RAI short strategy

Ethereum co-founder Vitalik Buterin may have made a profit of ¥12 million ($92,000) from shorting the RAI stablecoin.

As a result, the RAI, which can only borrow against the crypto asset (virtual currency) Ethereum (ETH) as collateral, and the flaws in its governance structure have been emphasized.

Vitalik closed his short RAI position https://t.co/jeatjS1JT0 .

Position summary:

– Age: ~230 days

– Borrowed: 400k RAI (sold for 1.221m DAI)

– Opening price: 3.053 RAI/DAI

– Closing price: 2.786 DAI/RAI (-8.7%)

– Profit: ~$92k https://t.co/IRmGgIFznI

— Kyoronut | Kyoro Nuts (@kyoronut) January 22, 2023

RAI will launch in 2021 as a fork of the MakerDAO (MKR) stablecoin DAI. RAI was characterized as a “floating stablecoin” with a target price of around $3 as a neutral number and a variable redemption rate to reduce volatility.

RAI also advocates Ethereum-oriented policies such as “ungovernment”, which uses only ETH as collateral and removes smart contract update keys. However, due to factors such as not meeting market needs and the pricing of around $3 being difficult to use in the DeFi market, the amount of RAI issued decreased and the price fell to $2.79.

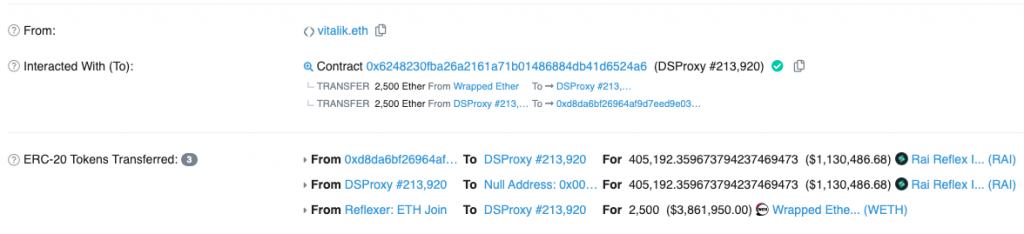

According to EtherScan on-chain data and researchers’ observations, Buterin has profited from the RAI’s price drop by holding short positions for about seven months since May 2022.

EtherScan

Vitalik closed his short RAI position https://t.co/jeatjS1JT0 .

Position summary:

– Age: ~230 days

– Borrowed: 400k RAI (sold for 1.221m DAI)

– Opening price: 3.053 RAI/DAI

– Closing price: 2.786 DAI/RAI (-8.7%)

– Profit: ~$92k https://t.co/IRmGgIFznI

— Kyoronut | Kyoro Nuts (@kyoronut) January 22, 2023

At the short position construction stage, a total of 400,000 RAI (160 million yen) was borrowed and exchanged for 1.22 million DAI. On the other hand, since the RAI fell by 7% when the position was closed, the buyback of 400,000 RAI could be executed at 1.13 million DAI, and the difference was 92,000 DAI.

Relation:Invest in US Treasuries with Stablecoins, Ondo Finance Launches on Ethereum

RAI flaws

RAI co-founder and now SpankChain CEO Ameen Soleimani has admitted that designing RAI to be collateralized solely by Ethereum was a mistake.

I tried to do some casual interest rate manipulation, to set the redemption positive for once

instead I end up serving as exit liquidity for @Vitalik Buterin

even V knows that RAI rates should be negative, and arbed me to make it so

thanks V  https://t.co/tGQchtiO05

https://t.co/tGQchtiO05

— ameen.eth (@ameensol) January 23, 2023

The RAI redemption rate will always be negative, as the ETH deposited as collateral will not get a yield opportunity. To improve, he said, collateral needs to be added to the liquid staking token (stETH), which yields a staking reward.

However, RAI’s smart contracts cannot be upgraded, so the only way to do this is to start a new project. In other words, RAI cannot do anything practically. Mr. Soleimani summarized the flaws in the ungovernment structure that he led mainly as follows.

Adding stETH as collateral would have been a no-brainer if the RAI team (mainly me) wasn’t obsessed with ungovernment. Ungovernance is your responsibility.

liquid staking

A DeFi (decentralized finance) mechanism that allows you to operate alternative assets (staking proof tokens) while receiving cryptocurrency staking interest. There is an advantage that the liquidity of assets that have been locked up in the past can be released. Lido Finance, the largest service provider, stakes ETH and receives the bond token stETH, which can be used as collateral for lending or operated on DEX (distributed exchange).

Cryptocurrency Glossary

Cryptocurrency Glossary

Relation:Ethereum Co-Founder Vitalik Explains the Benefits of “Stealth Addresses”

The post Vitalik Earns 12 Million Yen from Short Selling of Decentralized Stablecoin RAI appeared first on Our Bitcoin News.

2 years ago

138

2 years ago

138

English (US) ·

English (US) ·