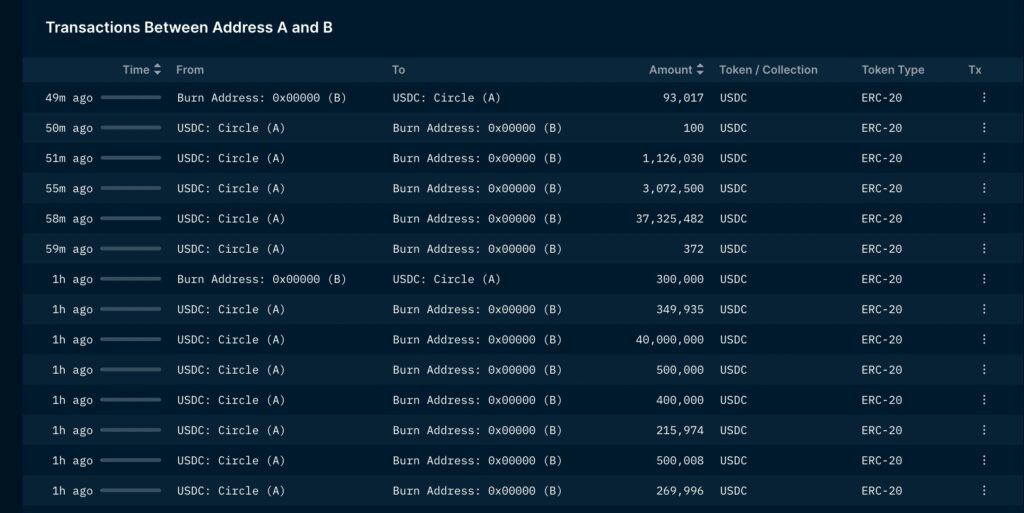

USD Coin (USCD) has lost about $1 billion in market capitalization since the morning of March 10, when Silicon Valley Bank (SVB) collapsed, according to Nansen data. there is

CoinMarketCap data also showed USDC’s market capitalization fell to $42.4 billion from $43.5 billion on the 10th. USDC also broke below $1, indicating market concerns about reserves.

Nansen

NansenUSDC is the second largest stablecoin after Tether’s Tether (USDT) and is the backbone of the crypto ecosystem. According to Circle’s website, USDC is backed by Treasuries and a total of $11.1 billion in cash held in various banks.

Investors have become concerned about USDC’s stability after a bank run at Silicon Valley Bank, one of the banks Circle held a portion of the USDC’s reserves. The US Federal Deposit Insurance Corporation (FDIC) announced the bank’s bankruptcy on the morning of the 10th.

“We are waiting for clarity on the impact of FDIC controls on depositors,” said a Circle spokesperson.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: Circle CEO Jeremy Allaire (Danny Nelson/CoinDesk)

| Original: Circle’s USDC Endured $1B of Net Redemptions Since Silicon Valley Bank’s Shutdown

The post USDC market capitalization drops by $1 billion, after Silicon Valley Bank collapse | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

123

2 years ago

123

English (US) ·

English (US) ·