Supply chain shortages and high gasoline prices have forced consumer packaged goods companies to manage trade more effectively over the past year to compete with other brands. Add in a worker shortage, and some brands are finding third parties they relied on are “dropping the ball when it comes to promotion execution,” Alexander Whatley, CEO of Vividly, told TechCrunch.

“We are seeing brands negotiate 20% off a promotion, but it might not run, yet they are still getting charged,” Whatley added.

Given that CPG companies spend over 20% of their revenue on trade promotion management, this is where Vividly comes in. Formerly known as Cresicor, the company provides trade promotion management tools for the $20 million global consumer packaged goods industry, which is forecasted to be valued at $25 million in 2028. The tools manage trade spend from the creation of campaigns to promotion planning, forecasting and deductions management.

Whatley estimates that customers have seen a 90% reduction in time required to complete business processes and a greater than 20% improvement in planning accuracy.

We profiled the company last year, back when it was still Cresicor, and when it raised $5.6 million in seed funding. At the time, it had grown revenue by 2.5x and employee headcount by 4x, to 20.

Cresicor was a company name Whatley had come up with back in 2017 when he founded the company with his brother Daniel, Stuart Kennedy and Nikki McNeil. At the time, he admitted it “was cool,” but as they got more into the trade promotion business, realized it didn’t fit.

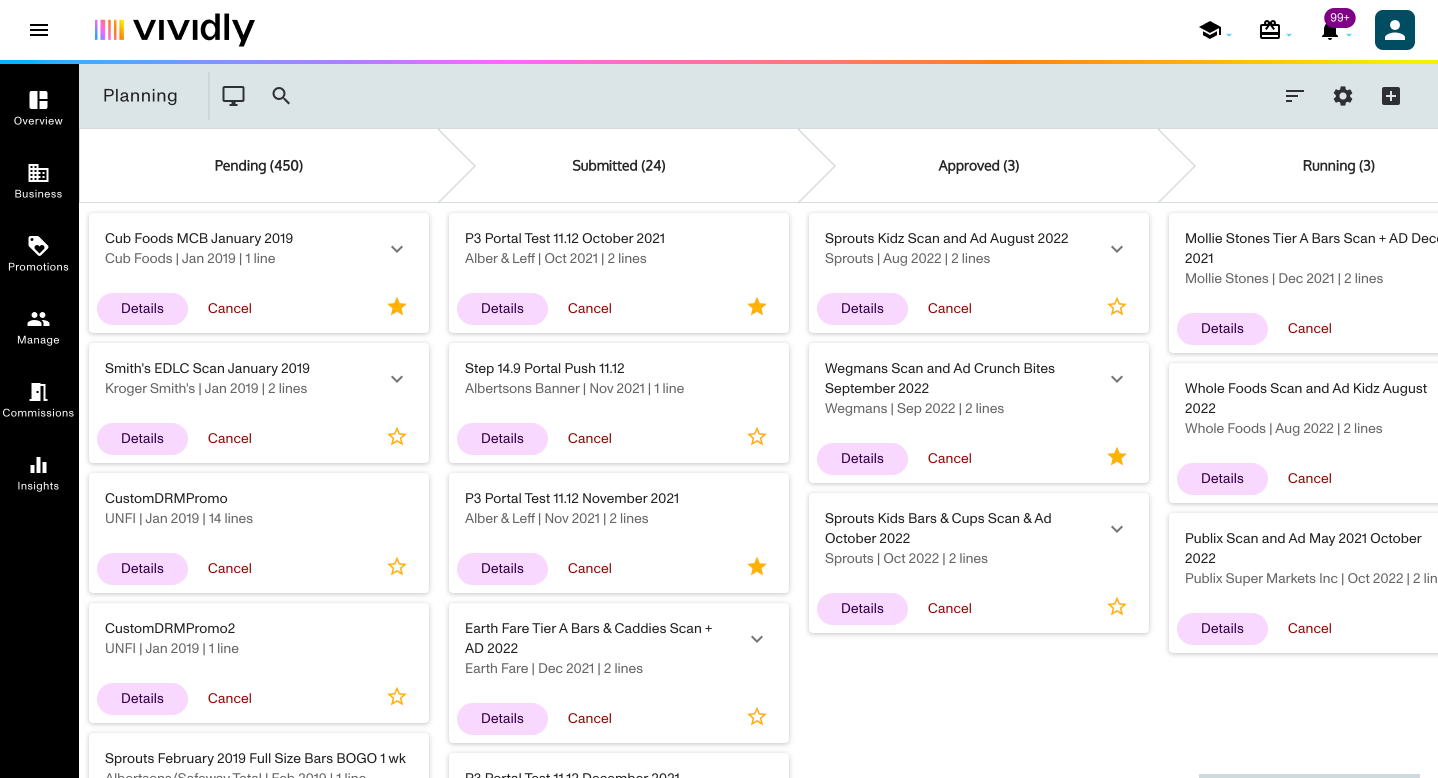

Vividly’s trade planning feature. Image Credits: Vividly

“It kind of sounded like a drug name, too, so we always knew we wanted to rebrand,” Whatley said. “We help brands process messy data from retailers, feeds and spreadsheets into a clear format and data-driven downstream analyses. Essentially helping brands that often operate opaque processes and shine a light ‘vividly’ on those problems.”

Today, Vividly has since grown revenue by over 4x and grew its customer base by 3x, which includes CPG brands like Liquid Death, Bulletproof and Quinn’s. In addition, employees grew to 60.

In addition, it announced $18 million in Series A dollars, co-led by 645 Ventures and Vertex Ventures US, with participation from existing investors Costanoa Partners and Torch Capital as well as Green Spoon Sales. The new investment, which closed in May, gives the company $23 million in total funding since it was founded.

As part of the investment, 645 Ventures Managing Partner Nnamdi Okike will join Vividly’s board.

Meanwhile, the company will use the new funding to accelerate product development to cater to larger CPG customers and scale its go-to-market team.

Up next, Vividly is eyeing a Series B round as it works on building out optimization and modules within its platform.

English (US) ·

English (US) ·