The post Will the US Election Impact on Crypto Market Push Bitcoin to $80K? appeared first on Coinpedia Fintech News

The US election result and the Fed Interest rate cut have influenced the entire crypto market positively, especially the Bitcoin market. Since November 5, the BTC market has seen a growth of 12.78%. A crypto analyst, in a recent post on X, suggests that the Bitcoin price will touch $80K level next week. How? Curious to know? Dive in!

Bitcoin Price Target of $80,000 Predicted

In the last 30 days, Bitcoin has grown by 25.9%. Many believe that the Bitcoin market has not yet reached its peak. The analyst’s post predicts that the BTC price will reach the level of $80,000 within the next week.

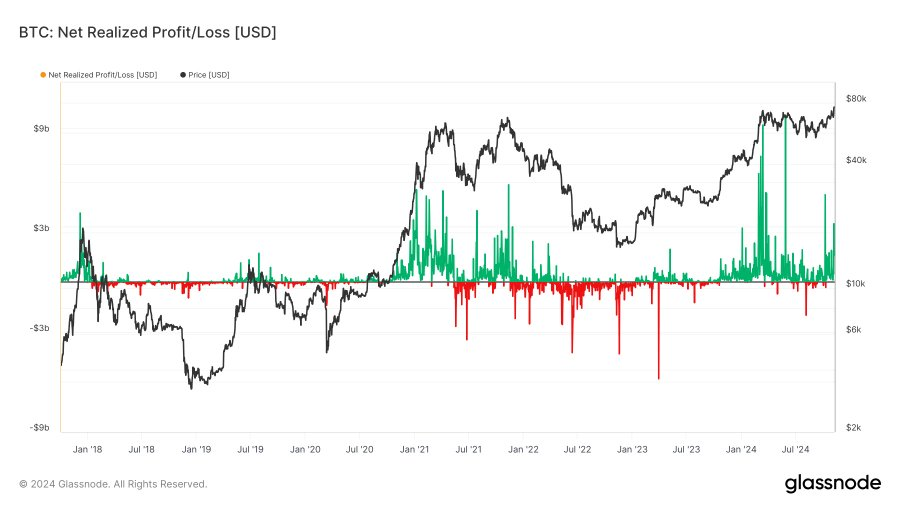

Low Profit-Taking Signals Investor Confidence

Generally, investors tend to take profits when they feel that their assets have peaked. If they choose to hold instead, it could suggest further growth potential. The Bitcoin Net Realised Profit/Loss chart shows that current levels of profit-taking are significantly lower compared to prior highs.

Bitcoin Below Inflation-Adjusted All-Time High

The crypto analyst also points out that the current price of Bitcoin is far lower than its inflation-adjusted ATH. This also indicates that the BTC market has the potential to grow further.

Bitcoin Consolidates for Nine Months

The crypto analyst highlights that the Bitcoin market has been in a consolidation phase for the last nine months. The analyst asserts that the consolidation of Bitcoin has strengthened the foundation of the asset. Many think that the stability gained by Bitcoin during the consolidation phase will help the asset to enter a strong bullish phase.

Bitcoin Market Landscape: A General Overview

The year 2024 is the second year of the current four-year cycle. Typically, the second and fourth years in a cycle are when the BTC market shows weaker performance. In 2012, the performance of BTC was just +183.5%. In 2016, it declined further to +123.8%. In the first quarter of 2024, the market registered a return of +68.7%. In the second quarter, it slipped to -12%.

However, in the third quarter, it slightly improved to +0.76%. In the first month of this fourth quarter, the market registered a return of +11.2%. Historically, Q4 has been a favorable period for BTC. In the previous Q4, the BTC market reported a return of +56.6%. On November 1, the Bitcoin price was $70,251.50. By November 4, it has fallen to a monthly low of $67,821.68. Since November 5, the market has surged by 12.78%.

In conclusion, with market momentum building, Van Straten’s projection suggests Bitcoin is poised for a significant leap, making $80,000 a realistic short-term target in line with this Bitcoin price prediction.

6 months ago

32

6 months ago

32

English (US) ·

English (US) ·