Bitcoin (BTC) is trading back above $108,000, marking a full recovery from last week’s dip below the six-figure level amid rising geopolitical tensions in the Middle East.

The rebound reflects a broader shift toward risk-on sentiment, supported by improving macro signals and renewed optimism across the crypto market.

Federal Reserve Chair Jerome Powell said this week that rate adjustments remain on the table, contingent on progress in trade talks and signs of easing inflation—remarks interpreted by markets as a signal of a potential policy pivot by late 2025.

At the time of writing, Bitcoin was trading at $108,008, up 1.3% over the past 24 hours. Ether (ETH) was holding at $2,490, posting a 1.8% gain.

Meanwhile, strong momentum is also building around early-stage projects, particularly Bitcoin Pepe.

The project’s presale has continued to attract investor interest, supported by its positioning as a meme-centric Layer 2 solution on the Bitcoin network.

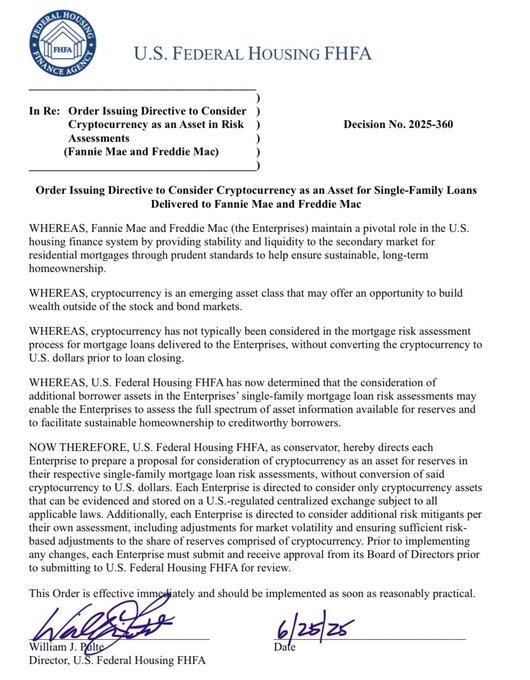

Major regulatory win for crypto

The Federal Housing Finance Agency (FHFA) on Wednesday directed Fannie Mae and Freddie Mac to begin considering cryptocurrency holdings as part of single-family mortgage loan risk assessments, a shift that could allow crypto investors to use their digital assets to qualify for home loans.

FHFA Director William Pulte announced the move in a social media post, stating that he had instructed the housing finance giants to “prepare their businesses to count cryptocurrency as an asset for mortgage,” aligning with President Donald Trump’s broader push to position the United States as “the crypto capital of the world.”

After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage. SO ORDERED

Fannie Mae and Freddie Mac, which have been under US government conservatorship since the 2008 financial crisis, back more than half of all US home mortgages.

Their risk assessment frameworks currently rely on traditional financial assets, and incorporating crypto could mark a notable departure from established underwriting practices.

President Trump has made cryptocurrency policy a key part of his administration’s economic agenda, courting the sector during his campaign and appointing regulators perceived as industry-friendly.

He has also hosted crypto executives at the White House in recent months, signaling growing institutional support for digital assets.

Shift in environment to help Bitcoin Pepe

Increasing regulatory clarity in the United States is expected to enhance visibility across the altcoin and meme coin sectors, potentially shifting investor sentiment in favour of projects that offer tangible utility.

As regulatory oversight expands, market focus may begin to move away from purely speculative plays toward initiatives that combine cultural resonance with meaningful technical foundations.

Bitcoin Pepe is aligning itself with this evolving narrative.

In contrast to meme tokens that rely solely on hype, the project merges infrastructure development with viral appeal.

Positioned as a Layer 2 solution, Bitcoin Pepe seeks to combine Bitcoin’s base-layer security with the scalability typically associated with platforms like Solana—an approach that differentiates it from much of the meme coin space.

This infrastructure-first strategy appears to be gaining traction among investors. The presale has already raised over $15.6 million.

Confirmed exchange listings on MEXC and BitMart have added momentum, with another listing announcement expected on June 30, further increasing interest as the presale approaches its final stage.

The post Where is Bitcoin Pepe headed as crypto markets score another regulatory win? appeared first on Invezz

English (US) ·

English (US) ·