You may have heard the fuss over an editorial published in a scientific journal that purportedly detailed how Bitcoin uses up a lot of water and destroys the environment. This commentary was picked up and spread by mainstream media despite its factual and data-based inaccuracies.

Some people may be shocked to hear this commotion and think, “Here we go again.” For years, we have had to work to refute false claims about Bitcoin’s power consumption. These false statements range from insane claims that Bitcoin mining uses up the world’s electricity to understandable but lazy confusion about what Bitcoin trading is. there were.

We have largely won such debates. Fewer regulators these days argue that Bitcoin mining should be banned due to its environmental impact. Instead, the focus has shifted to citing use in illegal activities as the main reason for outright rejection.

It’s as if the mainstream media were looking for another opportunity to justify their critical and condescending attitude. In response to these desperate people, Alex de Vries, a data scientist and founder of the research firm Digiconomist, has written a paper titled “Bitcoin’s growing water footprint.” A commentary was published.

It’s not a conspiracy theory

A smart idea, given that the aim was to reverse the growing global recognition that Bitcoin mining could also help protect the environment.

Inciting fear about climate change has long been a common tactic of people who seek to generate PV by provoking readers, and it was timely given that COP28 was just being held. Combine an existentially threatening doom scenario with a frightening new financial system that no one seems to be able to control, and the mainstream media will of course jump on it with glee.

Moreover, this new perspective was particularly interesting due to its timing. Water issues are a regular theme in the media I read every day. For example, economist Mariana Mazzucato and others recently published an article in Project Syndicate called “Water and the High Price of Bad Economics.”

On December 1, the United Nations released its Global Dwought Snapshot, which contained some predictably chilling data. The day before, Bloomberg reported on the Amazon drought, and the week before, The Economist covered the Panama drought. I could give more examples, but that’s enough.

Perhaps the water issue is even more subtle in that it implicitly suggests its scarcity. The argument that “power consumption is too high” was easy to refute philosophically. After all, we can create more energy by pulling power from the ground or harnessing sunlight (to name two examples).

Electricity is not a zero-sum game. So far, water is. If Bitcoin is indeed consuming “too much” water, there will be less water available for thirsty citizens and agriculture. Water shortages seem more deadly than electricity shortages.

And we have all seen how the hot topic of climate destruction can be effectively used to alienate the very people who could benefit most from Bitcoin. That means a younger generation that, unlike older generations, is not adamant about trusting the current system and should seriously consider how to save in the face of the coming currency depreciation.

This is not to say that Mr. de Vries is part of a systematic effort to discredit the crypto ecosystem. Especially at a time when official recognition of the crypto ecosystem’s potential to contribute to the environment is solidifying and traditional financial institutions are starting to offer a wider range of Bitcoin products. I don’t do that. I’m not a conspiracy theorist.

However, I have to admit that the timing is convenient, and the mainstream media is not interested in publishing commentaries published in obscure scientific journals that don’t appear in the outlets that journalists usually read in the morning. It’s amazing that it was picked up so quickly. By the way, did I mention that Alex de Vries works for the Dutch central bank?

not true

Now, let’s move on to the main points where Mr. de Vries is wrong.

Why is this data and conclusion contrary to reality? We all have a responsibility to patiently explain this to those who bring it up.

First, De Vries wants to calculate the amount of water consumed per transaction. This is either a misunderstanding of how Bitcoin works or a deliberate misdirection. I’m guessing it’s the latter, since De Vries has been studying Bitcoin’s power usage for at least five years (as far as I know).

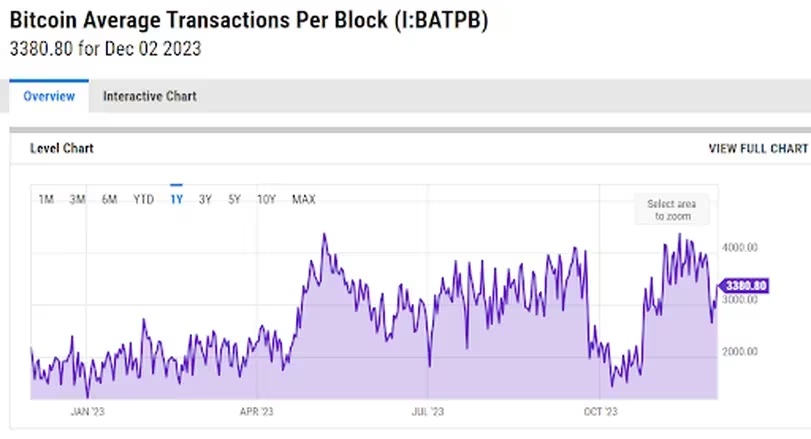

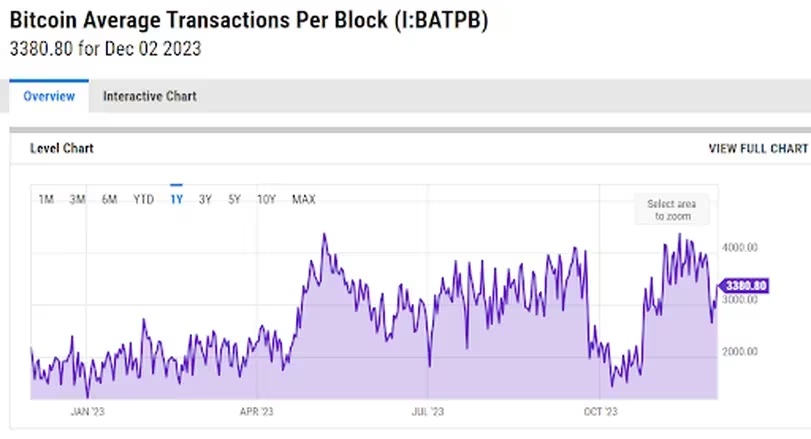

Bitcoin miners collectively pay for electricity to process blocks of transactions, and the number of blocks is predictable (about one every 10 minutes). The metric that can be calculated is the consumption (of electricity or water) per block. Each block can contain anywhere from one to several thousand transactions, depending on demand and size (memory consumption). Currently, the number of transactions per block is around 3-4,000, compared to around 1,000 at the beginning of this year.

(Average number of transactions per Bitcoin block)

(Average number of transactions per Bitcoin block)And each transaction could include anywhere from one to millions of payments, something De Vries fails to account for.

Second, De Vries asks us to believe that indirect water use from electricity consumption and direct water use from cooling mining equipment can be summed up and added together to arrive at a useful number. .

Water used on-site can be saved for other uses by switching off the Bitcoin miner. This is not necessarily the case with the water used by generators. These are two very different types of water use and cannot be combined into one useful but unrelated metric.

Furthermore, much of the water for cooling is recycled, so direct use is not necessarily the “cost” of water. Additionally, indirect consumption (by the electricity source) is not strictly a “cost”, as much of the water used in thermal power plants is returned to the water source after cooling. Water used in hydroelectric power generation will not be significantly affected by shutting down Bitcoin miners.

Third, de Vries’ calculations are based on very flimsy assumptions. The method de Vries uses is to estimate the energy consumption of Bitcoin mining (based on data from the Cambridge Bitcoin Energy Consumption Index), apply a rough geographical distribution, and calculate the average energy consumption for each region. The idea is to estimate the amount of water used by each type of energy, taking into account the energy composition.

Apart from errors in each of these factors, this method assumes that all miners are representative of the energy composition of their jurisdiction. But in reality this is not the case. As electricity is the main ongoing cost, miners tend to concentrate near lower cost sources, creating a distortion in the associated energy mix. Additionally, miners are increasingly collaborating with energy producers to eliminate waste and utilize surplus power.

Furthermore, the typical regional composition ratios are based on old information. Kazakhstan, for example, is considered one of the top three mining areas in the world. That may have been the case in 2021, but there are currently very few Bitcoin miners in Kazakhstan after experiencing repeated internet outages, power shortages, and regulatory barriers.

Yet each Bitcoin transaction consumes enough water to fill a small pool, the scientific journal says. This is shocking to us. Clearly, pools are more useful, and more Bitcoin transactions mean fewer people having fun in the water.

Who is the real culprit?

Just when I feel like I’ve reached the peak of my disappointment with mainstream media, I’m always reminded that there are new heights. The media treatment of De Vries’ comments was terrible.

Almost every media outlet that picked up the story ran with the claim, without questioning the source of the data or the author’s track record (De Vries has a history of making extraordinary predictions that make you want to cover your eyes). repeated.

Some media outlets made blatant factual errors, such as the BBC, which confused “payments” and “transactions” in a headline. Futurism is titled “The Average Bitcoin Transaction Wastes a Full Swimming Pool of Water, Scientists Say” .

The Independent newspaper uses vague language such as “Bitcoin consumes as much water as all the baths in Britain, study claims.” I chose. Most news coverage confuses “research” and “comment,” with the former tending to be peer-reviewed but the latter rarely. This is either negligence or intentional misleading.

Fortunately, a handful of eloquent people who understand the Bitcoin mining and climate change issues are taking action and detailing the mistakes. If you haven’t read it yet, I highly recommend following Daniel Batten and Magdalena Gronowska on X (formerly Twitter). Two analysts with extensive industry experience conduct relevant research without bias and understand the possibilities.

As I said, it’s now up to all of us to fight back against these claims. The facts are on our side, so it shouldn’t be difficult. However, it requires a lot of effort.

As we have unfortunately seen in recent years, the disinformation machine has become increasingly powerful in crypto and many other areas. But this is a worthy fight, not just for Bitcoin, but also for science and against what seems to be a post-truth media environment that increasingly prioritizes appealing to readers with falsehoods over truth.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Why Are People Spreading Falsehoods About Bitcoin’s Water Use?

The post Why is the hoax that “Bitcoin consumes a lot of water” spreading? | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

114

1 year ago

114

English (US) ·

English (US) ·