The post Why Bitcoin is Surging? Is $100K Imminent This Week? appeared first on Coinpedia Fintech News

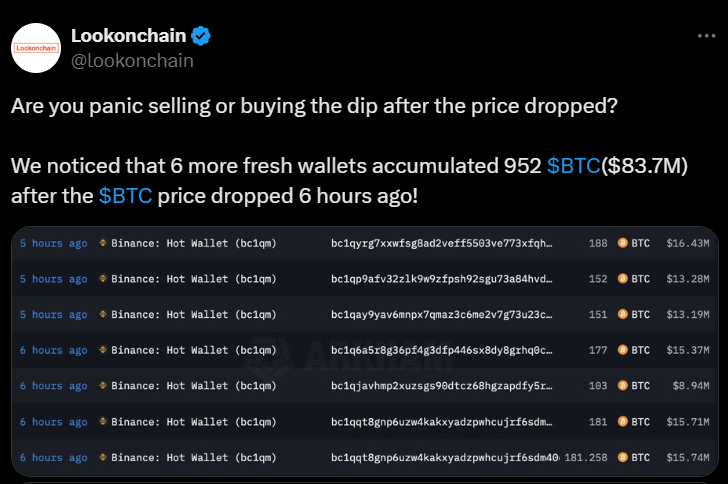

Amid the recent price decline in Bitcoin (BTC), some are panic selling while others are buying the dip. Recently, a whale transaction tracker Lookonchain made a post on X (Previously Twitter) that whales have made significant transactions and accumulated BTC as its price dropped.

Source: X (Previously Twitter)

Source: X (Previously Twitter)Bitcoin Whales Activity

In a post, Lookonchain noted that five whales have successfully accumulated 952 BTC worth $83.7 billion. This notable acquisition suggests a potential buying opportunity. Additionally, on November 12, 2024, the artificial intelligence firm Genius Group (GNS) successfully acquired $120 million worth of Bitcoin, following their plan to make BTC their primary treasury asset.

Apart from this, the market has experienced notable BTC acquisitions in the past 24 hours.

BTC Price Momentum

Currently, BTC is trading at $91,350 and has registered a gain of over 5.10% in the past 24 hours. Meanwhile, its trading volume has dropped by 35%, indicating fear among traders and investors, resulting in lower participation.

Technical Analysis and Upcoming Level

According to CoinPedia’s technical analysis, BTC appears bullish as it has successfully undergone a price correction and is now heading toward the $100,000 level. Based on recent price action, a further price correction may occur in the coming days, which could benefit BTC ahead of its upcoming rally.

Source: Trading View

Source: Trading ViewBullish On-Chain Metrics

On-chain metrics further support the asset’s bullish behavior. According to the on-chain analytics firm CoinGlass, BTC’s open interest (OI) has grown by 5.6% in the past 24 hours and 5.2% in the past hour, indicating notable participation from traders. However, OI has risen aggressively in the past hour.

Additionally, BTC’s long/short ratio currently stands at 1.02, indicating bullish market sentiment among traders.

7 months ago

51

7 months ago

51

English (US) ·

English (US) ·