Binance Coin was among the digital coins that remained elevated over the past seven days.

Increased interest in yield farming within the Binance Smart Chain platform kept BNB afloat this week, especially after Binance announced the Scroll (SCR) project on its Launchpool.

Introducing @Scroll_ZKP Scroll (SCR) on Binance Launchpool and Pre-Market. Read more ⤵️ binance.com/en/support/ann…

Renewed optimism saw the altcoin eyeing the viral resistance range at $606 – $618 – a barrier that has prevented price surges for over two months.

While BNB nears the area again, traders and investors seem to anticipate price declines, with most modifying their positions.

Investors losing trust in BNB

Despite maintaining a bullish trajectory on the weekly timeframe, BNB exhibits weak macro trends.

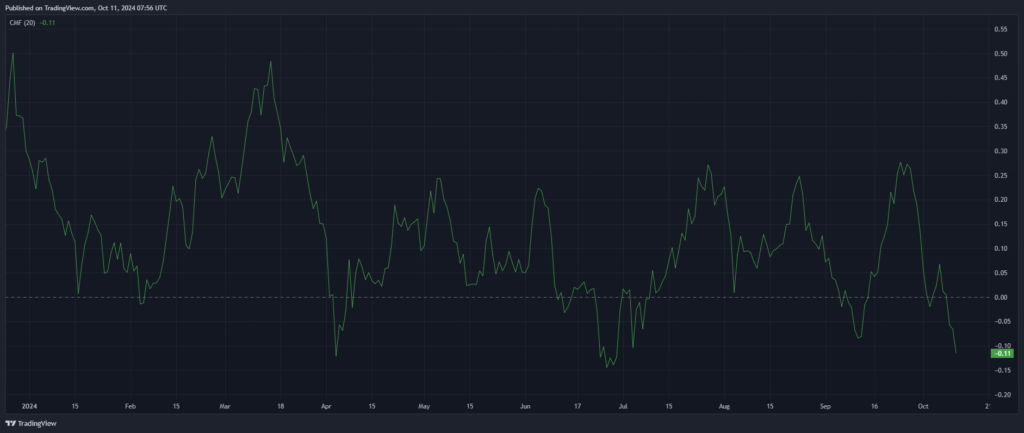

The Chaikin Money Flow has plunged to June 2024 levels, reading -0.11 at press time.

That reflects faded investor trust in the altcoin’s performance.

The CMF at 3-month lows indicates investors are reducing their exposure in Binance Coin, potentially to escape imminent plummets.

That will dent buying pressure, cementing the downward stance.

Thus, BNB’s current trend might signal upcoming challenges – where bears likely have the upper hand.

Moreover, BNB exhibits a negative funding rate, according to Coinalyze data, revealing significant bearishness.

That shows that investors are increasingly executing shorts, forecasting price dips.

Increased outflows and negative funding rates reveal that most participants are preparing to capitalize on bearish price actions.

Also, BNB’s open interest dipped 2.79% in the past day to $456.6 million as traders lost enthusiasm.

The pessimism will further dent the token’s sentiments.

BNB’s price performance

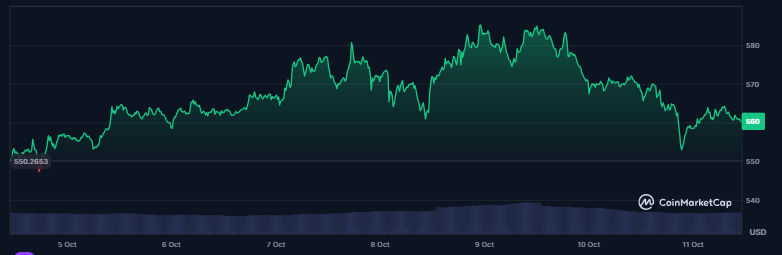

Despite the prevailing weakness, Binance Coin has recorded bullish price actions lately, gaining 3% and 10% in the past week and month, respectively.

The digital coin has retested an uptrend line as its support zone since failing to overcome the resistance at $606 last month.

Source: Coinmarketcap

Source: CoinmarketcapMeanwhile, bears threaten declines from the current price, which could plunge the BNB price towards the support barrier at $533.

The alt has relied on this zone to prevent continued dips several times.

However, flipping the value area at $569 into a support floor will cancel the projected decline.

BNB bulls could propel the asset towards the significant obstacle at $606 – $618.

Binance Coin will require massive bullish momentum to clear this resistance range.

A solid breakout will eye a near-term surge to $639 – $667. Meanwhile, buyers have their long-term target at 161.80% FIB level ($747) by 2024-end.

In summary, Binance Coin exhibits a complex outlook characterized by surging pessimism among traders and fragile macro momentum.

The negative funding rate and plummeted Chaikin Money flow, alongside the crucial support and resistance zones, reveal BNB’s potential cases and challenges in the near term.

Savvy analysts advise vigilance amid such unpredictable waters.

The post What’s next for Binance Coin (BNB) price as holder outflows hit 3-month high appeared first on Invezz

English (US) ·

English (US) ·