Annual return of 22% or more

On the 30th, Cega Finance, a provider of exotic options (special options), announced a 22% discount on crypto assets (virtual currency) Ethereum (ETH), stETH, and stablecoin USDCoin (USDC) holders. announced the launch of a new option strategy, “Dual Currency,” which provides annual percentage returns (APY) of

Sega operates on the Ethereum and Arbitrum networks, realizing a complex operation strategy called “structured investment” in traditional finance on-chain, and has already accumulated over $300 million in trading volume.

The key to Sega’s “dual currency” strategy is selling 27-day call options and earning fixed interest rates (annual interest rates ranging from 22% to 51%). This strategy offers an opportunity to earn a high fixed return while minimizing risk. However, the risk is that the deposited currency may be sold at a less favorable rate than the market rate, which may limit the maximum profit margin.

Sega is offering five new products as part of its dual currency strategy lineup: “ETH Elephant,” “ETH Dragon,” “stETH Elephant,” “stETH Dragon,” and “USDC Elephant.” Each of these is designed to meet the needs and risk tolerance of different investors.

connection:“Flexible and diverse financial products for Web3 investors” CEO of DeFi project Cega speaks — “WebX Weekly”

stETH total deposit amount is high

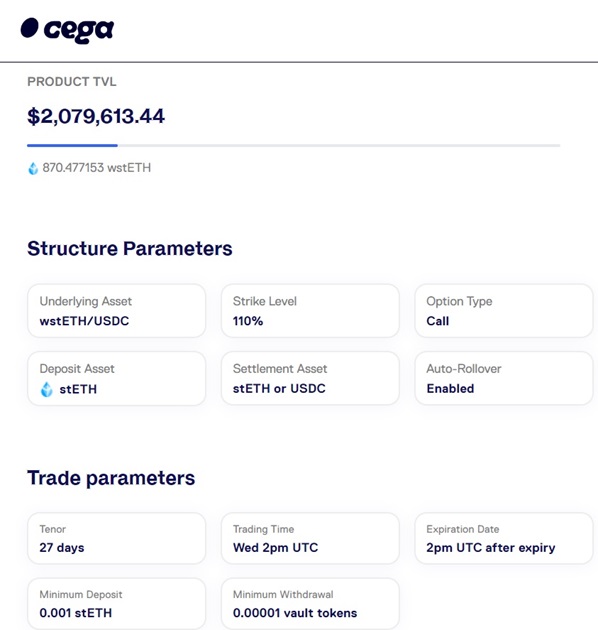

One that is attracting particular attention is “stETH Elephant”, which has a TVL (total deposit amount) of $2 million, and users can participate with as little as 0.001 stETH. In this product, you sell a 27-day call option and earn a premium at expiration, with the payment determined in ETH or USDC depending on where the market price at that time is relative to the strike price.

Source: cega

For example, if the price of ETH exceeds the strike level (110%) at expiration, investors will have their ETH deposited converted to USDC. However, since the trade will be at the strike price, there will be no profit from further price increases in ETH.

On this occasion @LidoFinance We have released a collaboration product with! This is the best product using stETH, which is well-known in the DeFi world. He also took this opportunity to make major updates to the UI and infrastructure. Please take a look at https://t.co/ZPiyzYXGXj  https://t.co/QVnCID0IF8

https://t.co/QVnCID0IF8

— Atoi  (@arisatoyo_jp) November 30, 2023

(@arisatoyo_jp) November 30, 2023

Sega CEO Arisa Toyosaki told The Block that “it’s the perfect product when the market is stable.” This strategy will provide new yield opportunities in the liquid staking market and support the growth of the Ethereum market.

What is liquid staking?

A DeFi (decentralized finance) system that allows you to operate alternative assets (staking proof tokens) while receiving staking interest on virtual currencies. Lido Finance (LDO) is the largest service provider of “liquid staking” with a TVL of 9.26 million ETH ($19.3 billion). It accounts for 32% of all ETH staking.

Virtual currency glossary

Virtual currency glossary

connection:DeFi “Cega” that issues structured bonds achieves cumulative procurement amount of 1.3 billion yen

Features of SEGA Finance

Sega raises $9.3 million in seed funding in a round led by Dragonfly. Until now, he has worked on strategies such as “Pure Options Strategy (PO)” and “Bond + Options Strategy (B+O),” with a focus on money management.

The B+O strategy builds on a strong foundation of risk management by lending funds to verified market makers, actively monitoring credit risk, and entering into ISDA agreements with market makers. This is a standard document that manages credit, legal and operational risks among market participants.

This strong risk management system was demonstrated during last year’s FTX crisis. By leveraging the ISDA legal agreement, Sega was able to forewarn Alameda Research’s financial situation and recover all of the funds it had lent before the company went bankrupt.

Although no specific information has been made public regarding which option markets Sega’s dual-currency strategy is being processed, past strategy designs indicate that it is generally available on major crypto exchanges and specialized options trading platforms. It is assumed that it will be processed.

connection:Lido’s stETH begins deployment to Ethereum L2

The post What is Cega Finance’s dual currency strategy to achieve high yields in the new era of Ethereum investment? appeared first on Our Bitcoin News.

1 year ago

116

1 year ago

116

English (US) ·

English (US) ·