While the U.S. Securities and Exchange Commission (SEC) wants to classify many crypto assets as securities, the market seems to think otherwise, treating them as commodities.

The SEC sued Binance on June 5 and Coinbase on June 6.

The lawsuit has had a major impact on two exchanges, with Binance seeing a large drop in net transfer volume and Coinbase’s share price dropping 20% from the previous day’s close.

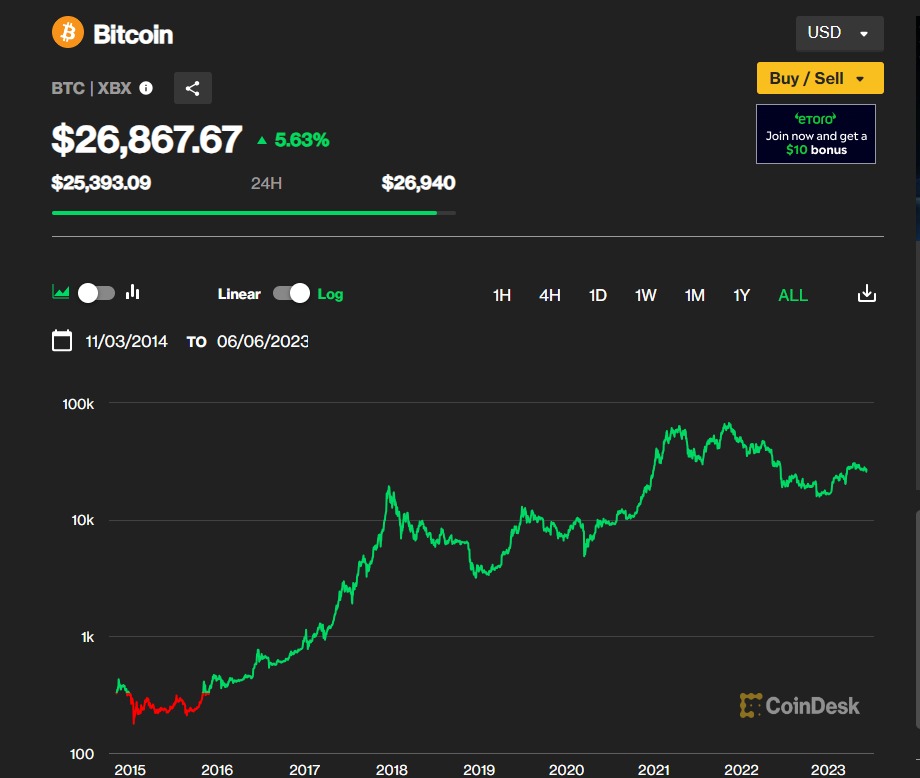

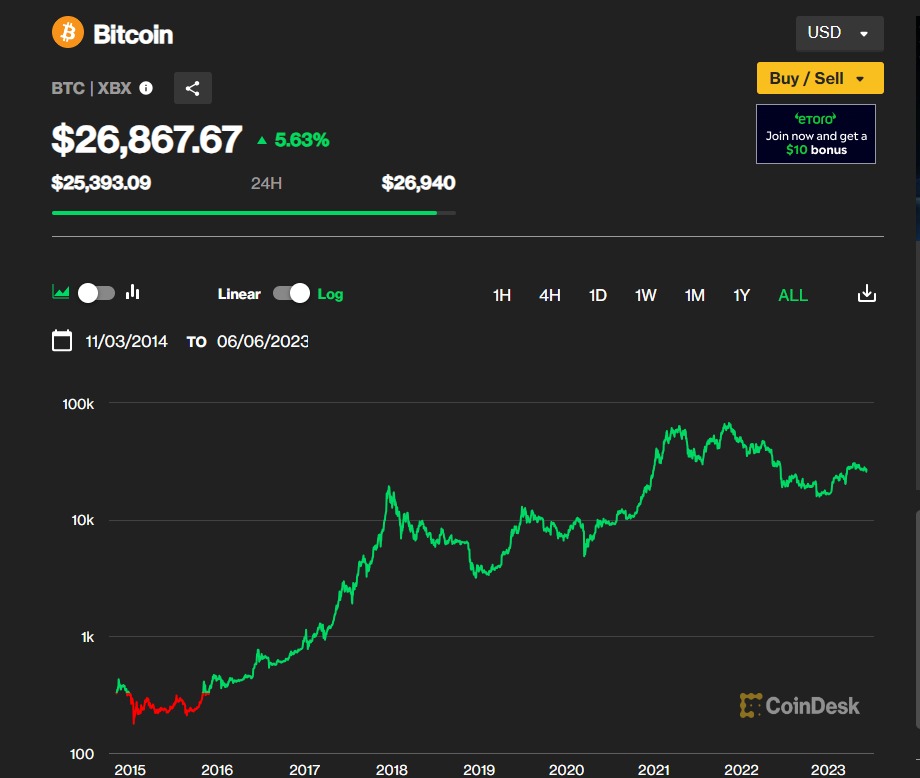

Meanwhile, Bitcoin (BTC) and Ethereum (ETH) are up 5% and 4%, respectively, over a 24-hour period. Bitcoin’s 5.4% drop on the previous day is not even in the top 50 daily declines from 2021 onwards.

Also, none of the 13 altcoins identified as securities in the lawsuit have fallen by more than 3% over a 24-hour period, and several altcoins have risen.

Despite the SEC’s appeal that many crypto assets are securities, the market seems to think otherwise.

Additionally, the SEC’s actions against crypto assets may further underscore the importance of crypto assets to crypto holders.

Decoupling from crypto assets?

Bitcoin and Ethereum have recently diverged from traditional financial indices like the S&P 500, and now it looks like they are about to diverge from crypto assets themselves. The movements of the two assets are more in line with physical commodities.

The SEC’s lawsuit against ExxonMobil won’t cause oil prices to plummet. The SEC’s lawsuit against Barrick Gold’s CEO won’t cause the price of gold to plummet.

Oil is oil, gold is gold—neither changes, is ever-present, and is largely unaffected by day-to-day events. Assets such as Bitcoin and Ethereum seem to operate on the same logic.

Similar to the physical commodity space, the major drivers for cryptocurrency prices are supply (such as the decline in Ethereum supply since September) and demand (such as macroeconomic factors affecting consumption).

Bitcoin and Ethereum did not plummet after enforcement actions on exchanges, cryptocurrencies are following the “greater fool theory” – buy overvalued assets, get even higher He denies the theory that he makes a profit by selling at . Rather, investors seem to think crypto has the brightest future ahead.

The following can be read from the current market trends.

- Regulators Can Surely Take Regulatory Action Against Coinbase and Binance

- However, crypto assets themselves continue to have value

Cryptocurrency exchanges are separate entities. Bitcoin is Bitcoin, Ethereum is Ethereum, and the market seems to want them to continue to give value unless all means of distribution are completely eliminated.

Investors will also see the regulator’s action as the kind of excess that has made cryptocurrency value.

CoinDesk

CoinDesk|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: CoinDesk

| Original: Why Isn’t Bitcoin Falling More? Cryptos Are Acting More Like Commodities Than Securities

The post Why Bitcoin is Recovering ──Crypto assets are not securities, but price movements like commodities | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

108

2 years ago

108

English (US) ·

English (US) ·