TrueUSD (TUSD) is a stablecoin whose use is rapidly expanding internationally. It is also used on the launchpad of the major virtual currency exchange Binance.

TUSD is the first stablecoin in the virtual currency industry to introduce real-time auditing by a third party. It has been rapidly increasing its market capitalization since 2023 and is attracting attention from the virtual currency community.

In this article, we will explain the background to the expansion of TUSD usage, as well as its characteristics and future prospects.

What is a stablecoin?

To begin with, a stablecoin is a virtual currency whose value is pegged (fixed) to the price of legal currency.

For example, USDT is pegged to the US dollar so that its price is always kept at $1.

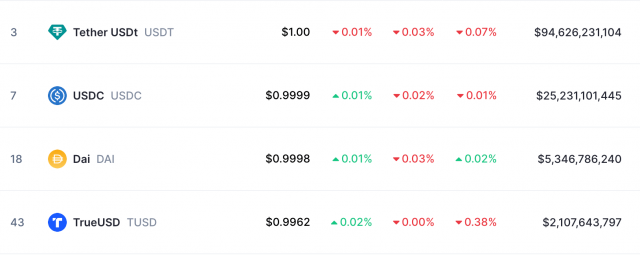

Image source: Coinmarketcap

Indispensable to the industry

Stablecoins are characterized by stable prices, unlike Bitcoin (BTC) and Ethereum (ETH). Stablecoins are valued by many cryptocurrency investors as an alternative asset to cash.

USDT, a representative stablecoin, boasts a market capitalization of approximately 13 trillion yen as of January 11, 2024. This is the third largest cryptocurrency in terms of market capitalization, after Bitcoin and Ethereum.

Stablecoins are proving to be an essential part of the cryptocurrency market.

Price discrepancies and regulatory risks

Stablecoins have a risk of price deviation. For example, UST (currently USTC), which was a stablecoin on the Terra blockchain, saw its price drop by tens of percent in 2022 and has not been able to recover since then.

On the other hand, there is also the risk of government regulation. BUSD, which was a major stablecoin until around 2022, has suspended new issuance due to regulations from the US government. As a result, as of January 2024, BUSD has almost no liquidity.

TUSD usage rapidly expands

While major stablecoins are experiencing various troubles, TUSD has rapidly expanded its support since the beginning of 2023.

TUSD is unique in that it is the first in the virtual currency industry to introduce real-time auditing from a third-party organization. It is attracting attention from the virtual currency community, as it is actively featured on the major exchange Binance.

What is TUSD?

Image source: TUSD

TUSD is a stablecoin issued on more than 10 types of blockchains, including Ethereum, Tron, Avalanche, BNB, Phantom, and Polygon.

It can be purchased on over 100 virtual currency exchanges and decentralized exchanges (DEX) such as Binance and HTX. You can also use TUSD on platforms such as Travala.com, UQUID, and HYVE.

TUSD was originally operated by TrueCoin, but in December 2020, management rights were transferred to Asia-based Techteryx.

Market capitalization is over 300 billion yen

Image source: Coinmarketcap

As of January 11, 2024, TUSD’s market capitalization is over 300 billion yen. In the stablecoin market capitalization ranking, it is the fourth highest after USDT, USDC, and DAI.

After appearing on the Binance Launchpad, usage expanded rapidly, and TUSD’s market capitalization approximately tripled in one year.

24-hour trading volume exceeds 60 billion yen

For stablecoins, trading volume is one of the most important points. If liquidity is low, investors may not be able to execute trades quickly.

As of January 11, 2024, TUSD’s 24-hour trading volume is approximately 62 billion yen, ranking 4th in the trading volume ranking of all stablecoins. In particular, the BTC/TUSD trading pair on Binance accounts for over 50% of the total, demonstrating its high liquidity.

Additionally, TUSD has zero maker fees on multiple exchanges, which is one of the reasons why it is supported by investors.

Binance Launchpad Regular

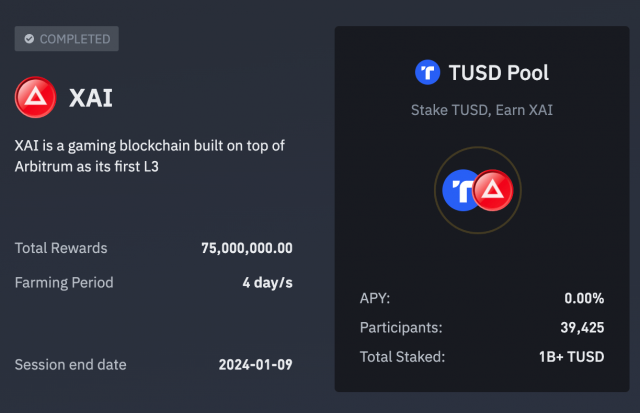

Image source: Binance

TUSD appeared on Binance Launchpad in 2023, and its usage has rapidly increased.

Binance Launchpad is a platform that distributes virtual currency for new projects listed on Binance. For example, it is possible to obtain newly listed tokens by staking (depositing) TUSD on Binance for a certain period of time.

TUSD appears in 11 stocks

Since May 2023, TUSD has appeared on the launch pad for a total of 11 stocks: RDNT, SUI, MAV, PENDLE, SEI, CYBER, NTRN, MEME, NFP, AI, and XAI.

This means that users who hold TUSD on Binance have always had the opportunity to obtain newly listed tokens.

Features of TUSD

The use of TUSD has expanded rapidly in recent years, and the reason for this is its “high level of transparency.” The characteristics of TUSD are as follows.

- real-time audit

- Partner with an independent CPA

- Partnered with Chainlink

real-time audit

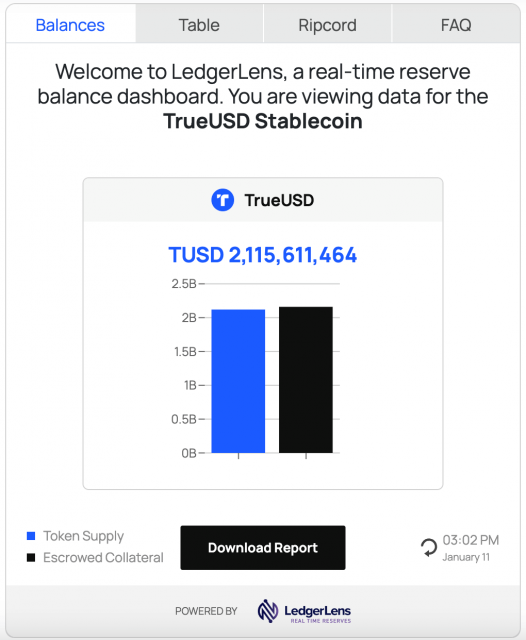

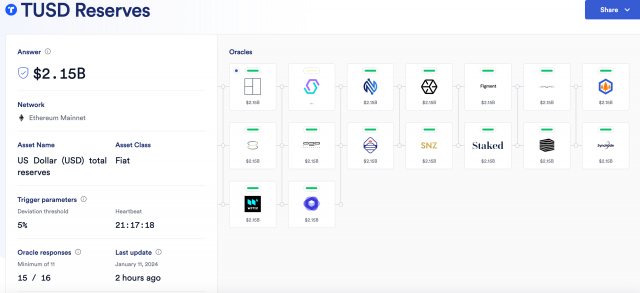

Image source: TUSD

What you need to be careful about when using stable coins is the presence or absence of collateral (backing) assets.

The reason a stablecoin can maintain the value of 1 USD is because the operating company holds USD equivalent to its market capitalization. Users must check from time to time whether the operating company securely holds the collateral assets.

TUSD conducts real-time audits to meet the needs of these users. Users can check the amount of collateral assets at any time on the TUSD official website.

As of January 11, 2024, we can confirm that TUSD holds collateral assets of approximately $2.1 billion (approximately 300 billion yen). This corresponds to the market capitalization of TUSD and is the basis for fixing the price of TUSD at 1 USD.

Partner with an independent CPA

Image source: TUSD

TUSD partners with MooreHK, an independent public accounting firm, to ensure transparency and fairness. Founded in 1975, MooreHK is a member of Moore Global, the world’s leading accounting and consulting network, with over 100 years of history in the UK.

By having an independent accounting firm audit its collateral assets, TUSD has gained a high degree of trust in the market.

We have also partnered with The Network Firm, an audit technology company specializing in cryptocurrencies, to provide very easy-to-understand information.

Partnered with Chainlink

Image source: Chainlink

Chainlink is the leading oracle protocol in the cryptocurrency industry and has partnered with over 2000 projects. TUSD uses Chainlink’s “Proof of Reserve” technology to achieve real-time auditing.

Automatically check when minted

Chainlink’s Proof of Reserve is an essential technology for safely operating TUSD.

First, the auditing firm The Network Firm aggregates the amount of TUSD’s collateral assets (such as US dollars held at financial institutions) in real time. The company then sends this data onto the blockchain through Chainlink’s Proof of Reserve.

This on-chain data is utilized by TUSD’s smart contract. For example, when a user mints TUSD, it is automatically checked whether the total supply of TUSD exceeds the total amount of collateral assets.

Through these measures, TUSD has achieved top-class transparency and safety among stablecoins.

Can TUSD make a leap forward?

The U.S. Securities and Exchange Commission (SEC) approved Bitcoin ETFs in January 2024, and the virtual currency market is starting to gain momentum. Under such circumstances, the importance of stablecoins is expected to only increase in the future.

TUSD is a pioneer in the virtual currency industry, having introduced real-time auditing by a third-party organization for the first time. As the number of new virtual currency users increases, TUSD may emerge as a representative stablecoin.

The post What is the stablecoin TUSD, whose demand is increasing? | Explaining the main features and strengths appeared first on Our Bitcoin News.

1 year ago

75

1 year ago

75

English (US) ·

English (US) ·