VC investment in Web3

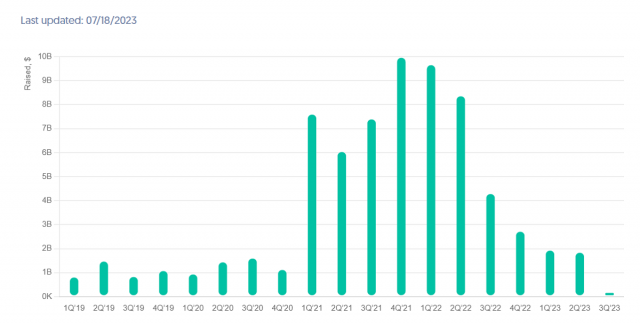

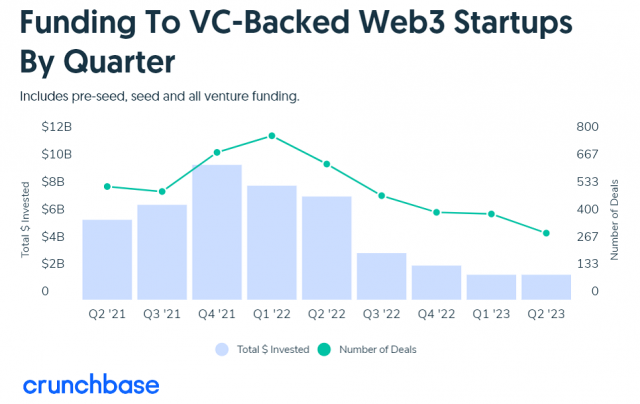

Data provider Crunchbase reported on the 18th that venture capital (VC) funding for startups active in the areas of crypto assets (virtual currencies) and blockchain has been declining.

Financing for Web3 (decentralized web) startups in the second quarter (April-June) of 2023 was only $1.8 billion (250 billion yen). Total investment is down about 76% compared to the same period last year when more than $7.5 billion (1 trillion yen) was invested.

Source: Crunchbase

Looking at the first half of this year (January-June), the severe trend continues. In the first half of last year, Web3 startups raised about $16 billion, but in the first half of this year that amount dropped to $3.6 billion, a decline of about 78%.

The number of deals (deal flow) has also dropped significantly, with 322 in the second quarter of this year, down 51% from the same period last year. In addition, the overall deal flow for the first half of this year remained at 740 deals, the lowest level since the fourth quarter of 2020 (October-December: Corona disaster), when about $ 1.1 billion was raised.

Source: Crunchbase

The scale of fund raising is also conspicuous. In the second quarter of last year, there were 15 startups that raised $100 million or more, but this quarter that number has dropped to three.

The three cases include the case of Swiss-based Islamic Coin, which raised $200 million from ABO Digital, and the example of LayerZero, a protocol that enables blockchain interoperability. LayerZero has raised a total of $120 million from 33 investors, including a16z crypto, in its Series B funding round, boosting the company’s valuation to $3 billion.

Additionally, Worldcoin, founded by OpenAI’s Sam Altman and others, has raised $115 million in a Series C funding round led by Blockchain Capital. Also participating in this round is a16z crypto.

connection:“Worldcoin” developer company involved in ChatGPT founders raises about 16 billion yen in series C

It’s unclear at this point if VCs will resume investing in Web3 startups. “The data so far points to a negative trend,” summarized Crunchbase Senior Reporter Chris Metinko.

On the other hand, procurement of AI-related companies has been active this year.

Bitcoin is doing well

Meanwhile, the cryptocurrency market as a whole is booming. Bitcoin (BTC) has surged more than 80% so far this year, well ahead of the Nasdaq’s 31.7% gain.

The U.S. Securities and Exchange Commission (SEC) has positioned many proof-of-stake (PoS) altcoins as “unregistered securities,” but has defined Bitcoin (BTC) as a “commodity” rather than a “securities” in the past.

In addition, there are increasing positive factors for Bitcoin with a clear regulatory environment, such as the filing of a Bitcoin ETF (Exchange Traded Fund) by the major asset management company BlackRock and the launch of “EDX Markets” invested by major financial institutions such as Citadel Securities, Fidelity Digital and Sequoia Capital.

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

The post Web3 Startup Funding Falls, Numbers Fall to 2020 Levels appeared first on Our Bitcoin News.

2 years ago

78

2 years ago

78

English (US) ·

English (US) ·