March 15 (Wednesday) morning market trends (compared to the previous day)

- NY Dow: $32,155 +1%

- Nasdaq: $11,428 +2.1%

- Nikkei Average: ¥27,222 -2.1%

- USD/JPY: 134.1 -0.01%

- US dollar index: 103.6 +0.07%

- 10-year US Treasury yield: 3.68 +4.8%

- Gold Futures: $1,908 -0.4%

- Bitcoin: $24,462 +1.2%

- Ethereum: $1,693 +1.2%

traditional finance

crypto assets

Today’s New York Dow rebounded for the first time in six days, temporarily rising over $400. The Nasdaq and S&P 500 also rose. The US consumer price index (CPI) for February was announced before the start of trading, and it seems that the headline CPI was in line with the median forecast of economists.

The S&P 500 rallied to close after narrowing its gains on Wednesday’s report that a Russian fighter jet collided with a U.S. Air Force drone.

US February CPI

Headline CPI rose 0.4% month-on-month in February, in line with median economist forecasts. On the other hand, the core index, which excludes the highly volatile food and energy sectors, rose +0.5%, exceeding market expectations of +0.4% and marking the first month-on-month growth (+0.4%) in five months. The data this time, like the previous one, show persistent inflationary pressure, which seems to justify next week’s FOMC interest rate hike.

【preliminary report】

US February CPI data release

・CPI (vs. previous month): This time +0.4% Last time +0.5% Forecast +0.4%

・CPI (year-on-year): This time +6% Last time +6.4% Forecast +6%

・Core (vs. previous month): This time +0.5% Last time +0.4% Forecast +0.4%

・Core (YoY): This time +5.5% Last time +5.6% Forecast +5.5%

— CoinPost-virtual currency information site-[app delivery](@coin_post) March 14, 2023

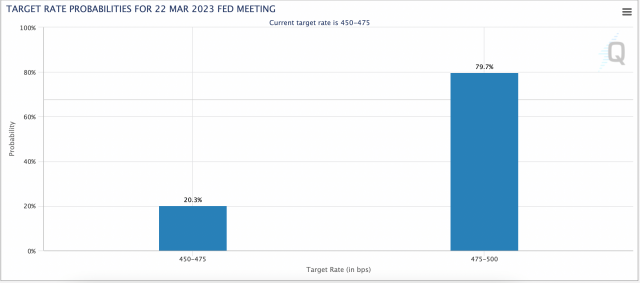

With the failure of the Silicon Valley Bank destabilizing financial stability, fears of a hawkish interest rate hike have largely receded, perhaps because the U.S. authorities responded swiftly with measures such as bailouts. There was even an argument. However, with inflation still too high, traders’ expectations for a +0.25% rate hike next week have risen to around 80%. It was about 50% at the close of trading yesterday.

Source: CME

The PPI announcement is due tonight.

Economic indicators for March (Japan time)

- Wednesday, March 15, 21:30: U.S. February Retail Sales

- Wednesday, March 15, 21:30: U.S. February Wholesale Price Index (PPI)

- March 23, 3:00 (Thursday): US Federal Open Market Committee (FOMC) interest rate announcement, chairman’s regular press conference

- March 30, 21:30 (Thursday): U.S. October-December Quarterly Real Gross Domestic Product (GDP, Final Value) (Quarterly Change Annual Rate)

- March 31, 21:30 (Friday): U.S. February Personal Consumption Expenditure (PCE Core Deflator) (MoM/YoY)

connection: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

The Aftermath of the Bankruptcy of a Mid-sized US Bank

In the market yesterday, the US Investment Grade Corporate Credit Default Swap (CDS) Index rose to 90.2 basis points, the highest since November last year. This reflects the deterioration in credit risk metrics across the board following last weekend’s cascading failures of Silicon Valley Bank (SVB) and Signature Bank. The widening CDS premium indicates that investors continue to build hedge positions against deteriorating credit conditions.

Also, the volatility in the short-term U.S. short-term interest rate market on Monday was unlike any volatility seen throughout the past 40 years, including the 2008 financial crisis. Yields on two-year U.S. Treasurys plunged 61 basis points today, their biggest drop since the early 1980s and surpassing those on Black Monday in 1987. Two-year yields fell for three days, and demand for U.S. Treasuries surged across all maturities. In addition, even after President Biden’s remarks, US bank stocks continued to sell, suggesting that the tension in the market is increasing.

Mr. Biden reiterated on Tuesday that taxpayers will not bear the losses, saying: “I want people to feel safe that the U.S. banking system is secure and that their money will be in their accounts when they need it.”

connection: US President Biden stresses the security of the banking system

US stocks

On this day, US bank stocks were bought back against the background of financial protection measures by the US authorities. JP Morgan +2.5%, Wells Fargo +4.5%, Bank of America +0.8%. Regional bank stocks such as First Republic (+27%), which crashed the day before, and Charles Schwab (+9.2%) also rebounded sharply.

Part of the IT/tech sector also rose. Compared to the previous day for individual stocks, NVIDIA +4.8%, c3.ai -3%, Big Bear.ai -17.9%, Tesla +5%, Microsoft +2.7%, Alphabet +3.1%, Amazon +2.65%, Apple +1.4% , Meta +7.2%, Coinbase +5.8%, Silvergate Capital -7%.

Last night, Meta announced another 10,000 job cuts. In a message to employees, CEO Mark Zuckerberg told employees of the continued job cuts, saying they should “be prepared for the new economic realities that may persist for years to come.” Last November, it cut 11,000 jobs, or 13% of its workforce, and just last week announced thousands of job cuts. Shares of Meta jumped 7% after the announcement of the additional cuts.

connection: US Meta suspends NFT efforts

Alphabet announced last night that it will bring generative AI technology to Google Workplace services such as Gmail and Docs. Google Cloud also announced a partnership with Midjourney, a company that develops AI-powered automated video services.

ALPHABET INC: TO ADD GENERATIVE AI TO GOOGLE WORKSPACE INCLUDING GMAIL AND DOCS

14-Mar-2023 14:00:00 – ALPHABET INC: GOOGLE CLOUD ANNOUNCES PARTNERSHIP WITH AI RESEARCH LAB MIDJOURNE$GOOGL $MSFT

— *Walter Bloomberg (@DeItaone) March 14, 2023

GM radio last week

The 12th GM Radio was held last Thursday. We invited Mousser Rahmouni, Head of Marketing & Sales at Striga, to talk about “Cryptocurrency Banking Infrastructure and Regulation”. Recently, problems such as the bankruptcy of Silver Gate have attracted attention.

connection: “GM Radio” European virtual currency infrastructure company “Striga” will participate next time

Here is the radio archive from last Wednesday.

https://t.co/SOPA9HkAzd

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 8, 2023

The post US Stocks/Nasdaq Rally Within CPI Expected Range | 15th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

155

2 years ago

155

English (US) ·

English (US) ·