NISA (Small Investment Tax Exemption System) is a system launched in 2014 to support stable asset formation for households. Approximately 20% of the profits earned from stock investments are exempt from tax, making it an important means of asset building for many individual investors.

The current Tsumitate NISA started in January 2018. With this plan, investors save a certain amount every month through their NISA account and automatically purchase selected investment products. An annual investment limit is set, and long-term savings will increase your assets through compound interest.

In 2024, a new NISA system will be introduced, and the current Savings NISA will be updated to the Savings Investment Allowance. It is important to understand the differences in this system change and enjoy the maximum benefits of accumulated investment using NISA.

In this article, we will explore the basics of the Tsumitate NISA and how future system changes will affect your investment strategy. Furthermore, we will explore why long-term investments are optimal and how to increase your assets more effectively through concrete simulations.

table of contents- If it starts within this year, you can also use the “tax-exempt quota” for 2023.

- Why Tsumitate NISA is suitable for long-term investment

- Simulation of savings investment allowance (former savings NISA)

- Investment strategies suitable for Tsumitate NISA

- Let’s actively utilize the freshly collected NISA

1. If it starts within this year, you can also use the tax-free allowance for 2023.

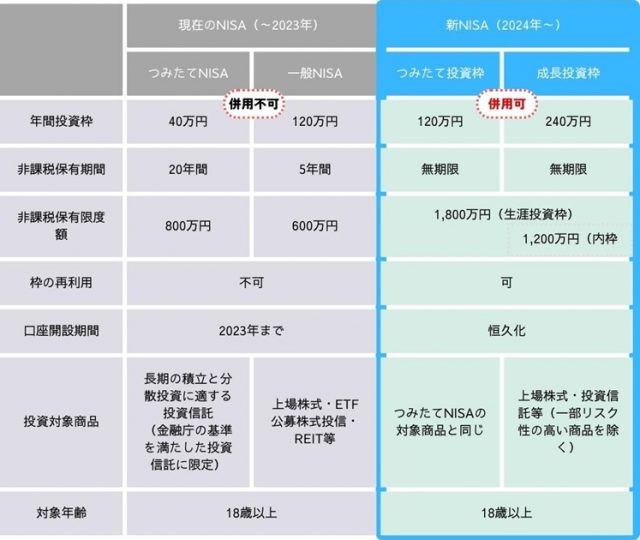

First, let’s summarize the main points about the differences between the current NISA and the new NISA that will be introduced in 2024.

Source: Created by CoinPost based on Financial Services Agency information

Current NISAs include the “General NISA” for adults and the “Tsumitate NISA” that specializes in savings investments, and investors can choose and use these according to their needs.

The current NISA was introduced as a temporary measure in 2014, but the new NISA will make the system permanent and optimize it for long-term asset management. The new NISA is divided into two parts: the “accumulation investment allowance” and the “growth investment allowance”, and has the following major changes.

- Indefinite tax-free holding period: Under the current NISA, there is a limit to the tax-free period, but under the new NISA, it will be possible to hold assets indefinitely without tax.

- Expansion of annual investment limit: The annual investment limit for the current NISA is set at 1.2 million yen (general NISA) and 400,000 yen (tsumitate NISA), but this will be expanded with the new NISA.

- Increase in tax-free holding limit: The new NISA will have a higher tax-free holding limit than the current NISA.

connection:Explanation of the “5 major benefits” of the new NISA, which triples the annual investment limit

Benefits of starting the current NISA within 2023

Source: Created by CoinPost based on Financial Services Agency information

The new NISA starting in January 2024 will have a tax-free investment limit that is different from the current NISA. Under this new system, you can maintain your current NISA account during the tax-free holding period and enjoy tax-free benefits on dividends and capital gains.

If you open a current NISA account in 2023, you will be able to use it in conjunction with the new NISA. For example, when opening a new Tsumitate NISA, in addition to the 400,000 yen Tsumitate NISA limit, you can use a new 18 million yen NISA limit. In this way, by starting NISA investment in 2023, you can fully enjoy the benefits of the tax-free allowance under the new system.

Allows for a smooth transition

At many securities companies, when you open a current NISA account, a new NISA account will be automatically opened, so no additional procedures are required. Furthermore, there is no need to sell financial products held under the current NISA system (general NISA and savings NISA). After purchase, you can hold your shares tax-free for 5 years with a regular NISA and 20 years with a accumulated NISA, and you can freely choose the timing of selling.

However, after the tax exemption period ends, assets held in a general NISA or Mitate NISA cannot be transferred (rollover) to a new NISA system.

2. Why the Tsumitate Investment Allowance (formerly Tsumitate NISA) is suitable for long-term investment

The Tsumitate Investment Allowance (formerly Tsumitate NISA) is a long-term investment option especially suitable for those with little investment capital or those who want to reduce risk. Here are two reasons why.

Reduce risk with diversified investments and dollar cost averaging

Tsumitate NISA is based on periodic savings investments and uses dollar cost averaging to smooth out the effects of market fluctuations. With this method, a fixed amount is invested regularly, so the same amount continues to be invested regardless of market price fluctuations, reducing the risk of buying at high prices over a long period of time.

With fresh investment, you can invest without being affected by market fluctuations, and there is less mental burden. The investment trusts that can be selected by Tsumitate NISA are officially certified, quality and transparency are guaranteed, and by diversifying investment into a variety of assets such as stocks and bonds, the risk of price fluctuations of individual assets is suppressed.

In the past, stock markets and crypto asset (virtual currency) markets have crashed due to events that shook financial markets, such as the Lehman Shock in September 2008 and the Corona Shock in March 2020.

Even in such cases, the “Tsumitate NISA” can be said to be an opportunity to accumulate assets mechanically at a low price, and is an ideal option for long-term investment aiming to build assets while reducing risk.

Benefits of long-term compound interest and tax-free investment profits

The Tsumitate NISA offers the dual benefits of long-term investment with compound interest and tax-free investment profits.

Regarding the compound interest effect, reinvesting distributions from mutual funds creates a situation where profits generate further profits. By reinvesting the investment profits back into the principal, your assets will grow like a snowball. If you invest over a long period of 20 years, this compound interest effect will have a large effect, and you can expect an effective increase in your assets.

In addition, with the Tsumitate NISA, you can invest up to 400,000 yen per year, with a tax-free holding limit of 6 million yen, and the investment profits earned from these investments are tax-free. Eligible stocks are stock investment trusts and ETFs that have been registered with the Financial Services Agency, and sales profits and distributions from these funds are also exempt from tax. Compared to the 20.315% capital gains tax that occurs in normal asset management, the benefit of tax exemption is a great attraction for increasing assets more efficiently.

3. Simulation of savings investment limit (former savings NISA)

Now, let’s simulate the profits and taxes when using the Tsumitate Investment Allowance (formerly the Tsumitate NISA). The annual investment amount under the current Tsumitate NISA is 400,000 yen, but with the new NISA, the annual investment amount will be expanded to 1.2 million yen.

The table below shows the future value of an individual investor between the ages of 30 and 40 who invests 1.2 million yen per year for 20 years and manages it at annual interest rates of 3%, 5%, and 10%. I am.

| 3% | 24 million yen | 8.83 million yen | 32.83 million yen |

| Five% | 24 million yen | 17.1 million yen | 41.1 million yen |

| Ten% | 24 million yen | 51.93 million yen | 75.93 million yen |

For example, if the annual interest rate is 5%, the future value after 20 years is approximately 41.1 million yen. This calculation includes the effect of compound interest. Compound interest refers to the profits earned from an investment being reinvested to generate further profits. As this process repeats, the return on your investment grows exponentially over time.

If you invest 1.2 million yen per year for 20 years with an annual interest rate of 5%, the simple total principal amount (1.2 million yen per year x 20 years) is 24 million yen. However, due to the effect of compound interest, each year’s profit is added to the investment principal for the following year. The profit of 17.1 million yen after 20 years is the sum of the profit added to the principal and the profit it generated. In this way, the compound interest effect is a major factor in increasing wealth in long-term investments.

*This simulation does not guarantee operational results. This is a rough guide based on past US stock market yields, so please use it as a reference only.

(Source: Financial Services Agency Asset Management Simulation)

Simulation of investment profits within the tax-exempt limit

In the case of Tsumitate NISA (formerly Tsumitate NISA), investment profits within the tax-exempt limit are not taxed, but for comparison, let’s calculate the tax amount if normal taxation were applied. The tax rate for capital gains and dividends on stocks and investment trusts in Japan is approximately 20.315%. The table below is a simulation of the after-tax return if this tax rate is applied.

| 3% | 8.83 million yen | 1.79 million yen | 7.04 million yen |

| Five% | 17.1 million yen | 3.47 million yen | 13.63 million yen |

| Ten% | 51.93 million yen | 10.55 million yen | 41.38 million yen |

If you made the same investment in a regular investment account, you could be subject to the taxes listed above. However, with the Tsumitate NISA, there is no tax on investment profits within the tax-exempt limit. This is one of the major benefits of the accumulated NISA for long-term investment.

If you make a relatively low-risk investment with an annual interest rate of 3%, the return after 20 years will be 8.83 million yen, but since a normal investment account will incur taxes of approximately 1.79 million yen, the actual return will be 7.04 million yen. It will be a yen. On the other hand, with the Tsumitate NISA, the entire amount is tax-free, so you can earn the full amount of 8.83 million yen as income. Similarly, the tax-free benefits of the accumulated NISA will be noticeable with annual interest rates of 5% and 10%.

What is the investment strategy for annual interest rates of 3%, 5%, and 10%?

The setting of annual interest rates of 3%, 5% and 10% is based on the feasibility of different investment strategies. An annual interest rate of 3% is suitable for low-risk investments (e.g. bonds and term deposits), and you can expect stable returns. On the other hand, a 5% annual return aims for a historically average return with a portfolio of medium-risk stocks and bonds.

The annual interest rate of 10% corresponds to high-risk stock investments and aims for higher returns, but it comes with the risk of market fluctuations. These interest rates consider the balance between investment risk and return.

4. Investment strategies suitable for Tsumitate NISA

Tsumitate NISA is especially suitable for investing in mutual funds. Under this system, there are no commission fees when purchasing investment trusts, and there is also a cap on management costs (trust fees) during operation. Therefore, when accumulating assets using a savings NISA, investment trusts are the main choice in terms of cost.

Now, let’s organize the main types of investment trusts that can be purchased with Tsumitate NISA.

4-1. Main investment trusts that can be purchased with Tsumitate NISA

| 225 stocks of companies listed on the First Section of the Tokyo Stock Exchange | Nikkei Stock Average (Nikkei 225) | |||

| All stocks of companies listed on the First Section of the Tokyo Stock Exchange: Approximately 2,100 stocks | (TOPIX) | |||

| Large and mid-cap stocks from 47 countries around the world: approximately 2,800 stocks | MSCI ACWI | |||

| Large and mid-cap stocks from 47 countries around the world: approximately 7,800 stocks | FTSE Global All Cap | |||

| Large-cap stocks of US-listed companies: 500 stocks | S&P500 | |||

| Almost all stocks of U.S. listed companies: approximately 3,600 stocks | CRSP US Total Market | |||

| Developed country | Large and mid-cap stocks from 22 developed countries (excluding Japan): Approximately 1,300 stocks | MSa Kokusai | ||

| emerging countries | Large and mid-cap stocks from 24 emerging countries: approximately 1,100 stocks | MSCI Emerging Markets | ||

| Japan/developed country stocks/bonds: 4 assets, Japan/developed country/emerging country stocks/bonds: 6 assets, Japan/developed country stocks/bonds/real estate + emerging country stocks/bonds 8 assets, etc. | ||||

| Only those that have strong support from investors and are expanding in scale | ||||

*As of the end of February 2019 (Source: Financial Services Agency, How to Choose Investment Products)

The investment products of the new NISA’s “Tsumitate Investment Limit” and the current NISA’s “Tsumitate NISA” are basically the same, as both target investment trusts that meet the standards set by the Financial Services Agency. However, we recommend that you refer to the latest information for specific operational details and changes to the new NISA.

4-2. How to choose an investment trust

Select based on trust fee (cost)

We will give you an easy-to-understand explanation of the investment trusts that Tsumitate NISA invests in. First, let’s focus on indexes and active mutual funds.

An index investment trust is an investment trust that aims to track the movement of a specific market index. Therefore, choosing an index investment trust is essentially the same as choosing a market index.

One of the most basic market indexes is TOPIX. This invests in the stocks of companies listed on the First Section of the Tokyo Stock Exchange, giving more weight to companies with larger market values. The Nikkei 225 invests in 225 major companies selected by the Nikkei Shimbun, and is designed to increase the investment ratio in companies with high stock prices. Furthermore, the stocks in this index are changed periodically based on Nikkei’s judgment.

Active funds, on the other hand, are managed based on the judgment of the fund manager. Performance will vary depending on the fund, but the items that can be purchased with a savings NISA are limited to those that can be expected to generate regular income.

One of the important factors when choosing an investment trust is cost. Costs include the “purchase fee” that occurs at the time of purchase, the “trust fee” that is an official expense required during operation, and the “trust property retention amount” that is borne by the investor at the time of cancellation. In addition, behind the scenes of products, there are also what are called “hidden costs” associated with transactions and audits to link to an index.

In Japan, many index funds have relatively low trust fees, and in the United States, many actively managed investment trusts have low costs. The cost is directly linked to the return on investment, so the theory is to choose the lowest cost option.

In other words, the general approach is to first choose an index investment trust, decide which market index to invest in, and then choose one with a low trust fee.

Choose based on long-term, stable returns

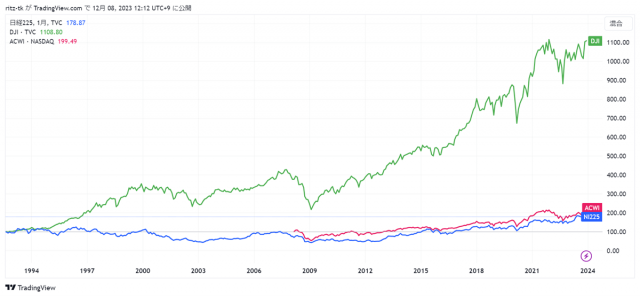

Looking at the stock market over the past 20 years, US stocks in particular have experienced remarkable growth. For example, the New York Dow Jones Industrial Average (NY Dow) has grown approximately seven times over this period. This strong performance of U.S. stocks is an important factor in mutual fund selection.

Indexed with end of December 1993 as 100

Nikkei Stock Average (blue), Dow Jones Industrial Average (green), ACWIiShares MSCI ACWI ETF (red) Source: TradingView

For example, a fund like eMAXIS Slim All Country has approximately 60% of its portfolio invested in US stocks. This allows you to diversify your investments in stocks around the world with a single fund, while also benefiting from the growth of the U.S. stock market.Funds that invest in global stocks like this play an important role in long-term asset formation.

Active funds are also an important option. Active funds that focus on specific emerging markets, particularly India, have the potential to capture growth opportunities specific to that market. However, active funds rely on the judgment of the fund manager, so selection requires more careful judgment.

In summary, when choosing an investment trust, we recommend choosing a portfolio that takes advantage of the strength of the U.S. stock market, especially index funds that are low-cost and reflect the movements of the overall market. Additionally, if you’re looking for investments that focus on specific needs or markets, it’s wise to consider investing in active funds or regional growth stocks. It is important to choose the right mutual fund, always considering your investment objectives and risk tolerance.

4-3. Recommended index funds for NISA

We know that index funds are more popular, but which index funds are more popular? In this chapter, we will introduce the funds that are eligible for NISA accumulation among the top 20 popular rankings (monthly) by sales amount at SBI Securities.

Aggregation period: 2023/11/1 to 2023/11/30.

(Source: SBI Securities: Popularity ranking of investment trusts and sales amount)

An analysis of the monthly sales value ranking of investment trusts by SBI Securities shows that funds that invest in international stocks, especially US stocks and all-world stocks (all-country), are at the top. These funds are characterized by relatively high one-year and three-year total returns. For example, Mitsubishi UFJ’s eMAXIS Slim Worldwide Stocks (All Country) and eMAXIS Slim US Stocks (S&P500) have shown good returns, indicating high interest from investors.

The US market is the world’s largest stock market and has many growth sectors such as technology, making it attractive to investors looking for high returns. For example, Mitsubishi UFJ’s eMAXIS Slim U.S. Stock (S&P500) invests in a major index that reflects trends in the U.S. stock market and is highly rated.

In addition, the article below provides a more detailed explanation of “eMAXIS Slim Worldwide Stocks (All Country)” and “eMAXIS Slim U.S. Stocks (S&P500),” which are tops in monthly sales rankings.

Additionally, many funds included in the ranking have relatively low trust fees. In either case, there is no trust property retention amount or cancellation fee (tax included). This is an important factor for investors who aim to invest efficiently while keeping costs down. Low-cost index funds are considered advantageous in long-term investment strategies.

Overall, this ranking shows that funds that invest in international stocks, especially US stocks and global stocks, are attracting a lot of interest from investors, especially those that can deliver high returns at low costs. . Investors are likely to select these funds based on market trends and risk tolerance.

4-4. Stocks that cannot be purchased with the accumulated investment limit are purchased with the growth investment limit.

The new NISA system that will start in 2024 has two slots: the “growth investment slot” and the “build-up investment slot.” The Growth Investment Facility inherits the General NISA, and the Accumulation Investment Facility inherits the Accumulation NISA, and these can be used together. Diversifying your portfolio using a growth investment line is an effective way to access a wide range of products, including products that cannot be purchased with a savings line.

Furthermore, you can use the growth investment limit to invest in mutual funds that are eligible for accumulated investment. We recommend that you invest in savings according to the strategy that suits you best.

5. Make active use of your savings NISA

Tsumitate NISA is suitable for individual investors with little capital and little investment experience. Not only can you reduce risk through diversification and long-term investing, but you can also expect even greater investment returns by taking advantage of compound interest.

In addition, the new NISA accumulation investment limit starting in 2024 includes expansion of the annual investment amount and permanent tax-exemption period. Please refer to this article and try NISA.

The post Why you should start stock investment “Tsumitate NISA” now appeared first on Our Bitcoin News.

1 year ago

84

1 year ago

84

English (US) ·

English (US) ·