4/13 (Thursday) morning market trends (compared to the previous day)

- NY Dow: $33,646 -0.1%

- Nasdaq: $11,929 -0.8%

- Nikkei Average: ¥28,082 -0.5%

- USD/JPY: 133.05 -0.03%

- US dollar index: 101.5 -0.6%

- 10 year US Treasury yield: 3.4 -1% annual yield

- Gold Futures: $2,029 +0.5%

- Bitcoin: $29,964 -0.7%

- Ethereum: $1,916 +1.2%

traditional finance

crypto assets

Today’s NY Dow dropped slightly and closed at -38 dollars. The Nasdaq was -$102.5. Last night’s March US consumer price index (CPI) was largely in line with expectations, with the headline index showing continued weakness in inflation. The stock market also seems to have reacted to the FOMC minutes.

US CPI

【preliminary report】

US March CPI data release

・CPI (vs. previous month): This time +0.1% Last time +0.4% Forecast +0.3%

・CPI (year-on-year): This time +5.0% Last time +6.0% Forecast +5.1%

・Core (vs. previous month): This time +0.4% Last time +0.5% Forecast +0.4%

・Core (year-on-year): this time +5.6% previous time +5.5% forecast +5.6%

— CoinPost Virtual currency media[WebX held in July](@coin_post) April 12, 2023

In the US consumer price index data for March, the Composite Index showed a slowdown in inflation due to falling energy prices. On the other hand, it was the first time in about two years that the growth of the core CPI exceeded the growth of the composite index on a year-on-year basis. The data also showed signs of disinflation (slowing price growth), but inflation still appears to be persistent in the services sector.

With the CPI and labor market still strong, speculation is mounting that at least one more rate hike will be forthcoming. Expectations for the next 0.25% rate hike in May rose to 66% in the CME interest rate futures market. In order to avoid a serious economic recession, it seems that the FOMC is expected to stop raising interest rates from June onwards and even cut interest rates by the end of the year.

According to a Reuters report, Joe Manimbo, senior market analyst at Convera, said the weaker-than-expected slowdown in headline inflation underpins the view that the Fed is basically done with one more rate hike. there is Meanwhile, Liz Young, SoFi’s head of investment strategy at SoFi, said the CPI wasn’t much lower than expected this time around, and that it’s actually the PPI that completes the CPI data this time around, according to Bloomberg. It says. PPI will be announced tonight.

Economic indicators (Japan time)

- Thursday, April 13, 21:30: U.S. March Wholesale Price Index Core (PPI)

- Friday, April 14, 21:30: U.S. March Retail Sales

- April 14, 23:00 (Friday): April University of Michigan Consumer Confidence Index, preliminary figures

connection: Ethereum “Shapella” completes mainnet implementation

FOMC Minutes

The March 21-22 FOMC minutes released this morning called for a moratorium on rate hikes until it was clear that the failures of two US banks (SVB and signature banks) would not cause widespread financial stress. was considered, but in the end it was revealed that the decision was made to give priority to dealing with inflation.

This content is consistent with the FOMC statement on March 22. Inflation was still high at the time, and Chairman Powell considered suspending interest rate hikes at the FOMC, but he emphasized that “if necessary, we will raise interest rates more than expected,” and that “the officials are not expecting a rate cut this year.” stabbed the

connection: FOMC additional interest rate hike, expectations for rate cut within the year recede

Some FOMC participants also said they would have considered a more aggressive 0.50% rate hike had there been no problems in the banking sector. The banking sector has calmed down since last month, but Fed officials are watching for signs of tightening credit conditions.

It also revealed that Fed staff expect a mild recession to start in the second half of the year and pick up in 2024-2025.

US IT/Tech Stocks

U.S. IT Tech Stocks vs. Previous Day: NVIDIA -2.4%, c3.ai -3.1%, Big Bear.ai +10%, Bullfrog AI +42.2%, Tesla -3.3%, Microsoft +0.2%, Alphabet- 0.67%, Amazon -2%, Apple -0.4%, Meta +0.07%, Coinbase -3.35%, MicroStrategy -2.8%.

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

connection: What is Blockchain Layer 2?

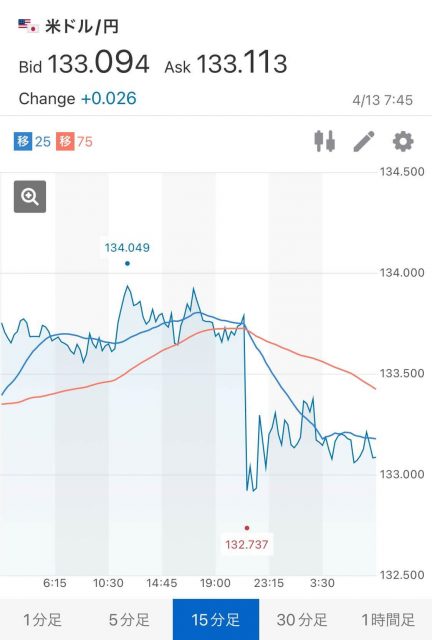

dollar yen

US dollar = 133.05 yen, down 0.03% from the previous day. The dollar/yen pair continued to sell off following the US CPI data.

Source: Yahoo! Finance

connection: Why did the Japanese government start promoting “Web3 policy”?Summary of important points and related news

connection: Commentary on the relationship between government bonds and interest rates, and the impact on the cryptocurrency market

The post US stocks fall Reaction to US March CPI and FOMC minutes | 13th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

122

2 years ago

122

English (US) ·

English (US) ·