Yes, we like to geek out about blockchain technology, and think it will one day become the foundation of a whole new infrastructure for digital finance. But what about as an investment?

The basis of capitalism is to allow investors to invest in the emergence of new technologies. And one of the remarkable things about blockchain is that it has created its own market where the industry can invest in the future of blockchain. However, whether these markets will be recognized by regulators is another matter. Until then, Solana (SOL) won’t be traded on Wall Street.

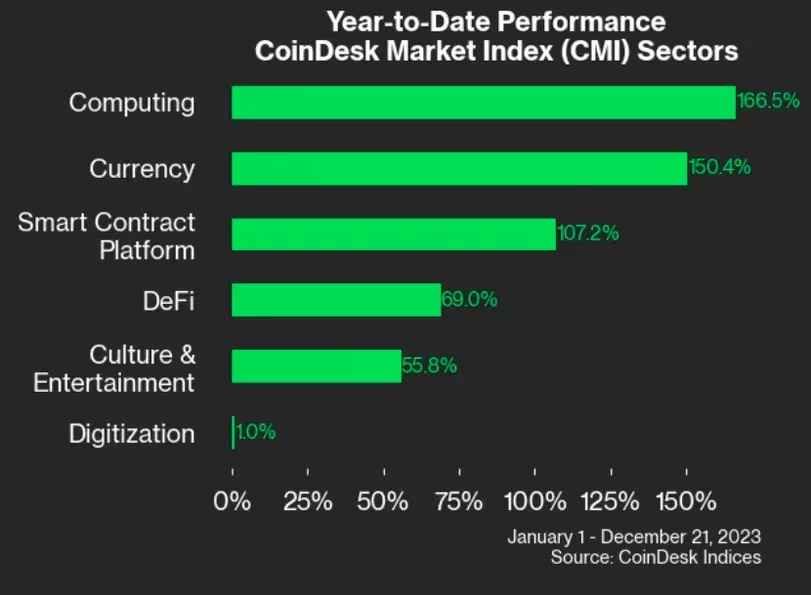

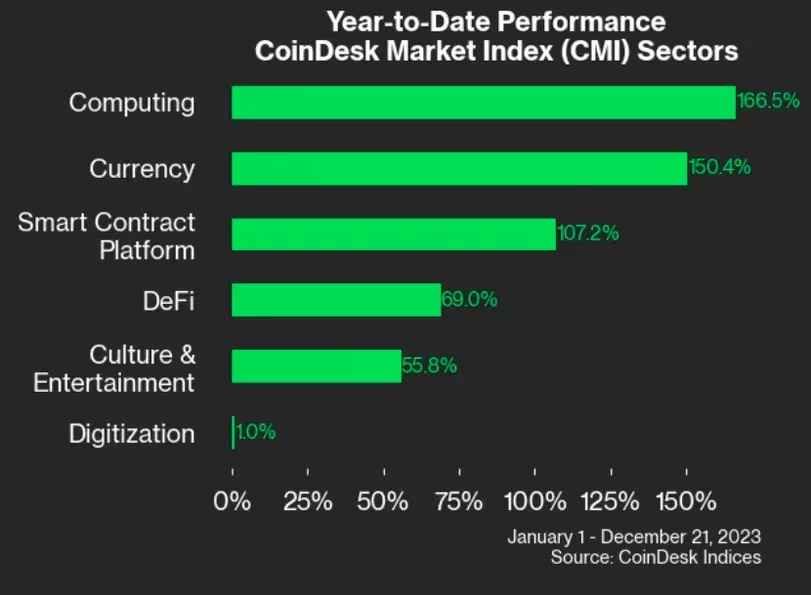

Aside from that, to look back at the performance of the digital asset market in 2023, let’s take a look at the benchmark CoinDesk Market Index (CMI) and a breakdown of year-to-date returns for each sector.

Below, we’ve prepared six charts that highlight the biggest takeaways for 2023.

CoinDesk Market Index (CMI) grows 5x faster than S&P 500

The CoinDesk Market Index (CMI) is CoinDesk’s broadest and most comprehensive index, and we call it the “S&P 500 of crypto assets.”

In the year to December 21st, CMI more than doubled, or 125% to be exact. As you can see in the chart above, most of this year’s returns came in the first and fourth quarters. During this time, there were a number of downturns before we started to see an uptick, leading to a lot of uncertainty (and layoffs) in the industry.

Bitcoin (BTC), the largest crypto asset by market capitalization, outperformed CMI, while Ethereum (ETH), the second-largest cryptocurrency, underperformed. CMI’s year-to-date return has been about five times the 23% return of the S&P 500, the benchmark U.S. stock market.

CoinDesk Computing Index (CPU) tops in sector returns

The CoinDesk Computing Index (CPU) returned 167% in 2023, making it the top gainer among CMI’s sectoral indexes. CPU corresponds to the computing sector of the CoinDesk Digital Asset Classification Standard.

The definition of the computing sector is as follows.

“The computing sector consists of projects that aim to decentralize the sharing, storage, and transmission of data by eliminating intermediaries and ensuring privacy for all users. All projects that aim to collect, transmit, store, and share data play an important role in building the Web3 infrastructure, including on-chain and off-chain data transmission, social data platforms, peer-to-peer secure data transactions, open networks, free market private computing, decentralized file storage and file sharing.

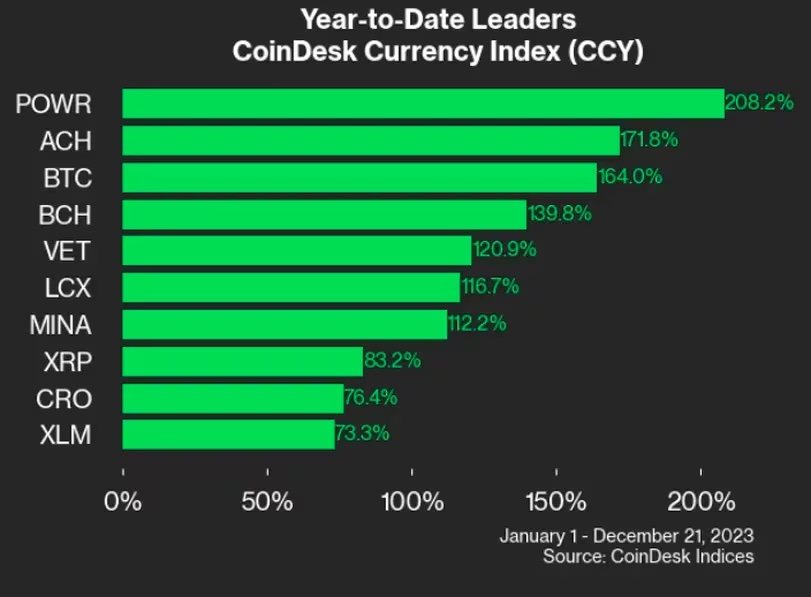

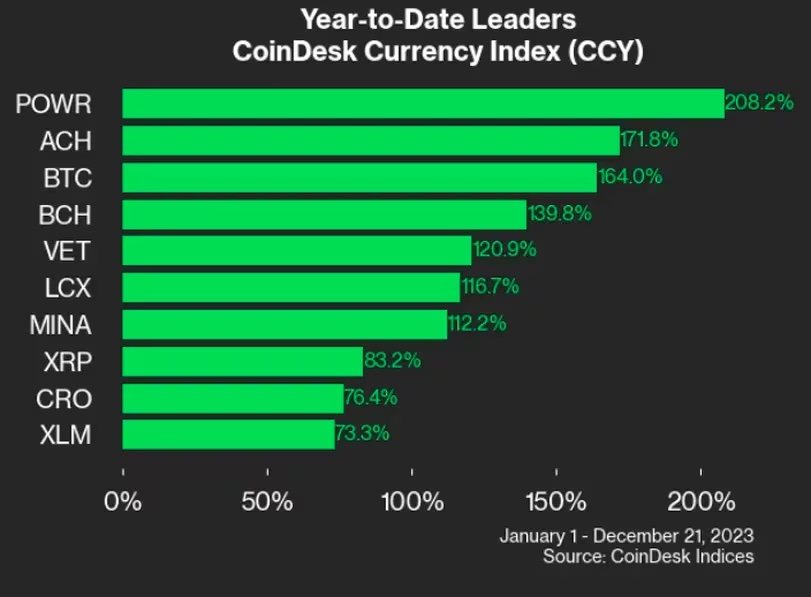

In second place is CoinDesk Currency Index (CCY) with a return of 150%. CCY includes Bitcoin, XRP (XRP), Stellar Lumens (XLM), and Dogecoin (DOGE).

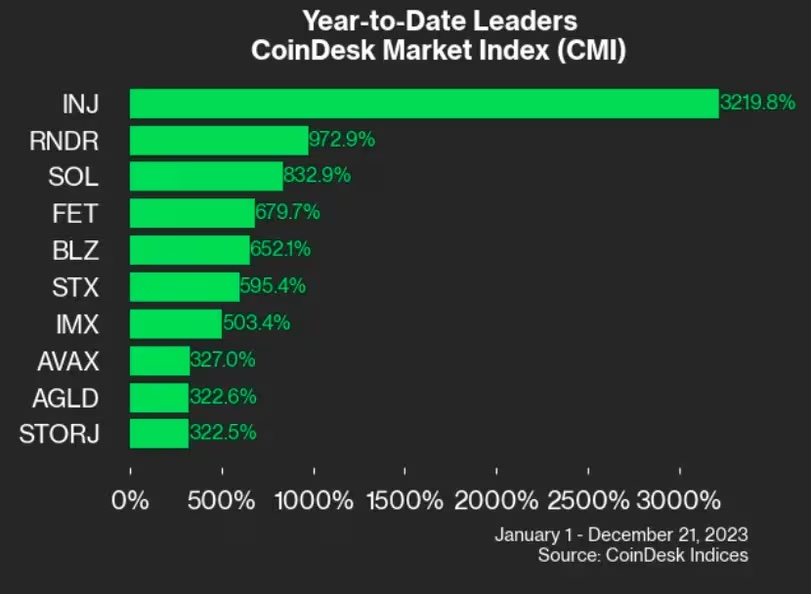

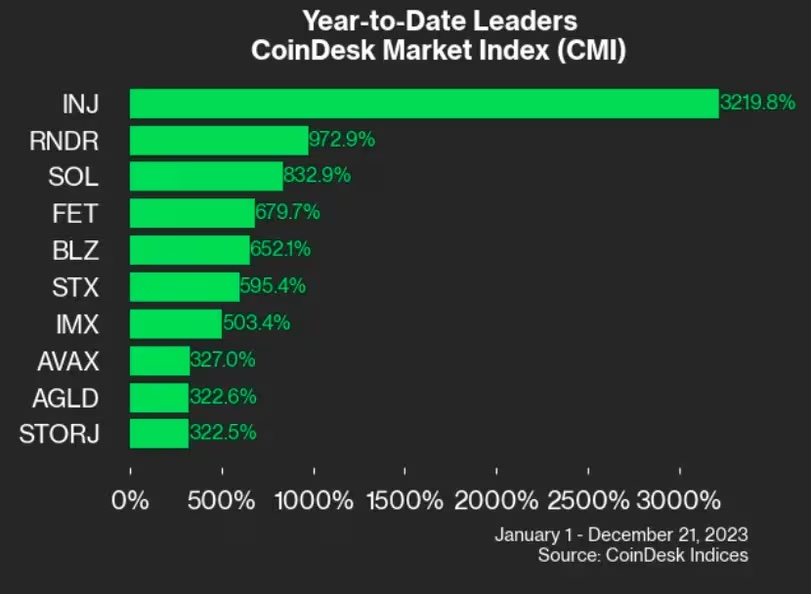

Injective, Lender Token and Solana drive CMI token returns

32 times. This is the return of Injective’s native crypto asset Injective (INJ). Injective is a blockchain built for finance using Cosmos blockchain technology, which it claims is the fastest in Layer 1.

In August, the tokenomics upgrade “2.0” was implemented, which “drastically increases the amount of INJ burned each week.”

Render Token (RNDR), the native cryptocurrency of Render, the GPU rendering network that migrated from Ethereum to Solana this year, has soared 972% (incidentally, Render Token was the top performer in the best-performing computing sector). Solana’s SOL increased by 833%.

In the volatile digital asset market, there is no guarantee that these gains will be reasonable or permanent.

What is certain is that the digital asset market of 2023 will once again feature the kind of incredible returns and high risks that have historically attracted many traders to crypto assets.

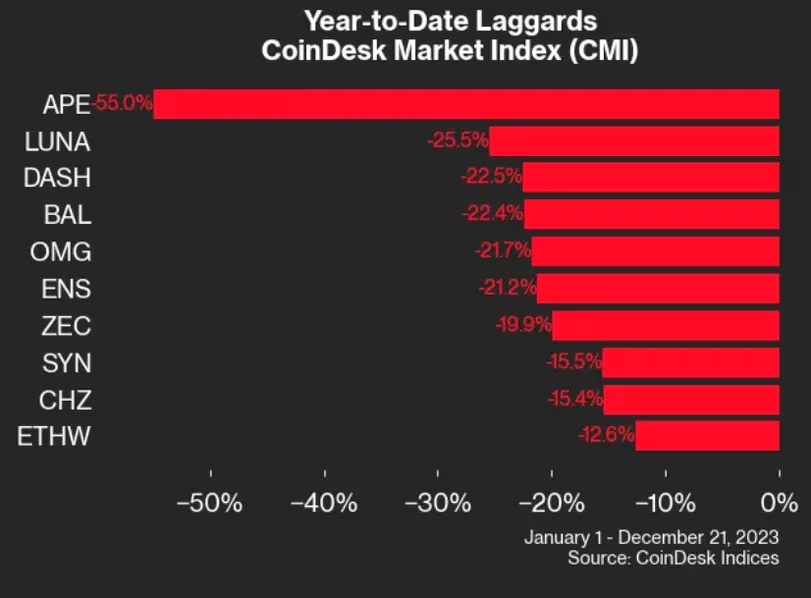

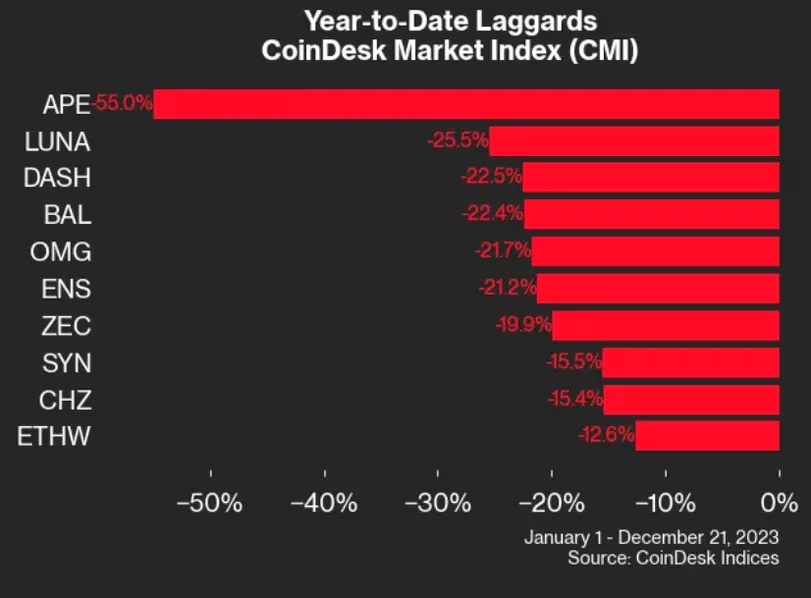

CMI’s big losers in 2023 are ApeCoin, LUNA, DASH, BAL, OMG, and ZEC.

There is no need to explain the following at length here. In 2023, perhaps the biggest gains went to long crypto traders. However, it is also possible that a lucky or smart manager managed to short the right token.

Some of those projects, like Terra’s LUNA, have failed. Also, like Ethereum POW’s ETHW, Ethereum’s main blockchain has successfully transitioned to Proof of Stake (PoS) and made withdrawals from staking possible with the “Shapella” upgrade. Some things ended without being tied together.

Ethereum Name Service’s ENS and Zcash’s ZEC represent projects that many crypto analysts still think are interesting enough, but it’s been a tough year. .

Bitcoin expands its dominance

Although it may be difficult for the average person to understand, Bitcoin is seen by many experienced crypto traders as a safe investment.

So, considering risk and return, it’s pretty hard to complain about Bitcoin’s 164% year-to-date return through December 21st (the chart above shows the CoinDesk Currency Index’s (CCY) year-to-date return. (indicating top return tokens).

XRP, the payment token used in the Ripple Labs network, is up 83% after a favorable court ruling with the U.S. Securities and Exchange Commission (SEC), giving it a decent start. It has been 1 year.

The following article will help you understand why this ruling suddenly makes learning the technology behind the XRP Ledger worthwhile again.

Related article: Concerns about centralization remain for XRP, but a new future is unfolding – threat of SEC regulation also weakens

Stellar’s XLM, which spent a year preparing for Soroban, a major smart contract upgrade scheduled for early 2024, returned 73%, not far behind XRP.

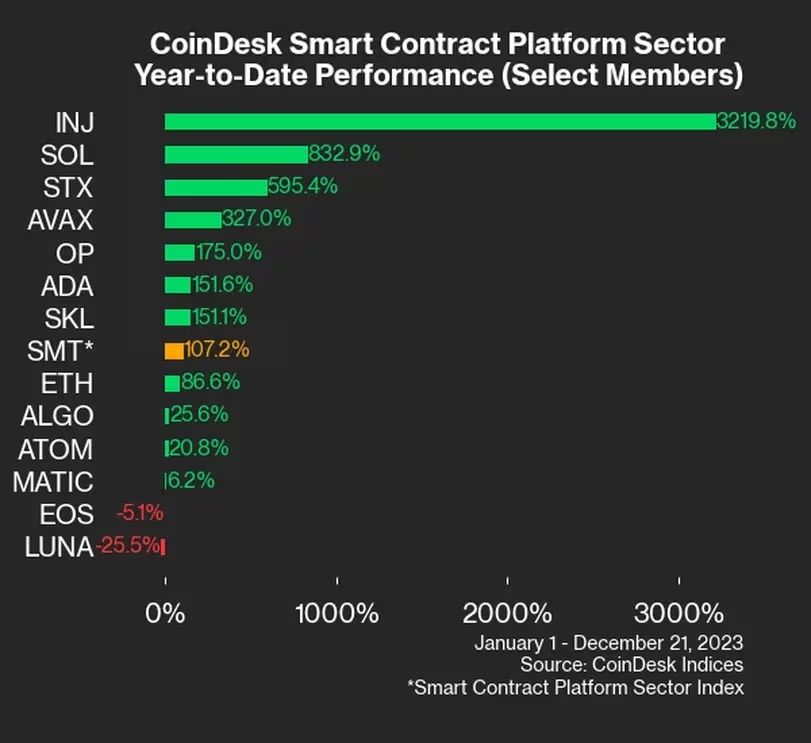

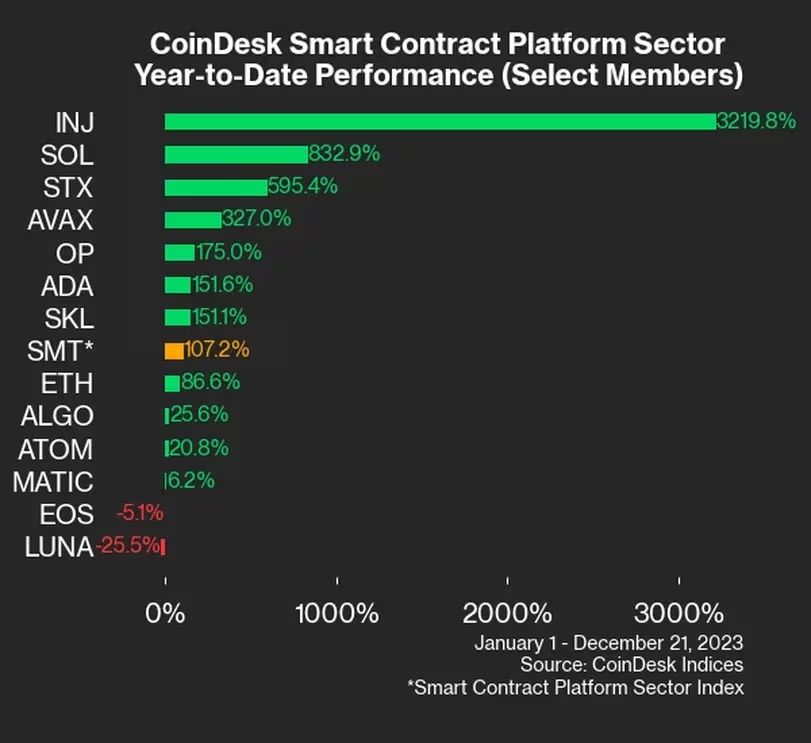

CoinDesk Smart Contract Platform Sector (SMT)

The CoinDesk Smart Contract Platform Index (SMT) covers major large-scale blockchains other than Bitcoin, including Ethereum, various layer 1 blockchains, and the rapidly growing layer 2 networks.

SMT’s 107% return in 2023 is slightly below benchmark CMI, at least in part due to Bitcoin’s outperformance.

We have already mentioned market leaders Injective and Solana.

While Ethereum rose a respectable 87%, those opposed to flipping (reversing Bitcoin as the largest blockchain by market capitalization) argue that Bitcoin’s 164% rise is a huge jump. They will point out the gaps.

Avalanche’s AVAX has soared on the narrative that it will gain support from institutional investors. The project played a leading role in a large-scale proof of concept with JP Morgan and Apollo.

The OP of the Optimism ecosystem rose after Coinbase’s Base and several other projects selected the technology as a template for new layer 2 networks they aim to develop.

Skale Network’s SKL touts itself as “an Ethereum-native multi-chain network developed to scale decentralized apps on Ethereum, with a focus on high throughput, fast finality, and zero-gas transactions.” This is a significant increase of 151%.

Of note is Polygon’s lackluster performance of MATIC at 6.2%. This performance comes despite Polygon being one of the most aggressive projects to position itself at the forefront of the Ethereum Layer 2 race, and a leader in popularizing the trending “zero knowledge” cryptographic technology.

ATOM in the Cosmos ecosystem was a bit of a disappointment on a relative basis, with only a 20% return despite the widespread vision of a multi-chain, interoperable blockchain world. .

Cosmos has received support from several major projects, including becoming the new layer 1 blockchain for decentralized derivatives exchange dYdX, which has migrated from Ethereum layer 2.

What will happen to the crypto asset market in 2024?

What will happen to the crypto asset market in the future? Historically, the quadrennial Bitcoin halving, scheduled for 2024, has driven four-year market cycles. However, its history is only 14 years old.

The crypto market is exactly like the traditional market in that no one knows what will happen, everyone is just guessing.

Or as they say about Wall Street investors: If they tell you to buy, they’ve already bought.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Who Won Crypto in 2023? The CoinDesk Market Index Broken Down in 6 Charts

The post Who will win in 2023? Analyzing the CoinDesk Market Index using 6 charts | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

97

1 year ago

97

English (US) ·

English (US) ·