1/13 (Saturday) morning market trends (compared to the previous day)

traditional finance

- NY Dow: 37,592 -0.3%

- Nasdaq: 14,972 +0.01%

- Nikkei average: 35,577 +1.5%

- USD/JPY: 144.9 0.0%

- Gold futures: 2,053 +1.7%

- NVIDIA: $547 -0.2%

- Apple: $185.9 -0.2%

Source: CoinPost

Today’s NY Dow fell and the Nasdaq was flat. The PPI (December Producer Price Index) announced last night was lower than expected, unlike the CPI the day before, and temporarily became a buying factor for the market, but there is a sense of caution about US corporate earnings that will become serious from next week onwards. became stronger and stopped buying.

The stock market will be closed next Monday, the 15th, to mark the anniversary of the birth of Martin Luther King Jr. in the United States.

connection: U.S. December CPI exceeds expectations, but expectations for early interest rate cuts do not subside; virtual currency-related stocks continue to fall on the first day of Bitcoin ETF trading | 12th Financial Tankan

Today’s main market materials are as follows:.

- BlackRock Financial Statement: “The arrival of Bitcoin ETF is an example of legitimizing this asset class”

- JP Morgan’s strong financial results, below Bankcam expectations, Citigroup cuts 20,000 employees

- Airline carriers such as Delta Air Lines also have weak financial results.

- December PPI declines for third consecutive month, with inflation continuing to slow at the corporate level

- US Treasury yields fall, expectations for early interest rate cuts increase again following PPI

connection: NTT Docomo becomes a small company, what are the strengths and merits of “Monex Securities”?

Important economic indicators/events from this week onwards

- 1/17 (Wed) 22:30 US December retail sales

- 1/19 (Friday) 8:30am Japan December National Consumer Price Index

- 1/25 (Thu) 22:30 U.S. 4th quarter real GDP

- 1/26 (Fri) 22:30 December personal consumption expenditure (PCE deflator)

- 2/1 (Thursday) 4:00: Policy rate announcement after FOMC close

connection:

Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Cryptocurrency-related stocks sharp decline

- Coinbase|$130.7 (-7.3%)

- MicroStrategy | $485.5 (-9.4%)

- Marathon Digital Holdings | $18.9 (-15.2%)

Virtual currency market high volatility

- Bitcoin: $42,743 -8%

- Ethereum: $2,515 -4.1%

While the trading volume of Bitcoin ETFs accelerated, “fact selling” also accelerated, significantly lowering the stock prices of virtual currency-related stocks and the Bitcoin market price.

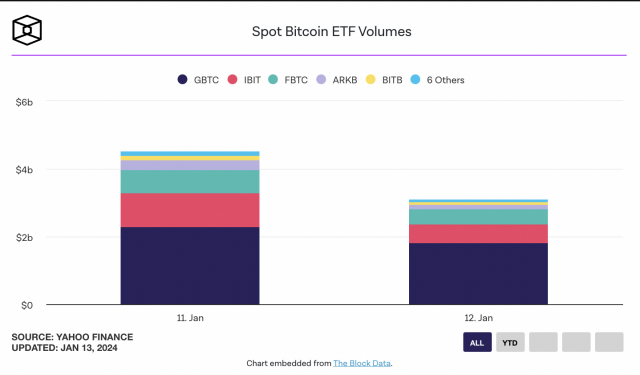

The trading volume of the entire Bitcoin ETF on the second day was strong following the first day. Overall, BlackRock was in first place with a total volume of $3.1 billion.

Source: The Block

Meanwhile, yesterday’s announcement by major asset management company Vanguard that it will no longer offer trading in Bitcoin ETFs appears to have been a bad news. Today, Vanguard announced that it is discontinuing access to Bitcoin futures trading.

connection:“Bitcoin could rise to over 200 million yen by 2030” ARK CEO Wood

CoinPost Special feature for virtual currency beginners

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

The post US stocks fall, Bitcoin briefly drops below $42,000 level ETF selling accelerates | 13th Financial Tankan appeared first on Our Bitcoin News.

1 year ago

102

1 year ago

102

English (US) ·

English (US) ·