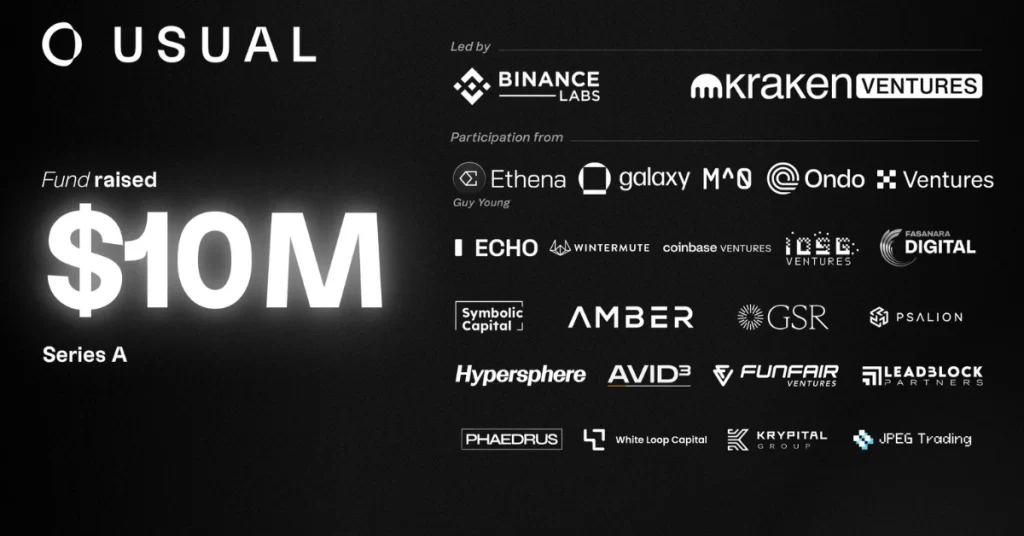

The post Usual Raises $10M in Series A Round Led by Kraken Ventures and Binance Labs appeared first on Coinpedia Fintech News

Usual, the groundbreaking decentralized stablecoin protocol, announces a $10M Series A funding round led by Binance Labs and Kraken Ventures, with participation from Galaxy Ventures, Guy from Ethena, Ondo, Coinbase Ventures, IOSG Ventures, OKX Ventures, Wintermute, Echo, Fasanara Digital, Symbolic Capital, Amber, GSR, Psalion, Hypersphere Ventures, Avid3, FunFair Ventures, Leadblock Partners, Phaedrus, JPEG Trading, White Loop Capital, and Krypital.

This funding milestone follows Usual’s remarkable achievements:

- Surpassing $1.4B in Total Value Locked.

- Ranking among the Top 5 stablecoins, ahead of PayPal USD and Frax.

- Usual is the first fiat-backed stablecoin to demonstrate sustained hypergrowth since Circle.

Pioneering a New Era for Stablecoins and leading DeFi Renaissance

Usual stands out with a DeFi-first spirit and an innovative model of redistributing ownership to its users. It represents a turning point for fiat-backed stablecoins, blending the security of real-world assets (RWAs) with DeFi’s composability and liquidity.

This summer, Usual became the fastest-growing stablecoin on Ethereum, achieving the first-ever hypergrowth for a fiat-backed stablecoin. By embracing synergies with projects like Ethena and Securitize (BlackRock BUIDL tokenizer), Usual is driving a new era of mature stablecoins that create meaningful opportunities for users beyond simple yield.

Notably, Usual has unlocked new avenues for collaboration with RWA tokenization platforms, as demonstrated by USYC’s growth via Usual’s ecosystem, showcasing the potential for creating real-world financial bridges in DeFi. More recently, Usual also adopted M^0 as an alternative collateral structure for its stablecoin, USD0.

Community-First Token Launch

Usual continues to push boundaries by committing 90% of its token allocation to the community. Already live on Binance’s spot market and following a successful community airdrop, Usual is now setting its sights on becoming one of the top 5 stablecoin projects.

Leadership Statements

Pierre Person, CEO and Co-Founder of Usual Labs commented on the news;

“We are proud to announce this funding round, which cements Usual as one of the most promising projects of 2024 in both the stablecoin and DeFi ecosystems. This milestone will propel Usual’s expansion from DeFi into CeFi, with the support of backers who are committed to reshaping the stablecoin landscape.”

Adli Takkal Bataille, DEO and Co-Founder of Usual Lab commented on the news;

“Over the past five months, Usual has demonstrated its robustness through an innovative model of value redistribution. We are bringing fiat-backed stablecoins into the DeFi era, and the next phase of our journey will accelerate this transformation, creating unprecedented opportunities for users.”

About Usual

Usual is a secure and decentralized fiat-backed stablecoin issuer that redistributes value and ownership through the $USUAL token

For more information, visit our website

Contact: pierre@usual.company

5 months ago

51

5 months ago

51

English (US) ·

English (US) ·