The post Where Are the $3.5 billion Terra’s Bitcoin Reserves, Should this be a Matter of Concern? appeared first on Coinpedia - Fintech & Cryptocurreny News Media| Crypto Guide

The Terra Foundation after accumulating a huge number of Bitcoins worth billions surprised the entire crypto space as it stood as the second-largest BTC holder after MicroStrategy. However, things got messed up as the TerraUSD(UST) got de-pegged heavily which destabilized the LUNA price too. And as speculated by many LUNA Foundation Guard emptied all their reserves to back their stablecoin but failed miserably.

In the past couple of days, Do Kwon clarified with the Twitter space that the organization was working on documentation and asked the community to remain patient. However, the missing BTC reserves are making huge rounds in the market as the founder still maintains his silence over this.

Therefore, where did these BTC actually go and what may be the next move?

The basic aim of the LFG’s Bitcoin reserves was to back the UST reserves so that it maintained its peg at $1. However even despite multiple attempts, UST lost its peg heavily also dragging the LUNA price towards the rock-bottom levels. However, now that the whereabouts of the BTC reserve still remain a mystery, Elliptic used its software to track them.

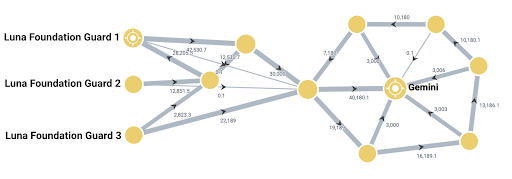

They found that exactly at the time Terra Platform announced the $750 million loan initially, 22,189BTC worth the same amount was sent from a BTC address managed by LFG to a new address. Further after a couple of hours, an additional 30,000 BTC worth nearly $930 million was transferred from another LFG address to the same address which all went into Gemini.

Source: Elliptic

Source: EllipticAfter this transfer, LFG had to have remained with 28,205 BTC which was sent to Binance at a single shot. However, it is still unclear whether these BTCs were sold or just moved to other wallets. Therefore, if the BTCs are not sold yet, then the Bitcoin turbulence may still not have ended here. Or another possibility is if the platform has to buy back the UST & LUNA tokens, then also they have to liquidate their BTC holding. In such a case, a huge influx of Bitcoin may be making its way that may seriously impact the BTC price in the upcoming days.

3 years ago

164

3 years ago

164

English (US) ·

English (US) ·