While the latest flash crash created panic in the crypto space, one investor capitalized on the discounted prices to add to his holdings.

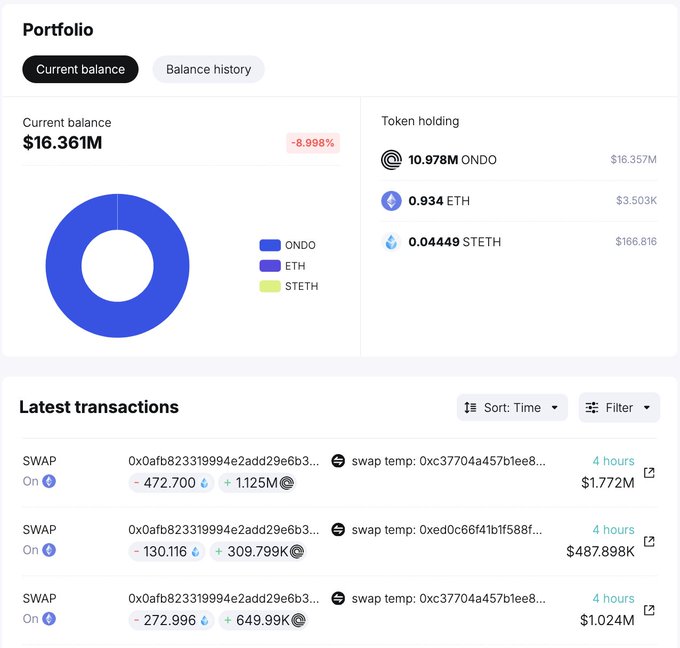

Blockchain stats show a large-scale investor (who created a new wallet within the past 24 hours) made a massive bet on Ondo Finance.

According to Spot on Chain, the whale spent $17.1 million or 4,611 ETH to purchase 10.978 million.

Massive $ONDO purchase detected! This whale created a new wallet 11 hours ago and has since spent 4,611 $ETH ($17.1M) to buy 10.978M $ONDO at an average price of $1.553 during the market crash. Follow @spotonchain and track this whale’s address at platform.spotonchain.ai/en/profile?add…

The transaction happened when ONDO traded at $1.553 per token.

The enormous purchase stirred the crypto community, with many expecting the RWA token to lead the upcoming altcoin season.

Whales often invest in assets with robust upward momentum.

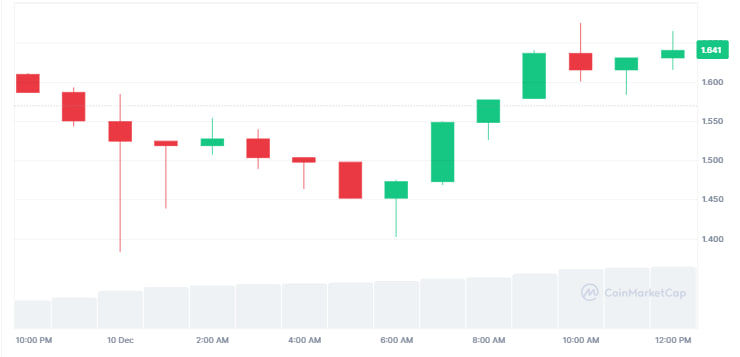

ONDO price actions

While most altcoins target recoveries amid double-digit losses, Ondo Finance dominated the past day with bullish price actions.

The token gained 2.55% within the past day to trade at $1.64, and the robust daily trading volume suggests notable momentum behind ONDO’s price actions.

Source: Coinmarketcap

Source: CoinmarketcapMaintaining the prevailing strength could propel the coin to the psychological mark of $2 in the upcoming sessions.

What technical indicators say

Ondo Finance’s market structure supports the upside thesis.

The Moving Average Convergence Divergence and signal lines approached a bullish crossover, suggesting possible trend reversals.

Trend-based FIB levels show ONDO has the nearest resistance around the 23.60% Fibonacci zone ($1.6952).

A successful breakout could see the altcoin soaring to $1.93 – the 50% Fibonacci area.

Such a move would translate to a 22% increase from current prices and open the doors to the $2 before 2024 end.

Further, ONDO prints a significant candlestick on the 4H timeframe, marking a 9% uptick inside a descending channel.

Source: TradingView

Source: TradingViewAlso, the asset completes a morning start formation following a rebound from the support zone at $1.47.

ONDO price has significantly magnified breakout odds while approaching the upper resistance trendline.

The prevailing reversal started from a long-standing support barrier with multiple price rejects.

That makes the Morning Star setup credible while increasing breakout chances.

The Relative Strength Index maintained gradual uptrends since early November, indicating stable accumulation.

Nonetheless, the indicator hit overbought regions, suggesting a potential near-term correction for ONDO.

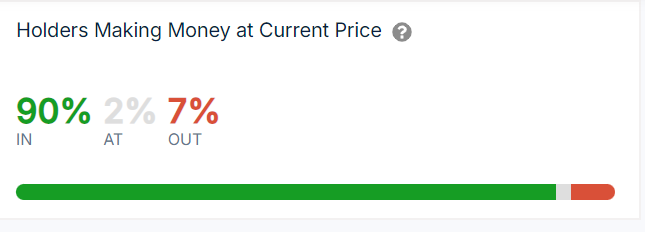

Meanwhile, investors remain optimistic about Ondo Finance’s future due to its profitability.

IntoTheBlock data shows most ONDO holders are making money at current prices.

Source: IntoTheBlock

Source: IntoTheBlockThese stats could attract more investors and buyers looking for profitable projects. That would support significant gains for the RWA coin.

Nonetheless, broad market sentiments remain crucial in determining Ondo’s performance, considering its 0.7 correlation with Bitcoin.

The cryptocurrency space displays a bloodbath as top assets continue to erase recent gains.

The market capitalization of all assets plunged by nearly 3% in the past day to $3.4 trillion.

That signals robust bearishness that could postpone Ondo’s swift move to $2 (in the near term).

Meanwhile, renowned analyst Michael van de Poppe predicts quick reversals as the market eyes the Q1 2025 altcoin season.

That’s the flash crash drop on #Altcoins. Some have dropped by 30% on the day. Don’t worry, this will reverse back fast, you’d want to see such a massive collapse and liquidity wipe. Onwards we go.

The post Whale scoops up millions of Ondo coins after recent dip; what’s next for ONDO price? appeared first on Invezz

English (US) ·

English (US) ·