Possibility of Bitcoin plummeting

BitMEX founder Arthur Hayes predicts that the cryptocurrency Bitcoin (BTC) could experience a 20% to 30% decline in early March 2024.

First, with the start of trading in the US Bitcoin spot ETF (exchange traded fund), there is a possibility that real US dollar investment in Bitcoin will increase, and the BTC price may approach all-time highs by March. I’m predicting. At the same time, it warns that if a “lag pull” event occurs, in which the liquidity of the US dollar sharply declines, there is a risk that the price of Bitcoin, along with other financial assets, will plummet.

His forecast includes three economic and financial events: the Reverse Repurchase Program (RRP), the Bank Term Funding Program (BTFP), and the Federal Reserve’s interest rate decisions. .

Mr. Hayes demonstrates a trading strategy that responds to these fluctuations. If his RRP balance declines faster than expected, he is considering buying Bitcoin put options (an investor who stands to profit if the price goes down) in early March.

On the other hand, if the “BTFP update” described below is confirmed, the market is expected to stabilize and liquidity will expand, so take an active trading strategy such as purchasing Bitcoin and other virtual currencies. I’m thinking about it.

In addition, in the long term, Bitcoin is a “neutral reserve currency” that is not tied to the debt of the banking system and is traded globally, so it will respond positively to the Fed’s liquidity injection measures and increase long-term stability. Mr. Hayes believes that there is a possibility of retaining the .

connection:TechCrunch Reporter: Pay attention to the SEC’s Friday announcement on whether Bitcoin ETF listing application is likely to be approved

Three economic and financial events

The Reverse Repurchase Program (RRP), the Bank Term Funding Program (BTFP), and the Federal Reserve’s interest rate decisions are important factors in Arthur Hayes’ analysis.

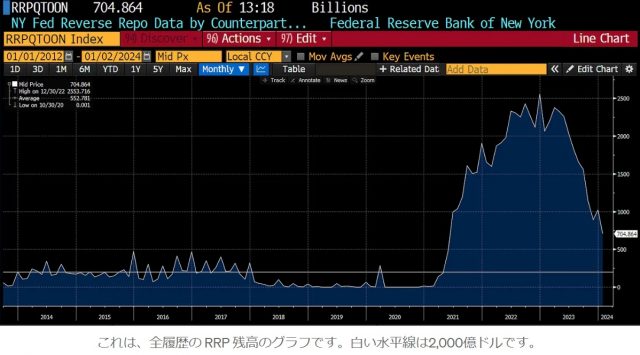

RRP is a traditional and routine means of absorbing funds for the Fed, which involves raising funds from private finance using bonds as collateral.

Regarding RRP, the pace of decline in its balance has a large impact on the market. When balances decline slowly, stable liquidity is provided to the market, and the prices of financial assets may stabilize or even rise.

Source: Arthur Hayes

On the other hand, if balances decline sharply and approach $200 billion, the market will seek new sources of dollar liquidity and face the risk of investors selling assets and prices falling, Hayes said. Based on 2023 data, such a decline in liquidity is expected to occur in early March.

Next is BTFP. This program uses securities such as government bonds as eligible collateral and lends an amount equivalent to their face value at preferential interest rates. In the wake of the SVB collapse, the Fed has instituted a new response tool as a time-limited measure, which is set to expire on March 12th.

At the end of the program, banks will have to pay back the dollars and take back the original collateral, which will force them to sell other assets or find new ways to raise capital. Hayes predicts that if the program is not renewed, some banks could fail.

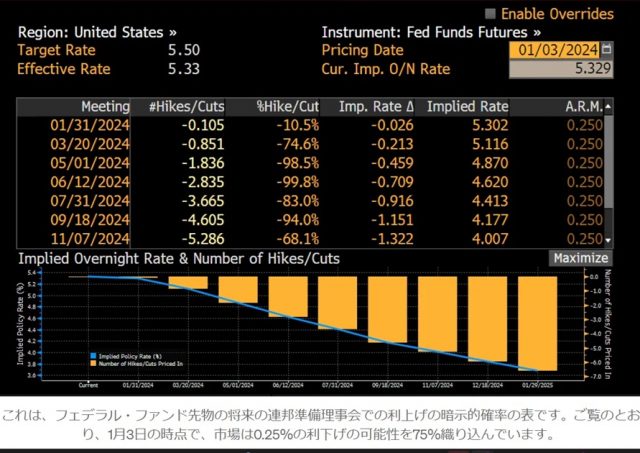

Source: Arthur Hayes

Finally, as a rebound event for the BTC market, we are also focusing on the Fed’s (Federal Reserve) interest rate decision. Currently, the market expects the Fed to cut interest rates by 0.25% for the first time since 2021. Based on this, Hayes believes that even if Bitcoin initially plummets along with the broader financial markets due to the disruption caused by RRP and BTFP, it will rebound before the Fed meeting.

connection:

Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Half-life special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

The post Why Arthur Hayes predicts a sharp fall in Bitcoin in March What are the three major events to watch? appeared first on Our Bitcoin News.

1 year ago

79

1 year ago

79

English (US) ·

English (US) ·