Connection between virtual currency and AI

On the 30th, Ethereum co-founder Vitalik Buterin analyzed four possibilities for the intersection of crypto assets (virtual currencies) and artificial intelligence (AI) and explained their use cases and risks in a blog post.

The promise and challenges of crypto + AI applications:https://t.co/ds9mLnshLU

— vitalik.eth (@VitalikButerin) January 30, 2024

Mr. Buterin first raised the following points as synergies between virtual currency and AI at a “superficial level”.

- Cryptocurrency decentralization balances AI centralization

- Cryptocurrency brings transparency to opaque AI

- AI needs data, and blockchain is suitable for storing and tracking data

On the other hand, when asked about synergies at a deeper level, he has previously answered that there are “not many” synergies, but there are signs of change as AI and cryptocurrencies have each become more powerful over the past three years. I pointed out that I could see it.

But Buterin cautions that it’s important to be careful about how AI is applied.

Particularly difficult is that in cryptography, open source is the only way to make something truly secure, but in AI, making models (or even their training data) open leaves them vulnerable to adversarial machine learning attacks. will increase significantly.

AI characteristics and concerns

Mr. Buterin expressed his view of AI as follows.

Rather than explicitly specifying an algorithm, I think of AI as stirring up a large computational soup and applying some kind of optimization pressure to generate an algorithm with the characteristics you desire. be able to

He pointed out that AI algorithms have a common property: “the ability to do very powerful things.” At the same time, however, he expresses strong concern that there are limits to knowing and understanding what is going on inside.

Four classifications likened to games

Mr. Buterin compared the area where AI and blockchain intersect to a “game” and classified it into four categories.

- AI as game player (most likely)

- AI as a game interface (high potential, but with risks)

- AI as a rule of the game (needs to be considered very carefully)

- AI as a game objective (long term but sparking interest)

Mr. Buterin presented a use case for the first category of AI as “game players” = participants in the blockchain mechanism, applying it to arbitrage trading in on-chain decentralized exchanges (DEX). This concept is most likely to be viable because it is not new and has already been implemented by arbitrage bots for nearly a decade.

He expects such AI bots to vastly outperform humans in arbitrage and expand into other use cases, such as prediction markets.

In general, the underlying mechanics will continue to be designed in much the same way as before, but there are immediately promising use cases where individual players become AIs and mechanics operate effectively on a more microscopic scale. , is the easiest thing to do well.

AI as an interface

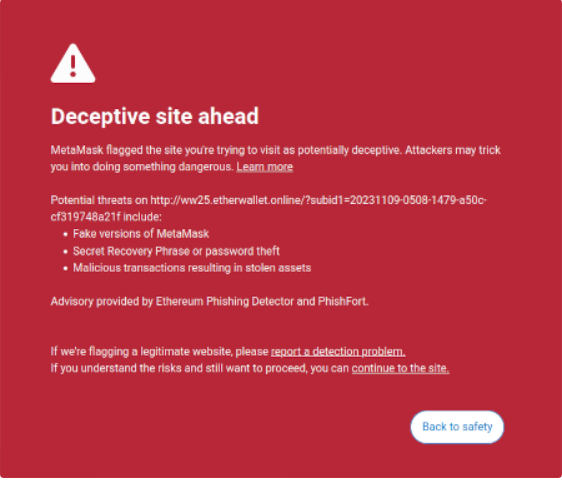

Buterin floated the idea of AI as an interface to help users navigate the complexities of online cryptocurrency transactions more securely. There are potential use cases for AI to protect users’ interests, such as detecting fraud, interpreting complex transactions, and showing users the likely outcome.

As an example, he cited the fraud detection function of crypto wallet Metamask.

However, Buterin pointed out that the risk is currently too high in an open source environment, as adversarial machine learning can lead to “fraud optimization.” He said AI could be useful in providing users with “real-time tutorials” and preventing mistakes, but should be wary of using it directly against those who spread fraud or malicious misinformation. Ta.

connection:MetaMask tests routing technology that reflects user intent

AI as rules

Regarding AI as rules, Buterin argued that it is “the most dangerous and needs to be approached with the greatest care.”

For example, a decentralized autonomous organization (DAO) might use AI when it needs to make subjective decisions. However, if the AI model is not open, its inner workings cannot be verified and it can become similar to a centralized app. Buterin also pointed to the risk that if it is open, an attacker could locally simulate machine learning that is optimized to fool the model and be able to reproduce it on the network.

most difficult application

Buterin said that using blockchain and cryptography to create a “single decentralized, trusted AI (singleton)” is the most difficult, but it will reduce functionality and avoid the risks of centralization. He argues that it is promising in terms of improving the safety of AI by doing so.

However, he added that there could be many cases where the underlying assumptions fail, so caution should be exercised in situations of high value and risk.

The post What is the beneficial intersection of virtual currency and AI (artificial intelligence)?Mr. Buterin explains four cases appeared first on Our Bitcoin News.

1 year ago

136

1 year ago

136

English (US) ·

English (US) ·