March 17 (Friday) morning market trends (compared to the previous day)

- NY Dow: $32,246 +1.1%

- Nasdaq: $11,717 +2.4%

- Nikkei Average: ¥27,010 -0.8%

- USD/JPY: 133.7 -0.03%

- US dollar index: 104.4 -0.16%

- 10-year US Treasury yield: 3.5 +2.4% annual yield

- Gold Futures: $1,923 -0.39%

- Bitcoin: $25,009 +2%

- Ethereum: $1,674. +0.8%

traditional finance

crypto assets

The New York Dow rallied today to close at +371.9. The Nasdaq and S&P 500 also turned positive after falling the day before. Investor concerns about the credit risk of European financial institutions appear to have receded.

solve the banking problem

The day before, credit uncertainty at Credit Suisse, a major Swiss financial group, surged, affecting many major European banks and regional banks. The announcement that it intends to borrow up to 7.1 trillion yen from the (central bank) appears to have given investors a sense of security. The STOXX Europe 600 Index rebounded +1.26% on the day.

connection: In response to Credit Suisse’s management instability, the Swiss central bank issued an emergency statement

In addition, there was growing concern about the chain reaction (contagion effect) from the bankruptcies of US SVB Bank and Signature Bank. The market also welcomed the agreement by 11 major banks, including Citi, to implement deposits of $30 billion (approximately ¥4 trillion). First Republic’s stock price plummeted -36% at one point on the 16th, but was repurchased to +28% on news of acceptance of deposits.

connection: Signature Bank’s Acquisition Auction, “Abandonment of Virtual Currency Customers” Is an Additional Condition = Report

Furthermore, analysts at JPMorgan Chase said on Thursday that the final injection into the financial system will come through the US Federal Reserve’s (Fed) newly launched Bank Term Funding Program (BTFP). It is estimated that the liquidity can reach up to $2 trillion (approximately 270 trillion yen). The BTFP is a special financing measure launched last weekend following the bankruptcies of three U.S. banks, including Silicon Valley Bank.

connection: Credit Suisse management anxiety leads to market downturn, 3 reasons for Bitcoin’s rapid dominance

Strong US economic indicators

The U.S. Producer Price Index (PPI) released on the evening of the 15th showed signs of slowing inflation, but the number of U.S. initial claims for unemployment insurance last week surged to 192,000 last week, down 20,000 from the previous week. Flip from. It was the biggest drop since July last year. (decrease = strong employment)

Meanwhile, wage growth, a key indicator of inflation, has signaled a slowdown, suggesting that the economy may be starting to curb personal spending. In addition, additional layoffs from companies such as Meta Platforms are continuing, which will be reflected in new unemployment insurance applications in the future.

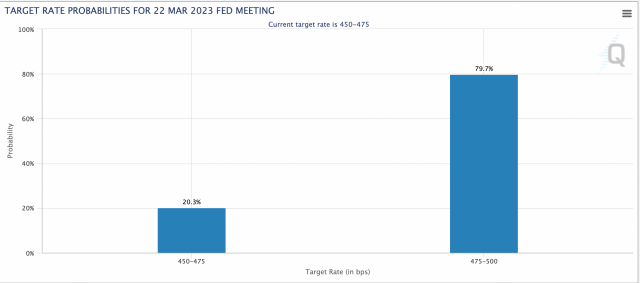

Expectations for a 0.25% rate hike at the FOMC next week have risen again, following strong economic conditions indicated by the number of U.S. unemployment insurance claims and the European ECB’s commitment to a significant rate hike of 0.5%. It rose from 50% yesterday to nearly 80%. In addition, the US Treasury market fell.

Source: CME

Economic indicators from this week onwards (Japan time)

- March 23, 3:00 (Thursday): US Federal Open Market Committee (FOMC) interest rate announcement, chairman’s regular press conference

- March 30, 21:30 (Thursday): U.S. October-December Quarterly Real Gross Domestic Product (GDP, Final Value) (Quarterly Change Annual Rate)

- March 31, 21:30 (Friday): U.S. February Personal Consumption Expenditure (PCE Core Deflator) (MoM/YoY)

connection: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

US stocks

US bank stocks were bought back from the previous day’s overall decline, Credit Suisse (European market) rebounded sharply +20%, and JP Morgan and Wells Fargo also turned into positive territory.

IT/tech stocks also rose across the board. Compared to the previous day for individual stocks, NVIDIA +5.4%, c3.ai +5.8%, Big Bear.ai -7.8%, Tesla +2.%, Microsoft +4%, Alphabet +4.3%, Amazon +4%, Apple +1.8 %, Meta +3.6%, Snap +7.2%, Coinbase +5.1%, MicroStrategy +5.9%, Algo Blockchain +1.9%.

Social media companies such as Meta and Snap performed well. On the 16th, the Biden US administration announced a policy to prohibit use in the United States unless the Chinese company ByteDance, which owns the video posting application “TikTok”, sells its holdings to a US company, and exerted strong pressure. I put it on.

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

GM radio of the week

The 13th GM Radio will be held this Friday, March 17th at 12:00. Evan Cheng, co-founder and CEO of Mysten Labs, the developer of the L1 blockchain “Sui,” has been invited.

connection: “GM Radio” Next time, Mysten Labs, the developer of Diem’s L1 “Sui” will participate

Click here for last week’s radio archive.

https://t.co/K2cQ03YNgK

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 9, 2023

https://t.co/SOPA9HkAzd

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 8, 2023

The post US stocks, NY Dow rebound Retreat concerns over financial risks | Financial Tankan on the 17th appeared first on Our Bitcoin News.

2 years ago

158

2 years ago

158

English (US) ·

English (US) ·