The post Why Trump’s Win Could Spark a New DeFi Boom for Ethereum appeared first on Coinpedia Fintech News

Ethereum’s recent performance has many wondering if the cryptocurrency is on the rise again, and with Donald Trump potentially bringing in a crypto-friendly administration, the conditions could be right for a new DeFi surge. Ethereum (ETH) just broke past the $2,800 mark—its highest level since August, pulling it out of a slump where it lingered between $2,300 and $2,600. Some industry experts are saying that Trump re-electing as President of the US could change the game for ETH and the DeFi sector. Let’s dig in to understand what they really mean by this.

Trump’s Deregulation Stance Could Spark DeFi Growth

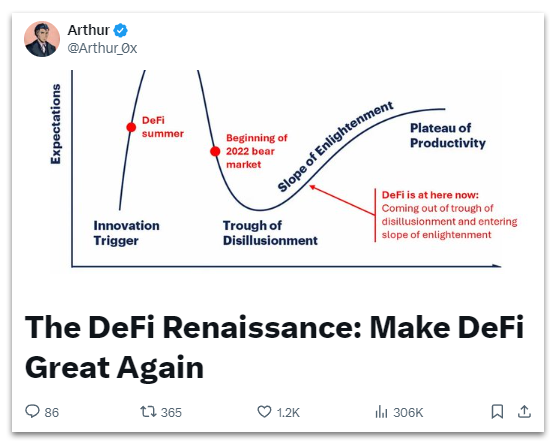

Trump’s presidency might mean easier regulations for crypto, including Ethereum and DeFi projects. Many in the crypto world, including big names like Arthur Cheong from DeFiance Capital, believe Trump could bring a “DeFi Renaissance.” This term points to a time when DeFi could grow without as many regulatory hurdles. Cheong thinks that if Trump lowers these barriers, we could see a rise in both new projects and the value of tokens linked to DeFi, possibly boosting ETH demand as more people join in.

Interestingly, a ratio tracking ETH and Bitcoin (BTC) shows investor interest in ETH has been lower lately. But with Trump’s approach, we might see a change in that trend, especially if ETH can secure a stronger position in the market.

DeFi Performance: Signs of Resilience and Growth

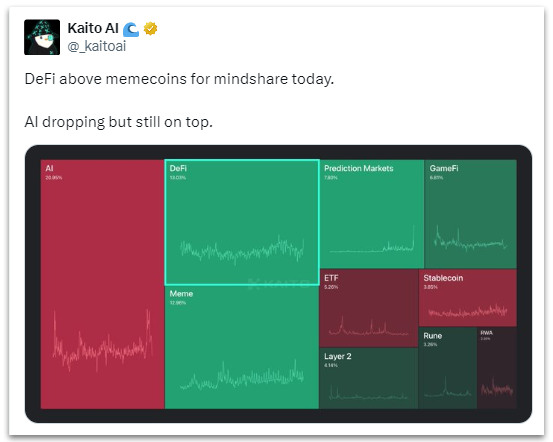

Another signal pointing toward DeFi’s potential growth comes from key metrics like user activity and capital inflows, both rising recently. Aave, a core project within the DeFi world, is reportedly performing better than it did at its peak in late 2021, showing the sector’s resilience and maturity. DeFi’s increased visibility on social media platforms, especially X (formerly Twitter), also suggests that retail investors are paying closer attention. According to Kaito data, DeFi is trending more than popular sectors like AI or meme coins, a sign that more everyday investors are getting interested.

A look at DeFi indexes also reveals a positive market response, with prices for top DeFi tokens jumping by an average of 22% within the last 24 hours, according to CoinGecko. The anticipation around a possible crypto-friendly approach under Trump might be driving this price surge, especially with his family’s links to World Liberty Financial, a financial services player.

What’s Next for DeFi and Ethereum?

With Trump’s presidency, many are expecting fewer compliance costs and clearer rules for DeFi platforms. Some experts, like Ethereum influencer @sassal0x, suggest that Trump’s policies might even reclassify certain tokens as commodities rather than securities. Such a move could open up more revenue avenues, with DeFi projects potentially implementing “fee switches” to generate steady income.

While Trump’s policies remain speculative for now, the market is already showing signs of enthusiasm. If these hopes pan out, DeFi and Ethereum might be on the verge of a major upswing. Will Trump’s presidency truly unlock DeFi’s next phase? That remains to be seen, but the early signs are promising.

7 months ago

67

7 months ago

67

English (US) ·

English (US) ·