Address scaling issues with concatenated configurations

“Modular” architecture is attracting attention as a major trend in blockchain technology in 2024. This approach addresses blockchain scaling issues based on the efficiency of functional division of labor. They have also succeeded in acquiring users through airdrops and a point system that creates expectations.

This time, I would like to focus on Celestia and Eigenlayer, which are representative projects in this field.

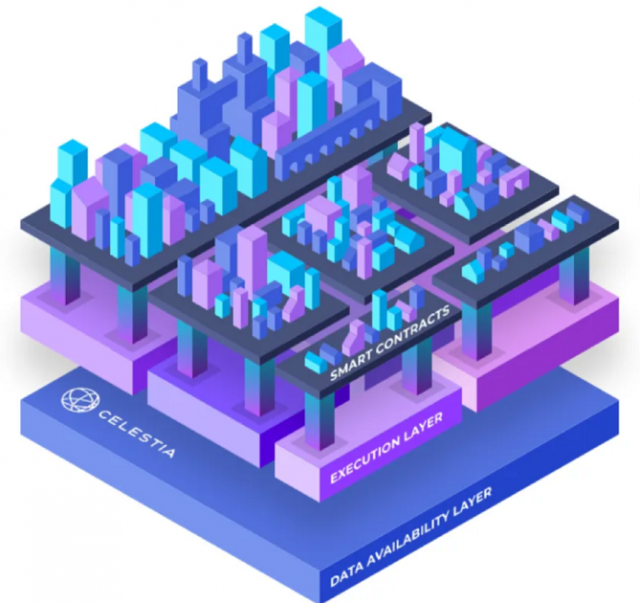

Modular architecture separates the main functions of a blockchain into independent layers that provide specialized functionality. This differs from monolithic networks such as Ethereum and Solana, in which the execution layer, payment layer, consensus layer, data availability layer, etc. are handled separately.

This architecture overcomes the scaling issues of monolithic chains and allows greater flexibility in application design and adaptability to technological demands. Specialized blockchains will be formed to address specific functions and requirements.

Linking with app-specific rollups

Source: Celestia Labs

Particularly noteworthy is the “rollup,” which incorporates a modular architecture. For example, Ethereum-based rollup Arbitrum last October allowed developers to select Celestia as their data availability layer. In this case, the configuration is an execution layer (Arbitrum), a payment layer (Ethereum), a consensus layer (Ethereum), and a data availability layer (Celestia).

connection:Modular BC construction “Celestia” encourages initial participation through airdrop targeting 580,000 addresses

Polygon has also started supporting the DA layer “Celestia”. Competitors to Celestia are also emerging, with reports that Near Protocol will launch NEAR DA on Ethereum, which will be used by Starknet’s Madara and others. Avail, which is independent from Polygon, plans to launch its mainnet in 2024.

Ethereum is expected to implement EIP-4844 (Proto-Danksharding) in the next update “Dencun” and reduce L2 rollup fees by 2-10 times (according to Coinbase). Against this background, rollups that incorporate modular architecture are becoming even more important.

connection:Polygon’s modular blockchain Avail goes independent

Engage your community with airdrops

Rollup as a Service (RaaS) and corresponding SDK (Software Development Kit) enable you to build application-specific modular rollups and quickly deploy customized AppRollups. , is now possible with low coding requirements.

In particular, new projects that use Celestia as a data availability layer have adopted a kind of practice of distributing their own tokens to the TIA staking community as a strategy for initial user acquisition.

Source: CoinMarketCap

As the market realized the usefulness of Celestia, demand for TIA tokens increased, and as a result, the market capitalization of TIA tokens skyrocketed late last year. However, with a large-scale unlocking of TIA scheduled for October 2024, investors considering purchasing new TIA need to carefully consider both risk and return.

Some have recommended a delta neutral strategy in relation to the TIA token. The delta neutral strategy is a method to reduce the risk of price fluctuations in the underlying asset, and is a measure to build a hedge position at the same time as holding TIA tokens.

(3,3) always ends in (-3,-3) eventually, lack of momentum, liquidity exhaustion, and unlocks will def all be contributors to the latter. But in the meanwhile, while the momentum is still hot, we ride

— Westie  (@WestieCapital) January 15, 2024

(@WestieCapital) January 15, 2024

Interest in EigenLayer

EigenLayer is a platform that is also attracting attention in terms of data availability solutions.

The platform originally offers a “re-staking” feature that allows Ethereum staking tokens to be reused for added security. According to DeFillama, over $1.8 billion in assets are locked up at the time of writing, and EigenLayer has created an extensive ecosystem of applications being built to leverage asset security.

connection:EigenLayer-based Ethereum “restaking” Renzo raises $3.2 million

For example, there is a data availability (DA) layer called “EigenDA” that uses EigenLayer. While Celestia combines the consensus layer and DA layer, EigenDA builds a single DA layer. EigenDA operates on Ethereum restaking, and as transactions increase, the use of the DA layer increases, and rewards are distributed to restaking participants. By separating Ethereum’s consensus layer and DA layer, it improves scalability while maintaining Ethereum’s security.

Retaked Points are used as an indicator of the EigenLayer ecosystem’s contribution to shared security. Source: EigenLayer

And “AltLayer” provides “Restaked Rollups”, a RaaS framework operated by EigenLayer’s Ethereum restaking. AltLayer’s RaaS framework supports important rollup stacks such as Polygon CDK and Arbitrum Orbit, and this RaaS and restaking-based rollup is being adopted in the DeFi, SocialFi, and gaming spaces. There are also reports.

Introducing @alt_layer $ALT on #Binance Launchpool!

Farm #ALT by staking #BNB and $FDUSD.

https://t.co/sUraU4wkMO pic.twitter.com/jQuzuiDyo3

https://t.co/sUraU4wkMO pic.twitter.com/jQuzuiDyo3

— Binance (@binance) January 17, 2024

AltLayer has successfully raised funding from prominent investors and was selected as the 45th project on the Launchpool platform of global cryptocurrency exchange Binance. Investors will receive ALT tokens depending on the duration and amount of liquidity provision (farming) on Binance. ALT is scheduled to be listed on the global version of Binance on January 25th.

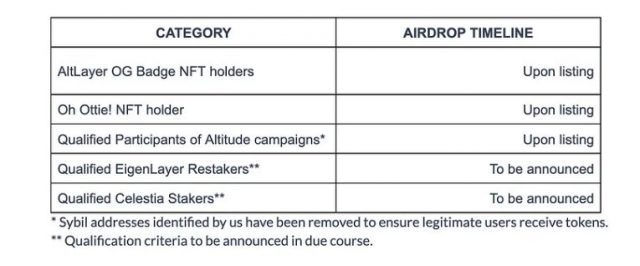

AltLayer is also preparing allocations for Celestia and EigenLayer stakers in preparation for the token launch.

Source: AltLayer

connection:Manta Network, which is attracting attention through airdrops, is scheduled to be listed on Binance

The post What is the next trend for modular blockchains? Explaining Celestia airdrop case study and EigenLayer ecosystem appeared first on Our Bitcoin News.

1 year ago

142

1 year ago

142

English (US) ·

English (US) ·