The Shanghai upgrade is likely to increase the popularity of ETH staking in general. Encourage competition among staking protocols and benefit users – pick what you want to read on Sunday from the columns and interviews published this week. There are eight this week.

What impact will the “Shanghai” upgrade have on ETH liquidity – will new growth begin?

The “Shanghai” upgrade will be the most significant event for the Ethereum blockchain. In Shanghai, a number of improvements will be made to the Ethereum blockchain.

Chief among them is the ability for those who stake Ethereum (ETH) to withdraw their staked coins and earned rewards. …read more

“Shanghai” Will Change ETH Economics Forever

A major upgrade of the Ethereum blockchain, “Shanghai,” has been completed. Shanghai will eventually be remembered as a positive event for Ethereum (ETH).

However, many of the world’s leading ETH quant traders, who have so far earned higher yields than ETH’s staking yields, are now able to withdraw their staked ETH at last, resulting in a significant increase in ETH circulation. In the short term, we believe that the price will be neutral or head to the downside. …read more

Is “Shanghai” Selling Pressure on Ethereum? What Analysts Expect?

Analysts differ on how much selling pressure the Ethereum blockchain “Shanghai” will put on Ethereum (ETH).

JPMorgan says it will likely face selling pressure from upgrades as more than 1 million Ethereum will be available immediately. …read more

Is Real Assets (RWA) Tokenization Finally Coming?

Shutterstock

ShutterstockMy veteran colleagues at CoinDesk get tired of talking about tokenizing “Real World Asset” (RWA). I’m tired of hearing it.

But at the risk of falling into the trap of optimism, the current hype around RWAs is more genuine and impactful than 2018’s hype around security tokens. It feels like …read more

The world’s worst cryptocurrency policy caused by the FTX bankruptcy

When thinking about policy making in Washington, DC, it’s important to remember that governments, like all other organizations, are made up of people. Humans are often complex creatures whose emotions undermine their ability to make rational decisions.

For some time now, following the barrage of regulatory enforcement actions against the crypto industry, I have been concerned that there are danger signs of politicizing crypto policy in the United States. …read more

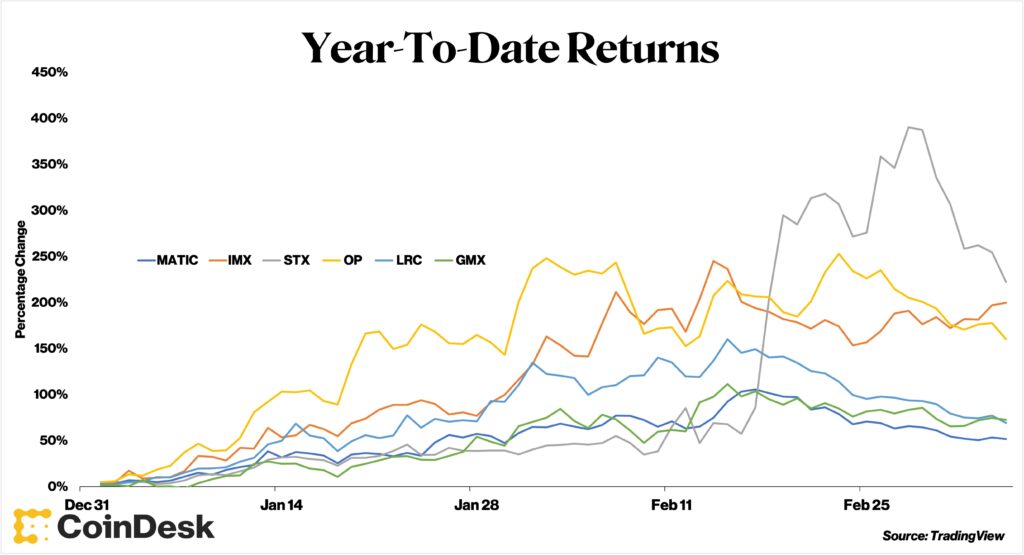

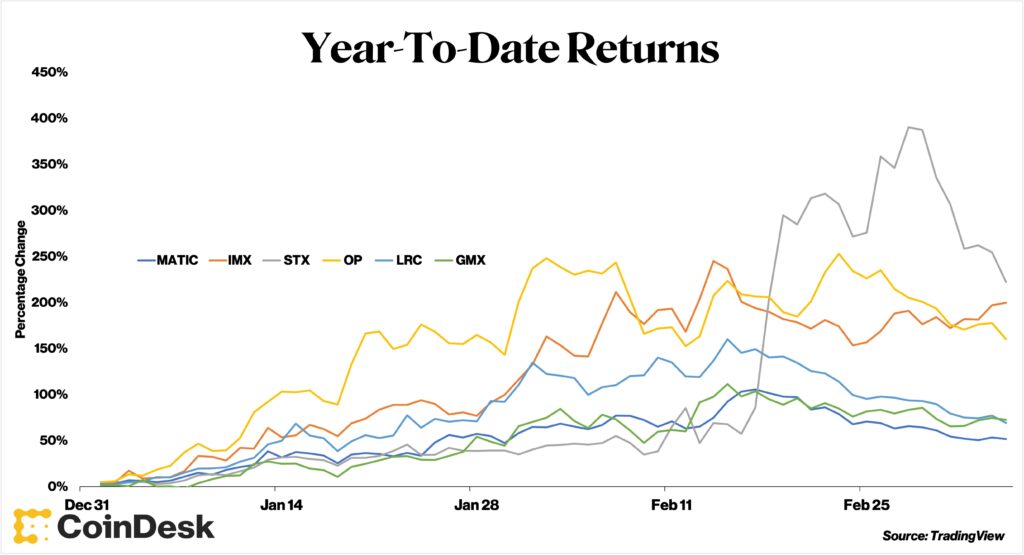

Layer 2, why is it important?

TradingView

TradingViewFinding new profitable investments is a never-ending task faced by all investors. Bitcoin (BTC) and Ethereum (ETH) dominate the crypto buzz, but the opportunities for investors are much wider.

Some of those opportunities stem from the need to extend the capabilities of the Bitcoin and Ethereum blockchains, and are inherently connected to them. …read more

U.S. Congressman’s “Anti-Crypto Corps” Begins Politicalization of Crypto Assets

![U.S. Congressman’s “Anti-Crypto Asset Corps” Is the Beginning of the Politicalization of Crypto Assets[Column]](https://www.coindeskjapan.com/wp-content/uploads/2023/04/GTDV5EJ45NGQTFXNWLWBD4WSJM-710x458.jpeg)

![U.S. Congressman’s “Anti-Crypto Asset Corps” Is the Beginning of the Politicalization of Crypto Assets[Column]](https://www.coindeskjapan.com/wp-content/uploads/2023/04/GTDV5EJ45NGQTFXNWLWBD4WSJM-710x458.jpeg) Council Bluffs Town Hall 10/Wikimedia Commons

Council Bluffs Town Hall 10/Wikimedia CommonsWith the United States entering the midterm election year, it is only a matter of time before crypto assets (virtual currencies) become a focal point of the election campaign.

Florida Governor Ron DeSantis, who is seen as a likely Republican presidential candidate, announced a bill on March 20 to ban the use of federally controlled central bank digital currencies (CBDC) in Florida. …read more

Whereabouts of “Freedom of Payment” Considered from Report on Criminal Use of Cash App

Investment research firm Hindenburg Research said on March 23 that Jack Dorsey’s Block (formerly Square) payment tool “Cash App” was being abused by criminals. The company released a lengthy report saying it wasn’t taking enough precautions.

Hindenburg is still a new research firm, but it has garnered widespread credibility by exposing the frauds of high-profile electric-vehicle makers such as Nikola. …read more

|Text and editing: coindesk JAPAN editorial department

|Image: Shutterstock

The post What is the impact of “Shanghai” on ETH liquidity / Tokenization of Real Assets (RWA), has it finally arrived?[8 carefully selected books you want to read on Sunday]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

132

2 years ago

132

English (US) ·

English (US) ·