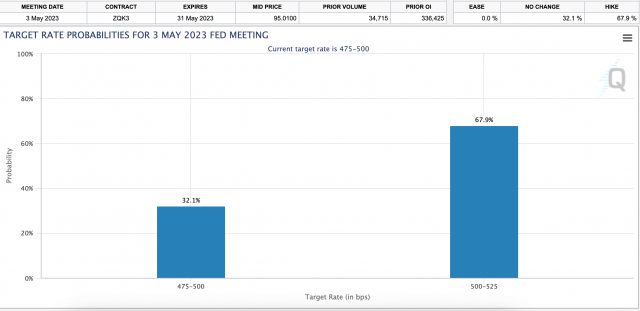

At present, more than 60% of the CME interest rate futures market is expecting the next 0.25% rate hike in May, but there are also growing expectations that the FOMC will halt rate hikes in June.

source:

remarks by dignitaries

Hawkish New York Fed President Williams said in a speech last night that one more rate hike was a “reasonable starting point.” “Inflationary pressures have eased but are still well above the Fed’s target of 2%,” he said. He also dismissed his view that the March financial crisis was due to the Fed’s radical rate hikes.

On the other hand, US Treasury Secretary Janet Yellen emphasized in a speech on the 11th that “the US banking system remains sound and the global financial system is also strong.” On inflation, which remains high, there have been welcome signs of a slowdown over the past six months, he said.

IMF Outlook

The IMF (International Monetary Fund) released its latest global economic outlook on the 11th. The global economic growth rate for 2023 is 2.8%, down 0.1% from the previous forecast (January). Next year we will also revise it downward by 0.1% to 3%. He said the global economic outlook was “very skewed to the downside” after the bankruptcy of the US bank in March. It also warned of greater uncertainty and risks than in 2022, citing continued financial tightening and pressures from the war in Ukraine, combined with stress in the financial sector.

Economic indicators (Japan time)

- April 12, 21:30 (Wednesday): US March Consumer Price Index (CPI)

- Thursday, April 13, 3:00 PM: Federal Open Market Committee (FOMC) Minutes

- Friday, April 14, 21:30: U.S. March Retail Sales

- April 14, 23:00 (Friday): April University of Michigan Consumer Confidence Index, preliminary figures

connection: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

connection: What is Blockchain Layer 2?

US stocks

From this Friday, the earnings season for the January-March quarter (1Q) will begin, starting with major US banks such as JP Morgan and Wells Fargo.

U.S. IT Tech Stocks vs. Previous Day: NVIDIA-1.4%, c3.ai-1.3%, Big Bear.ai-0.5%, Bullfrog AI-7.5%, Tesla +1.2%, Microsoft-2.2%, Alphabet- 1%, Amazon -2.2%, Apple -0.7%, Meta -0.4%, Coinbase +6.1%, MicroStrategy +6.2%.

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

micro strategy

Bitcoin held by MicroStrategy seems to have seen unrealized gains from the average acquisition price of $29,803 as the BTC price reached $30,000. It has long had unrealized losses following the 2022 bear market. In addition, the company’s stock price recorded +114% performance since the beginning of the year.

connection: US Micro Strategy buys 3.8 billion yen worth of Bitcoin

The post US stocks continue to rise slightly, CPI announced tonight | Financial Tankan on the 12th appeared first on Our Bitcoin News.

2 years ago

189

2 years ago

189

English (US) ·

English (US) ·