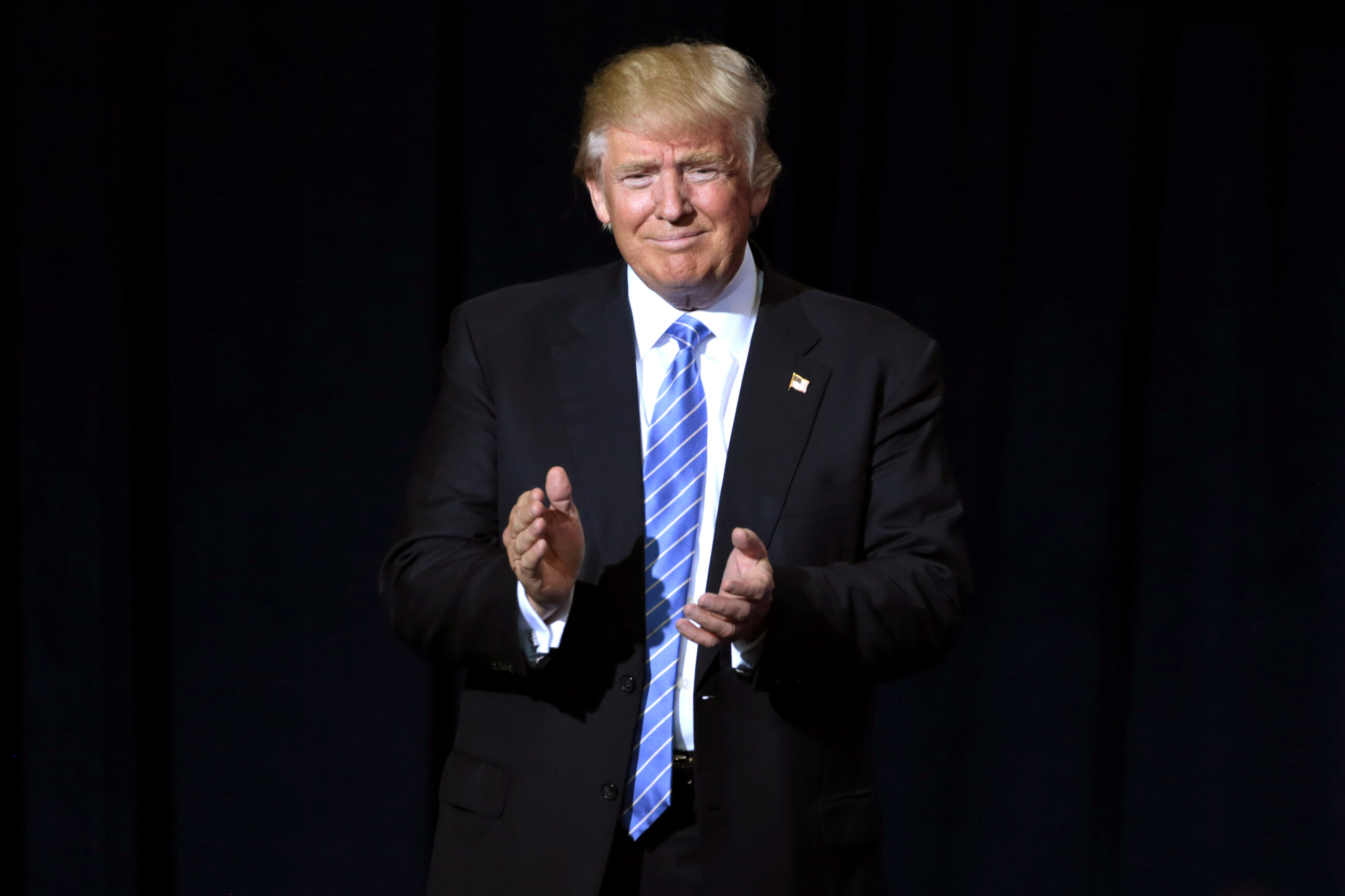

World Liberty Financial (WLFI), a decentralised finance (DeFi) project tied to the Trump family, is making strategic moves as it prepares for heightened visibility with Donald Trump’s upcoming inauguration.

The platform, supported by Trump and his sons, Eric Trump, Donald Trump Jr., and Barron Trump, has caught attention for its recent asset reallocation.

The crypto project has moved $61.4 million worth of ether within the last 24 hours, according to data from Arkham Intelligence.

The project’s wallet, as monitored by Arkham, distributed the funds into several wallets, including Coinbase Prime.

While initially sparking speculation, WLFI clarified these adjustments as standard treasury management practices aimed at optimising operational efficiency and bolstering its financial resilience.

World Liberty Financial’s asset reallocation

On 15 January, WLFI addressed public queries about its recent crypto transactions, stating they were part of routine treasury operations.

The company explained that reallocating assets helps cover operational costs, fees, and working capital requirements, ensuring seamless operations.

We’re making routine movements of our crypto holdings as part of regular treasury management, and payment of fees and expenses and to address working capital requirements. To be clear, we are not selling tokens—we are simply reallocating assets for ordinary business purposes.…

The company in post said that:

These actions are intended to be part of maintaining a strong, secure, and efficient treasury. No need to speculate—this is all standard practice for managing operations at WLFI.

Partnership potential with Ethena Labs

Another critical development for WLFI is its evaluation of a proposal from Ethena Labs, submitted in December 2024. Ethena Labs has proposed integrating its staked synthetic dollar, sUSDe, into WLFI’s Aave platform.

The sUSDe stablecoin, backed by leveraged cryptocurrency positions like Bitcoin (BTC) and staked Ethereum (ETH), offers a novel solution for maintaining dollar stability in decentralised systems.

If implemented, the integration could significantly enhance WLFI’s offerings by increasing liquidity and diversifying collateral options.

These features would enable users to better manage their funds, secure loans, and participate in various financial activities with greater flexibility.

Using sUSDe as collateral would allow users to earn rewards in the same currency, creating further incentives to engage with WLFI’s ecosystem.

Token performance and market positioning

As of now, 5.36 billion out of a total of 20 billion WLFI tokens have been sold, leaving 14.645 billion tokens available for purchase.

Investors can acquire these tokens using Ethereum (ETH), USDC (USDC), Tether (USDT), or Wrapped Ether (WETH).

The value of tokens received depends on the investment amount, aligning with WLFI’s flexible investment model.

The association with Trump has undoubtedly played a role in boosting the platform’s visibility.

Both retail and institutional investors have taken interest in WLFI, viewing it as a unique DeFi offering with significant growth potential.

Trump’s inauguration could further amplify this momentum, potentially driving the platform’s adoption and development to new heights.

World Liberty Financial’s recent actions signal a calculated approach to securing its position in the decentralised finance market.

Its asset reallocations, combined with strategic partnerships and a robust token strategy, underscore its ambitions to become a leading platform in the DeFi space.

With the added visibility from Trump’s inauguration, WLFI stands poised to capitalise on its unique market positioning and expand its reach within the crypto ecosystem.

The post Why Trump-backed World Liberty Financial is reallocating assets ahead of Jan 20 inauguration appeared first on Invezz

![AI tokens are heating up! Story’s [IP] 25% pump is just the start IF…](https://ambcrypto.com/wp-content/uploads/2025/07/Lennox-4.png)

English (US) ·

English (US) ·