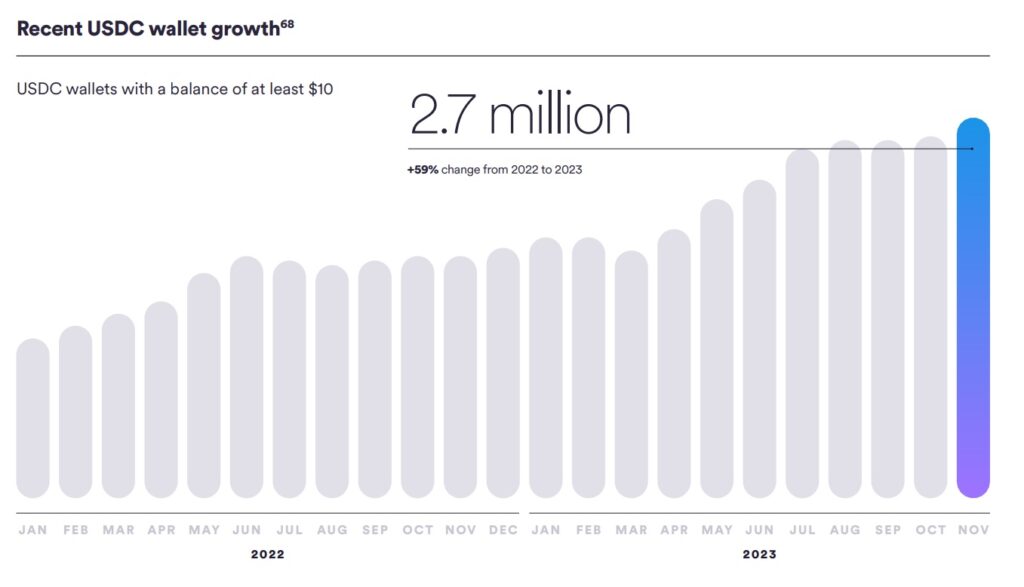

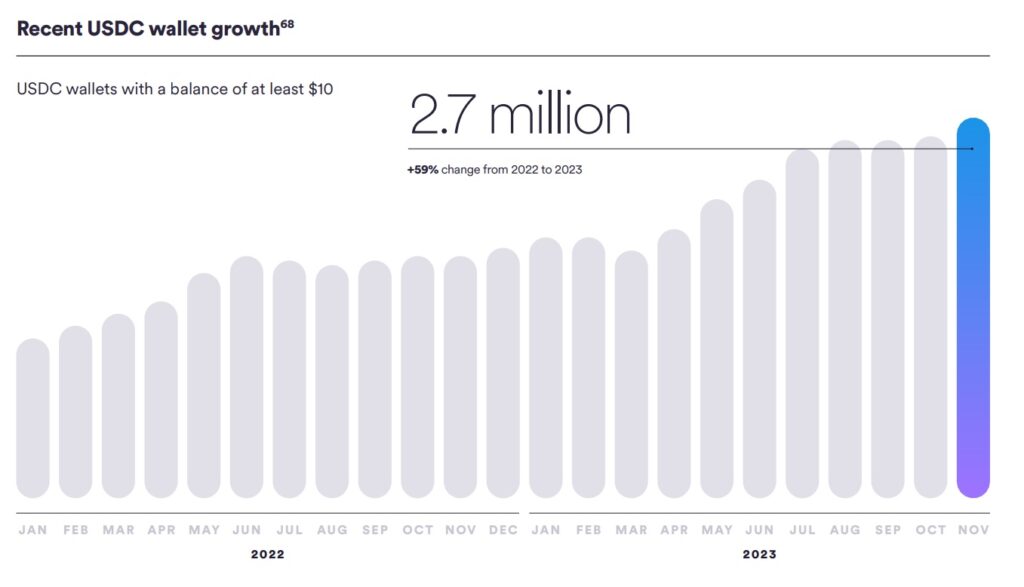

US Circle, which has expanded its digital currency business by issuing USDC, a stablecoin linked to the US dollar on a blockchain, has seen a 59% increase in the number of wallets with USDC balances of over $10 over the past year. It was revealed that the number has reached 2.7 million.

Circle Internet Financial LLC, which is participating in the annual meeting of the World Economic Forum (WEF) that started on January 15th in Davos, Switzerland, released a report on the current state of the USDC economy on the same day. (State of the USDC Economy)” was released.

Jeremy Allaire, CEO and co-founder of Circle, said: “Over the past 20 years, the Internet has made human knowledge available to all by reducing the marginal cost of data dissemination to zero.” , emphasized in the report, “The Internet financial superhighway is not yet in place. Everything we are doing is building and accelerating this Internet financial system.”

Since its founding in 2013, Circle, led by Allaire, has been developing and issuing stable coins that are stably pegged to the US dollar and approved by financial authorities. The reason why Circle focused on the US dollar is clear: the US dollar has overwhelming influence in global trade transactions and international remittances.

Increasing hegemony of the US dollar, increasing need for “cheap” digital dollars

Trends in the number of wallets holding USDC of $10 or more over the past year: From a Circle report

Trends in the number of wallets holding USDC of $10 or more over the past year: From a Circle reportAccording to the Circle report, the US dollar currently accounts for more than 90% of trade transactions in Latin America, 74% in Asia-Pacific and 79% in the rest of the world excluding Europe. Additionally, $1 trillion worth of U.S. dollars (including two-thirds of all $100 bills in existence) is held outside the United States, according to the Federal Reserve.

The current state of international remittances shows that $130 billion in remittances will flow into the Asia-Pacific region in 2022, but the average cost to send $200 is 5.7%, creating even greater friction for unbanked recipients. is occurring (same report).

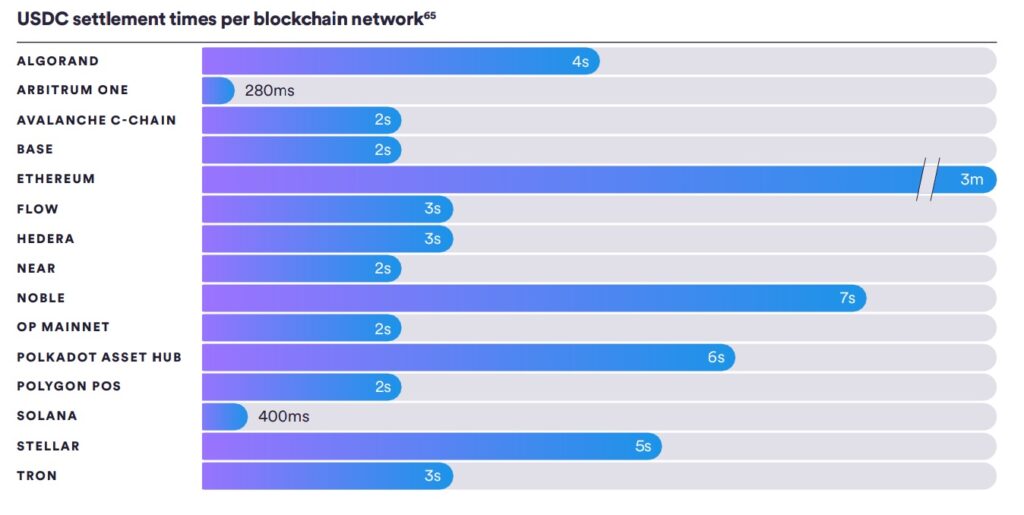

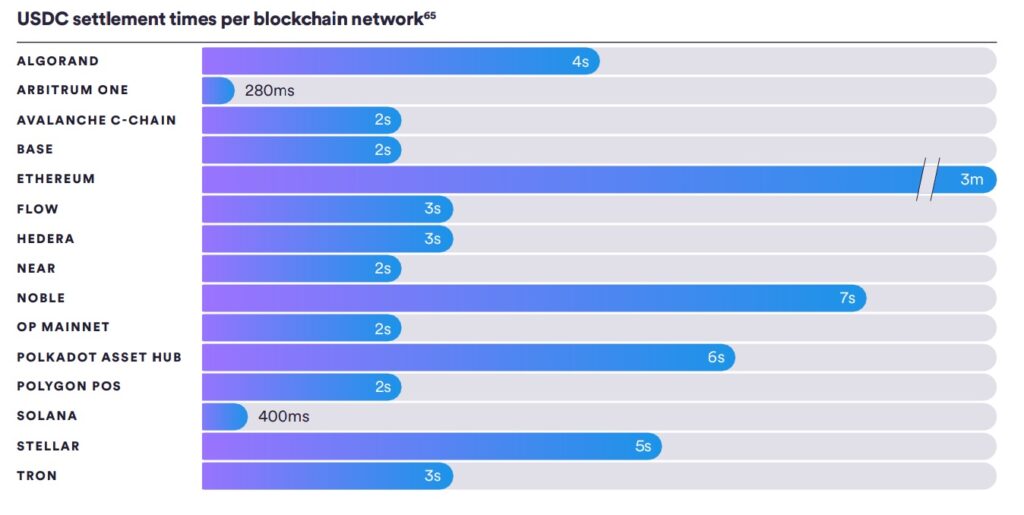

USDC settlement time on 15 blockchains: Circle report

USDC settlement time on 15 blockchains: Circle reportThe report highlights that USDC, which is currently deployed on 15 blockchains including Ethereum, Solana, and Avalanche, is not only faster but also lower cost than traditional payment methods.

Even Ethereum, which has the most applications on the blockchain and is known for its soaring fees, sometimes called “gas fees,” will have an average cost per transaction in USDC of 1% in 2023. For other blockchains, such as Solana, it was less than 0.1%.

BlackRock, VISA, Robinhood…Circle’s partnership strategy

Photo: Shutterstock

Photo: ShutterstockCircle, headquartered in Boston, Massachusetts, has been working to expand the spread of USDC by collaborating with financial institutions, credit card companies, and fintech companies that drive the global financial world. One of the most notable is its strategic partnership with BlackRock, the world’s largest asset management company.

BlackRock, which became the first company to list a Bitcoin spot ETF (exchange traded fund) in the United States this month and made headlines in financial business magazines, is a shareholder of Circle and is also a company that holds the key to USDC being stably linked to the US dollar. be.

In order to maintain USDC’s value on a par with the US dollar, Circle has set up a reserve (fund) consisting of cash in US dollars and short-term US Treasuries, and BlackRock manages these underlying assets. Circle and BlackRock are also conducting research on how to utilize digital currencies, including USDC, to streamline existing financial services.

Circle is extending this partnership strategy globally, including Europe, North America, Asia, and the Middle East/Africa. Credit cards VISA and MasterCard, US stock trading app Robinhood, Singapore’s Grab, which started out as a ride-hailing smartphone app and is progressing to become a super app, and a service that allows companies to easily introduce online payments. In addition to companies such as Stripe in the US, which operates Yahoo!

In Japan, where stablecoin laws are already in place, we plan to work with SBI, which has solidified its business foundation in the digital asset field, to popularize USDC in the Japanese market.

Tether vs. Circle: The battle for stablecoin supremacy

In the global competition for US dollar stablecoins, “USDT” issued by Tether Inc. is leading in terms of circulation volume. According to data from CoinMarketCap, USDC is currently around $25.5 billion in circulation. Meanwhile, Tether’s USDT is worth $95 billion, nearly four times the size of USDC.

Although Tether maintains a numerically superior position, it has been criticized by the U.S. Commodity Futures Trading Commission (CFTC) for the three years up to 2018, saying that its USDT backing assets were insufficient. In 2021, it paid over $40 million in fines.

After that, Tether was temporarily included in the underlying assets.commercial paperThe company has improved the way it operates its reserve funds by replacing them with U.S. Treasuries. In October last year, Tether announced plans to publish data on the underlying assets (reserves) managed by Tether in real time.

commercial paperWhat is: An unsecured promissory note issued by a company at a discount for the purpose of raising short-term funds.

Meanwhile, Circle, whose corporate value was reported to be $9 billion two years ago, announced on the 11th of this month that it would proceed with an initial public offering (IPO) in the United States, which it had previously abandoned. The company aims to go public on the stock market, diversify its means of raising funds, and further accelerate business expansion.

Existing financial institutions and financial systems will likely increasingly introduce stablecoins that circulate on blockchain. At the same time, stablecoins are already being used on a daily basis in the market for trading crypto assets (virtual currencies) and in financial services developed on blockchain (DeFi = decentralized finance).

In 2024, which began with the news of the listing of Bitcoin ETFs, how far will stablecoins spread worldwide, and how well will the “Internet financial superhighway” that Mr. Allaire aims for be developed?

|Text: Shigeru Sato

|Photo: Jeremy Allaire CEO (Keisuke Tada)

The post USDC wallets with balances of $10 or more increase by 60% – Current status of Circle’s financial superhighway concept | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

163

1 year ago

163

English (US) ·

English (US) ·