Bitcoin has broken through the crucial $63,000 support level as the escalating conflict in the Middle East sends shockwaves through the crypto markets.

The downturn has taken a heavy toll on the altcoin market, triggering a widespread selloff.

This market-wide bloodbath is starkly reflected in the global cryptocurrency market cap, which has plunged 4.9%, now standing at $2.25 trillion.

Only two of the top 99 altcoins, namely W and CFX, managed to post double-digit gains on the day, while the majority saw their hard-earned weekly gains wiped out. This sharp reversal followed a brief surge of optimism after the September 18 rate cut.

However, some bearish macroeconomic factors have since favoured the bears. Firstly, the election of Japan’s new Prime Minister Shigeru Ishiba, has added pressure to the markets.

Known for his hawkish stance on monetary policy, Ishiba’s leadership raised fears of increased interest rates in Japan, which resulted in a lot of liquidity flowing out of risky assets like Bitcoin.

Making matters worse, Iran’s recent attack on Israel catapulted the flight to safe havens like gold, which saw its value inflate over the past few days.

Bitcoin dropped as low as $60,315 on October 2 as over $374 million was liquidated from the market in the past 48 hours.

The fear was evident among traders on X as many pointed to the support level near the $60,000 mark as the only line of defence that is preventing further downfall.

Crypto analyst Trader Fred urged caution if BTC dropped below $60,300, while analyst Wazz speculated that the “bloodbath might be much worse than anticipated” below $60,000 due to a significant portion of altcoin traders holding leveraged positions in hopes of alt season.

Some optimism came from prominent analyst and cryptocurrency influencer Satoshi Flipper, who reminded his followers to stay focused on the bigger picture.

Despite recent volatility and setbacks, he pointed out that Bitcoin has faced and overcome even greater challenges throughout the year.

According to his analysis, the key price target remains at $68,500, signalling a potential upside if Bitcoin can break above resistance levels.

Meanwhile, ‘Moustache’ brought attention to the historical significance of October as the starting month for Bitcoin’s parabolic rises during previous cycles.

According to his analysis, each major Bitcoin bull run has kicked off in October.

Coupled with the current “Fear” reading on the Crypto Fear & Greed Index, Moustache suggests that market sentiment may be underestimating Bitcoin’s potential for an explosive rally in the coming weeks.

While September, typically a bearish month for Bitcoin, ended on a positive note, October—widely regarded as the most bullish month for the asset—has ironically begun with one of its worst performances, challenging the usual optimistic outlook for this period.

At press time, BTC was making another attempt to retest the resistance level at $62,000 after failing to sustain a position above the $61,800 mark on three separate occasions earlier in the day. Here the top gainers of the day:

Wormhole

Wormhole (W) saw the highest gains on the day, outperforming the broader market, with most cryptocurrencies seeing red.

The token experienced a sharp 34% rise within the last day, reaching a price of $0.3723—its highest since June 18, when it touched $0.3979.

This surge brought its market capitalisation to $935 million and its total value locked to $3.2 billion.

Source: Coinmarketcap

The rally can be attributed to its recent listing on Upbit, a major South Korean crypto exchange.

According to Upbit’s announcement, the exchange has initiated trading for Wormhole with specific conditions: sell orders are capped at less than 10% of the prior day’s closing price, with these restrictions lasting approximately five minutes post-listing.

This price action also coincides with the launch of Wormhole’s Era3, an upgrade aimed at enhancing cross-chain interoperability.

Era3 introduces advanced features designed to simplify the integration and interaction of apps, tokens, networks, and institutional systems across multiple blockchain platforms.

Conflux

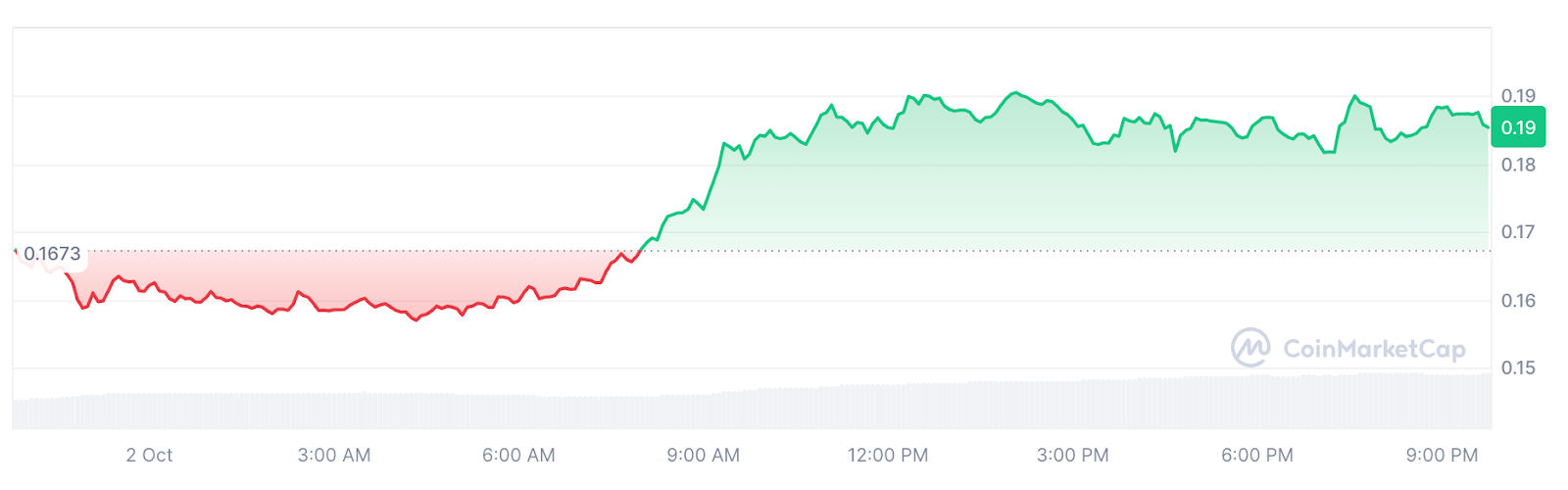

Conflux (CFX) gained 11.4% over the last 24 hours, exchanging hands at $0.185 when writing.

This rise propelled its market capitalization from $699 million to $831 million despite a broader downturn in the global crypto market triggered by macroeconomic factors.

Source: Coinmarketcap

Conflux’s jump in price followed the release of Conflux’s latest roadmap, which includes key updates aimed at enhancing data management efficiency.

The roadmap outlines plans for extending support for Layer 2 solutions through integrated native support and developing a first-party multichain architecture.

Other positive developments this month include a pivotal collaboration with Alibaba Cloud, announced earlier in September, focused on creating localized Web3 solutions for businesses in Hong Kong.

Mantra

Mantra (OM) rose 8% over the last day, reaching a two-month high of $1.30. OM’s market cap stood at $1.15 billion, marking it as the 72nd largest cryptocurrency per CoinMarketCap data.

Source: Coinmarketcap

The rally coincides with a significant rebound in Mantra’s futures open interest, which has climbed to a multi-month peak of $31.9 million.

A rise in open interest indicates growing demand from investors and positive market sentiment towards the asset.

Anticipation is also building around Mantra’s strategic developments, particularly its upcoming mainnet launch scheduled for this month.

The network aims to position itself as the premier platform for developers in the Real World Asset tokenisation sector.

Top losers

PEPE, the meme coin based on the famous Pepe the Frog meme, was down 8.3%.

BEAM, a privacy coin, had dropped 7.6%.

LDO, Lido DAO’s token for liquid Ethereum staking, had tanked 7.5% in the past 24 hours.

The post W, CFX, and OM post gains while Bitcoin crumbles amid Middle East chaos appeared first on Invezz

![Cronos [CRO] drops 12% amid $20M outflow – Rebound ahead IF…](https://ambcrypto.com/wp-content/uploads/2025/08/Abdul-9-1.webp)

English (US) ·

English (US) ·