Largest BTC holdings among listed companies

A pioneer in the business intelligence (BI) industry, MicroStrategy has delivered innovative products to thousands of companies. It’s a seemingly inexplicable investment strategy that has pushed the stock price even higher in recent years.

The company’s co-founder, Michael Thaler, purchased $250 million worth of Bitcoin in August 2020 as part of its capital allocation strategy. This bold strategy saw the potential for high returns and Bitcoin’s appeal as an anti-inflationary measure. As a result, MicroStrategy’s stock has nearly tripled since early 2020.

The company’s trust in Bitcoin investment is increasing, and as of July 2023, it boasts over 150,000 BTC holdings, which is the largest amount among listed companies. MicroStrategy’s stock (MSTR) has now become a proxy investment vehicle for Bitcoin, attracting the attention of major institutional investors such as BlackRock, Vanguard Group, Morgan Stanley and Fidelity.

This article explores MicroStrategy’s bitcoin investment strategy, financials, and Michael Thaler’s vision.

table of contents

- Overview of MicroStrategy

- Changes in BTC holdings of Micro Strategy

- BTC purchase funds and financial situation

- Michael Thaler’s vision

- Major shareholder of MicroStrategy

Overview of MicroStrategy

Based in Virginia, USA, MicroStrategy was founded in 1989 by MIT graduates Michael Thaler and Sanju Bansal.

After providing a platform for companies to efficiently analyze and visualize business data, the company achieved steady growth, and in 1998 it went public on the NASDAQ market in the United States (NASDAQ: MSTR).

A renowned pioneer in the field of business intelligence (BI), MicroStrategy provides enterprise-level analytics solutions and mobile software. Leveraging these innovative products, thousands of organizations around the world gain insights to make data-driven decisions.

In the BI area, the main competitors are products such as SAP AG Business Objects, IBM Cognos, and Oracle Corporation’s BI Platform.

A notable recent trend is that in June 2011, MicroStrategy partnered with Microsoft to expand its products on Microsoft Azure and strengthen its AI capabilities. The partnership will enable customers to achieve a comprehensive solution to manage and analyze data in the cloud to make faster and better decisions.

Largest holding of BTC as a listed company

The revenue generated by MicroStrategy is mainly derived from cloud service license and subscription fees. Sales in the first quarter (January-March) of 2023 were approximately 16.8 billion yen ($121.9 million), compared with the previous year. Increased by 2.2% compared to the same period. Sales and operating profit have been flat for the past few years.

But when it comes to stock prices, things are different. Since the beginning of 2020, MicroStrategy’s share price has nearly tripled, largely due to the company’s August 2022 purchase of Bitcoin as a capital allocation strategy.

Since then, the company has continued to increase its bitcoin holdings, and as of July 2023, the holdings will exceed 150,000 BTC, making it the largest listed company. MicroStrategy’s stock price (MSTR) has increasingly tended to move with Bitcoin’s price volatility.

When the Bitcoin price fell 60% in 2022, MSTR’s stock also fell about 35%. However, in 2023, the wind changed, and it surged from about 19,000 yen (about $145) at the beginning of the year to about 56,000 yen (about $400) as of July 11.

MSTR stock price (yellow), BTC price (candlestick), Nasdaq 100 index (blue) Source: Trading View

When MicroStrategy first bought Bitcoin, the BTC price was around $11,700 and the MSTR price was around $144. However, as of July 2023, the price of Bitcoin has nearly tripled to around $30,300, while MSTR shares have also increased 2.7 times.

Over the past five years, MicroStrategy (MSTR) has significantly outperformed the S&P 500 and outperformed Meta and Amazon.

Changes in BTC holdings of Micro Strategy

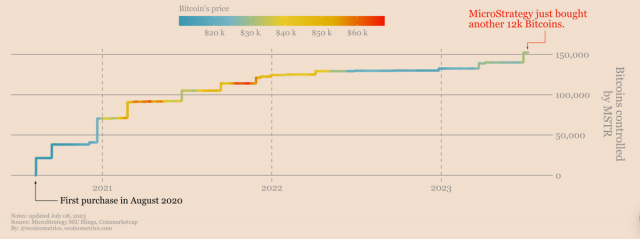

Source: Ecoinometrics

Since August 2020, MicroStrategy has been an active Bitcoin buyer, making more than 25 purchases over the past three years.

The purchase pace will be maintained in 2023, and an additional 1,045 BTC was purchased on April 5 of the same year. In addition, on June 28, the company made a massive purchase of 12,333 BTC worth 50 billion yen ($347 million).

Through these transactions, MicroStrategy’s bitcoin holdings totaled 152,333 BTC (equivalent to approximately $4.6 billion), with a total investment of approximately ¥650 billion ($4,516.98 million). . The average price the company has bought bitcoin so far is $29,668.

connection:Bitcoin’s $30,000 Knot Continues, MicroStrategy Buys BTC Worth $500 Million

Considering that the current market price of Bitcoin is around $30,000 per BTC, the unrealized gains and losses from MicroStrategy’s Bitcoin investments so far have turned slightly positive. This represents a significant improvement when compared to the approximately ¥27.1 billion ($197.6 million) impairment loss recorded in the fourth quarter of 2022.

connection:US Micro Strategy Posts Impairment Loss of 25 Billion Yen for Holding Bitcoin 2022 4th Quarter (October-December)

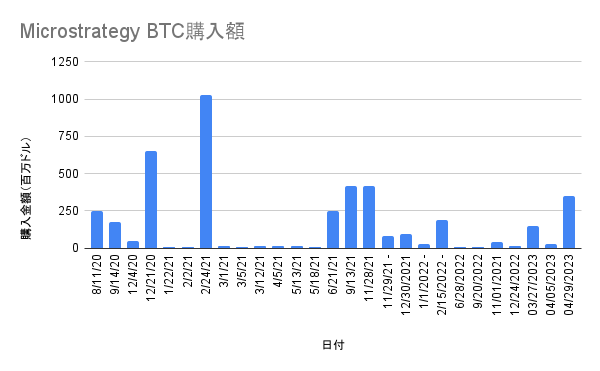

Microstrategy BTC purchase history

| 8/11/20 | 21,454 | $250M | 21,454 | $0.250B |

| 9/14/20 | 16,796 | $175M | 38,250 | $0.425B |

| 12/4/20 | 2,574 | $50M | 40,824 | $0.475B |

| 12/21/20 | 29,646 | $650M | 70,470 | $1.125B |

| 1/22/21 | 314 | $10M | 70,784 | $1.135B |

| 2/2/21 | 295 | $10M | 71,079 | $1.145B |

| 2/24/21 | 19,452 | $1.026B | 90,531 | $2.171B |

| 3/1/21 | 328 | $15M | 90,859 | $2.186B |

| 3/5/21 | 205 | $10M | 91,064 | $2.196B |

| 3/12/21 | 262 | $15M | 91,326 | $2.211B |

| 4/5/21 | 253 | $15M | 91,579 | $2.226B |

| 5/13/21 | 271 | $15M | 91,850 | $2.241B |

| 5/18/21 | 229 | $10M | 92,079 | $2.251B |

| 6/21/21 | 13,005 | $249M | 105,085 | $2.740B |

| 9/13/21 | 8,957 | $419M | 114,042 | $3.159B |

| 11/28/21 | 7,002 | $414M | 121,044 | $3.573B |

| 11/29/21 – 12/8/2021 | 1,434 | $82.4M | 122,478 | $3.655B |

| 12/30/2021 | 1,914 | $94.2M | 124,391 | $3.750B |

| 1/1/2022 – 1/31/2022 | 660 | $25M | 125,051 | $3.775B |

| 2/15/2022 – 4/5/2022 | 4,167 | $190M | 129,218 | $3.965B |

| 6/28/2022 | 480 | $10M | 129,699 | $3.975B |

| 9/20/2022 | 301 | $6M | 130,000 | $3.981B |

| 11/01/2021 – 12/21/2022 | 2,395 | $42.8M | 132,395 | $4.024B |

| 12/22/2022 | -704 | ($11.8M) | 131,690 | $4.012B |

| 12/24/2022 | 810 | $13.65M | 132,500 | $4.027B |

| 03/27/2023 | 6,455 | $150.00M | 138,955 | $4.140B |

| 04/05/2023 | 1,045 | $29.30M | 140,000 | $4.170B |

| 04/29/2023 – 6/27/2023 | 12,333 | $347M | 153,222 | $4.517B |

Data Source: Buy Bitcoin Worldwide

BTC purchase funds and financial situation

MicroStrategy has purchased and held bitcoin both directly and indirectly through its wholly-owned subsidiary MacroStrategy. Bitcoin purchases are made using working capital, borrowing, issuing corporate bonds, and raising new funds on the stock market, so-called “public offerings.”

Data Source: Buy Bitcoin Worldwide

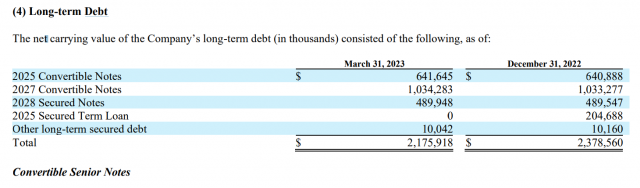

In the first quarter of 2023, we are working on improving our financial structure, including paying off the Bitcoin-backed loan. MicroStrategy’s long-term debt decreased from Rs 2.378 billion to Rs. 2.175 billion.

Currently, MicroStrategy’s major long-term liabilities are:

Source: MicroStrategy

・Convertible bonds due 2025, interest rate: 0.75%: $650 million (October 2020)

・Convertible bonds due 2027, interest rate: 0%: $1.05 billion (February 2021)

A convertible bond is a bond with the right to convert it into shares under certain conditions (conversion option). MSTR can raise capital without diluting the shares and use the proceeds Used to buy bitcoin.

Convertible bonds among the liabilities held by Michael Strategy have a low interest rate of 0 to 0.75%, and unless they are delisted from NASDAQ or NYSE, they are excluded from risk because there is no risk of being required to repay them early.

・2028 maturity, 6.125% annual interest secured junk bond (high yield bond): $500 million (June 2021)

As of the end of September 2010, Micro Strategy has deposited 14,890 BTC as part of the collateral for this loan, and the settlement line is a BTC price of approximately 500,000 yen ($3,561). This liquidation line is still slack and MicroStrategy poses no direct risk to the Bitcoin market.

However, interest on the loan accrues twice a year, which could put pressure on MicroStrategy’s results. From January to September 2022, MicroStrategy paid about 3 billion yen ($22 million) in BTC-related interest. That’s not a small amount, even when compared to the company’s “cash and cash equivalents” balance ($94.3 million as of March 31, 2023).

The fully repaid secured loan in Q1 2023 is a secured loan with Silvergate Bank in March 2022 due 2025. At that time, it had borrowed $205 million with $820 million (19,466 BTC) as collateral. MicroStrategy has advanced approximately $161 million to fully repay this secured long-term loan.

Additionally, in the first quarter of 2023, MicroStrategy sold its shares in the public market for net proceeds of approximately $339 million. About $179.3 million of that was used to buy Bitcoin.

Meanwhile, MicroStrategy’s total assets stood at $3.0264 billion in the first quarter of 2023, up from $2.41027 billion in the previous quarter. The increase was primarily due to a significant increase in digital assets ($1.84 billion to $2.0392 billion) and deferred tax assets ($188.15 million to $651.51 million).

Michael Thaler’s vision

MicroStrategy co-founder Michael Thaler is known as a leader in Bitcoin investment strategies. Thaler decided in August 2020 that bitcoin was more advantageous than other investments as a measure against inflation and could bring even higher returns, so he decided to allocate about $250 million worth of bitcoin to the capital. Acquired as part of strategy.

“Investing in Bitcoin is part of a new capital allocation strategy aimed at maximizing long-term shareholder value,” Thaler said at the time. It is an attractive investment asset and a reliable store of value that has the potential to appreciate over the long term.”

And even if the Bitcoin market enters a bear market after 2022, MicroStrategy continues its strategy to expand its holdings of Bitcoin, and its commitment is unwavering. Despite the criticism, Thaler has made it clear that the company will continue to grow its holdings of bitcoin and has no intention of selling it.

connection:MicroStrategy CEO Says He Will Not Sell Bitcoin

Additionally, on August 8, 2022, Thaler stepped down as CEO of MicroStrategy and became Executive Chairman. He said the decision will allow MicroStrategy to focus more on its Bitcoin-related efforts.

connection:“Dedicated to Bitcoin investment strategy” Thaler CEO of US MicroStrategy becomes chairman

connection:MicroStrategy 1Q Earnings Announcement, “Confidence in Bitcoin Strategy”

And now, Mr. Thaler says, “Clarification of regulations will make it easier for institutional investors to enter the market. If we restructure our operations around Bitcoin, that advantage will be further strengthened in the future.” presents a strong point of view.

connection:Bitcoin Reversal Offensive, Dominance Exceeds 50% Level for First Time in 2 Years

The U.S. Securities and Exchange Commission (SEC) considers most cryptocurrencies (tokens) to be unregistered securities, but has made a relatively clear indication that it treats Bitcoin as a commodity. And according to data from CoinMarketCap, Bitcoin’s market dominance rate has risen from 43% at the end of February 2023 to about 49.9% as of July.

Market share of BTC market capitalization Source: CoinMarketCap

In recent years, MicroStrategy has been actively working on bitcoin adoption, including developing new products related to bitcoin’s Layer 2 scaling solution, the so-called “Lightning Network”. The main trends are as follows.

|

2021/5/25 |

Why the community fears the “Bitcoin Mining Council” established by North American mining companies (related article) |

|

2022/4/27 |

MicroStrategy to Offer Employees Bitcoin Investments in Defined Contribution Pensions (Related article) |

|

2022/12/30 |

MicroStrategy to provide enterprise solutions for Bitcoin Lightning (related article) |

|

2023/04/1 |

MicroStrategy enables sending bitcoin via corporate email (related article) |

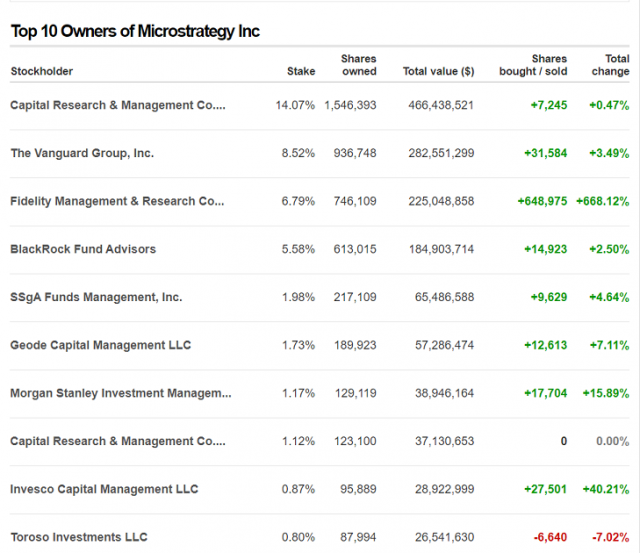

Major shareholder of MicroStrategy

The bitcoin investment strategy adopted by MicroStrategy creates an interface between mainstream investment institutions and bitcoin.

Major shareholders of MicroStrategy, a leading company in the business intelligence (BI) industry, have been major institutional investors such as BlackRock, which has the world’s largest amount of assets under management, and Vanguard Group, which has the world’s second largest amount of assets under management. has come to the fore.

connection:$400 Million Micro Strategy Accelerates Bitcoin and Mainstream Investor Interfaces

In January 2020, it was reported that financial giant Morgan Stanley acquired an 11.9% stake in MicroStrategy. Additionally, the first quarter of 2023 revealed that Fidelity affiliates, with over $4.5 trillion in assets under management, have significantly increased their stake in MicroStrategy. The two companies are now among MicroStrategy’s top 10 shareholders.

connection:Morgan Stanley Acquires 10% Stake in Bitcoin Owner MicroStrategy

According to 13F filings, a quarterly report to the U.S. Securities and Exchange Commission (SEC), BlackRock owns a 6% stake in MicroStrategy, which is worth more than ¥22 billion. Fidelity also increased its stake in MicroStrategy by 650,000 shares in the first quarter of 2023, giving it a 6.79% stake.

Top 10 MicroStrategy Shareholders Source: CNNMoney

This movement is spreading not only in the United States, but also around the world. Canada’s sixth-largest bank, National Bank of Canada, bought more than $500,000 in MicroStrategy shares in the first quarter of 2023, increasing its stake by 8.8%.

Acquiring MicroStrategy shares (MSTR shares) has become a very easy way to gain exposure to Bitcoin, especially for U.S. investors. As a result, some speculate that the MSTR stock is effectively functioning as a Bitcoin ETF.

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

The post What is the reason why the US listed company Micro Strategy continues to buy Bitcoin in large quantities? appeared first on Our Bitcoin News.

2 years ago

151

2 years ago

151

English (US) ·

English (US) ·