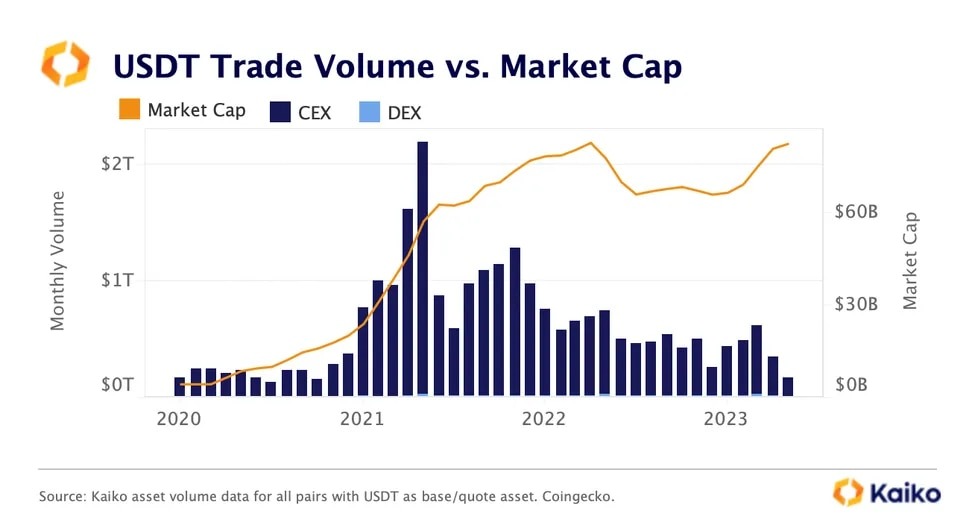

Stablecoin Tether (USDT) has seen trading volumes fall to multi-year lows and its market capitalization has risen to near-record highs “beyond question,” said a cryptocurrency market research firm. Kaiko said in a report released May 22.

Trading is the main use of stablecoins, and while trading volumes have fallen, the recent increase in market cap to $83 billion is “out of the ordinary,” Kyco said.

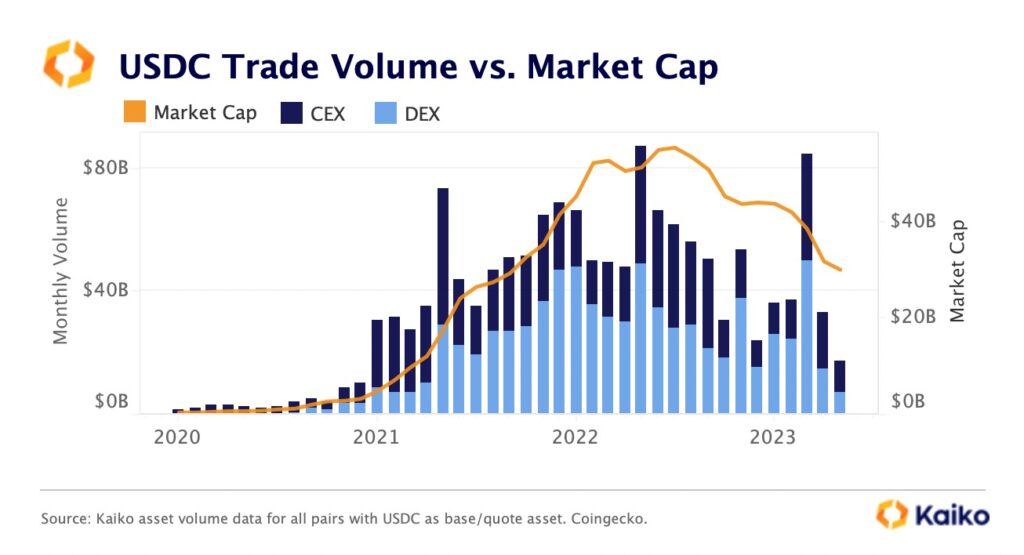

USDT has seen its market capitalization increase since the beginning of the year, approaching an all-time high of $83.4 billion. The increase is largely due to US bank failures and US regulatory crackdowns on rivals such as Circle’s USD Coin (USDC) and Paxos’ Binance Dollar (BUSD).

Kaiko

KaikoHowever, USDT trading volumes have surged recently due to a combination of weak cryptocurrency trading in a bear market and the reintroduction of fees for trading with USDT by Binance, the world’s largest exchange. has decreased to Over the weekend, USDT’s daily trading volume fell below $10 billion for the first time since March 2019, according to CoinGecko data.

mysterious case

According to an assurance report signed by BDO Italia, the world’s fifth-largest accounting firm, the issuer Tether has a market capitalization of USDT of $79 billion against a market capitalization of USDT of $79 billion, while Treasury bonds, gold and Bitcoin are worth about $82 billion. holds dollars.

According to Clara Medalie, research director at Silkworm, a decline in trading volumes and, assuming trading is the primary use case for stablecoins, a decline in market capitalization is expected. The USDC and BUSD market caps have declined in tandem with trading volumes.

“But we don’t see this trend in USDT,” said Medley.

Kaiko

KaikoOne possible reason for USDT’s trend-defying growth is a shift from regulated exchanges to offshore exchanges as regulators seek to separate crypto assets from the traditional financial system. .

“Traders who normally used US dollars are turning to USDT because the US dollar is no longer an option,” Medalley said.

Another reason may have to do with the Tron blockchain and cheaper transaction fees compared to Ethereum. The majority of USDT is issued on Tron, with Binance being the largest holder of USDT on Tron.

“There could be a relationship between Tron, USDT, and Binance, perhaps with market makers choosing to use the network because of the low transaction fees, and supplying liquidity to Binance in USDT,” added Medery. .

As of this writing, Tether did not respond to a request for comment.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: Kaiko

|Original: Tether Trading Volume Falls to Multi-Year Lows, Market Cap Rise Is ‘Questionable:’ Kaiko

The post USDT Market Capitalization Increase Is ‘Questionable’, Trading Volume Hits Multi-Year Low: Kaiko | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

106

2 years ago

106

English (US) ·

English (US) ·