March 9 (Wednesday) morning market trends (compared to the previous day)

- NY Dow: $32,798 -0.18%

- Nasdaq: $11,576 +0.4%

- Nikkei Stock Average: ¥28,444 +0.47%

- USD/JPY: 137.4 +0.2%

- USD Index: 105.6 +0.05%

- 10-year US Treasury yield: 3.98 +0.16% per annum

- Gold Futures: $1,818 -0.1%

- Bitcoin: $22,067 0%

- Ethereum: $1,558 +0.7%

traditional finance

crypto assets

Today’s New York Dow continues to fall slightly. The Nasdaq rose slightly into positive territory. It seems that concerns about the prolonged interest rate hike have increased.

At the Senate Banking Committee hearing on the previous day, Powell showed an aggressive stance of tightening monetary policy, but in congressional testimony on the 8th, he said, “No decision has been made on the pace of rate hikes,” but “data “Given all of this, we stand ready to increase the pace of rate hikes if more rapid tightening is warranted.” He repeated this message in his testimony on Wednesday, but said he tweaked the pre-prepared manuscript to include the phrase “Nothing has been decided.”

The final decision on whether to raise interest rates by 0.25 points or 0.5 points at the FOMC, which will be held for two days until the 22nd of this month, will largely depend on the US employment data to be released on the 10th and next week’s inflation indicators (CPI, etc.). explained that it would be On the other hand, the US ADP employment statistics for February announced last night showed an increase of 242,000, exceeding market expectations of 200,000, indicating a still tight labor market.

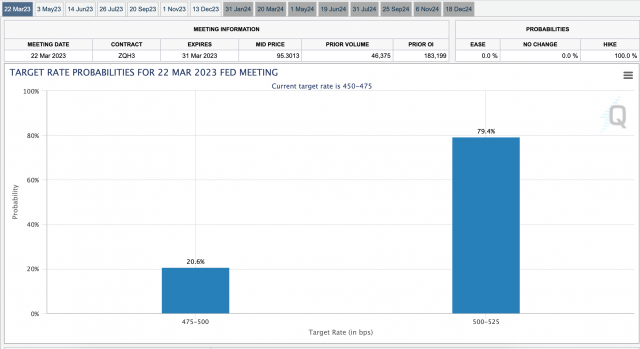

In the CME interest rate futures market, expectations for a 0.50 percentage point rate hike at the next FOMC jumped from 70.5% the day before to just under 80% in the CME interest rate futures market, influenced by the chairman’s hawkish remarks every day. This year’s interest rate level is likely to be higher than expected, and the final destination (terminal rate) seems to be priced at 5.5% to 5.75%.

Source: CME

Concerns about an eventual recession scenario due to prolonged interest rate hikes have also resurfaced.

connection: Expectations of US Fed interest rate hikes after May

March Economic Indicators (3/10-3/15)

- March 10, 22:30 (Friday): U.S. February average hourly wage (vs. previous month), change in February non-agricultural sector employment (vs. previous month)

- March 14, 21:30 (Tuesday): US February Consumer Price Index Core Index (CPI)

- Wednesday, March 15, 21:30: U.S. February Retail Sales

- Wednesday, March 15, 21:30: U.S. February Wholesale Price Index (PPI)

connection: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

US stocks

IT and tech stocks today are mixed. Compared to the previous day for individual stocks, NVIDIA +3.8%, c3.ai -4.9%, Big Bear.ai -14.5%, Tesla -3%, Microsoft -0.2%, Alphabet -0.4%, Amazon +0.4%, Apple +0.8% , Meta +0.2%, Coinbase +1.8%, Silvergate Capital -5.8%.

connection: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase|$63 (+1.8%/-2.3%)

- MicroStrategy | $232 (+0.5%/-5.7%)

- Silvergate Capital | $4.9 (-5.7%/-15%)

Silvergate Capital has announced that it will cease operations and voluntarily liquidate its banking business, Silvergate Bank, in accordance with applicable regulatory processes. Specifically, “Our liquidation and liquidation plan includes full repayment of all deposits. We are considering how to After the announcement, the stock plunged -33.8% after hours.

Bloomberg reported yesterday that Silvergate Capital had consulted with the FDIC (Federal Deposit Insurance Corporation) for business continuity.

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

Dollar-yen temporarily fell below the mid-136 yen level

US dollar = 137.4 yen, up 0.2% from the previous day. The dollar-yen pair temporarily fell below the mid-136 yen level, making a major correction. In his testimony before the House of Representatives, Chairman Jerome Powell said, “Nothing has been decided yet on raising rates.” Afterwards, however, the dollar/yen pair rebounded and returned to the 137 yen level after receiving remarks suggesting that interest rate hikes would be prolonged.

Source: Yahoo! Finance

connection: Why did the Japanese government start promoting “Web3 policy”?Summary of important points and related news

connection: Commentary on the relationship between government bonds and interest rates, and the impact on the cryptocurrency market

GM radio of the week

Last night was the 11th GM Radio. We invited Mr. Yuki Yuminaga from Fenbushi Capital to talk about the challenges of investing in Asian and global projects, including Aster Network.

https://t.co/SOPA9HkAzd

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 8, 2023

connection: “GM Radio” Blockchain-specialized VC “Fenbushi Capital” will participate next time

Click here for last week’s radio archive.

https://t.co/p0vjT2xo4I

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 2, 2023

The post US stocks NY Dow continues to fall Chairman Powell emphasizes that “nothing has been decided” regarding interest rate hike | 9th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

168

2 years ago

168

English (US) ·

English (US) ·