Macroeconomics and financial markets

In the US NY stock market on the 23rd, the Dow rose 75 dollars (0.23%) from the previous day, and the Nasdaq rose 117 dollars (1.01%), closing the trading with a slight rebound.

connection:U.S. IT stocks and Nasdaq rebound Overnight after additional FOMC interest rate hike | 24th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 3.14% from the previous day to $28,271.

BTC/USD daily

Buying interest seems to be strong as the price has recovered from the previous day’s sharp drop of $2,000. In addition to rising prices due to global inflation, there are also those who believe that the “alternative asset” of Bitcoin is attracting attention again due to the heightened financial instability triggered by a series of bankruptcies of major US banks.

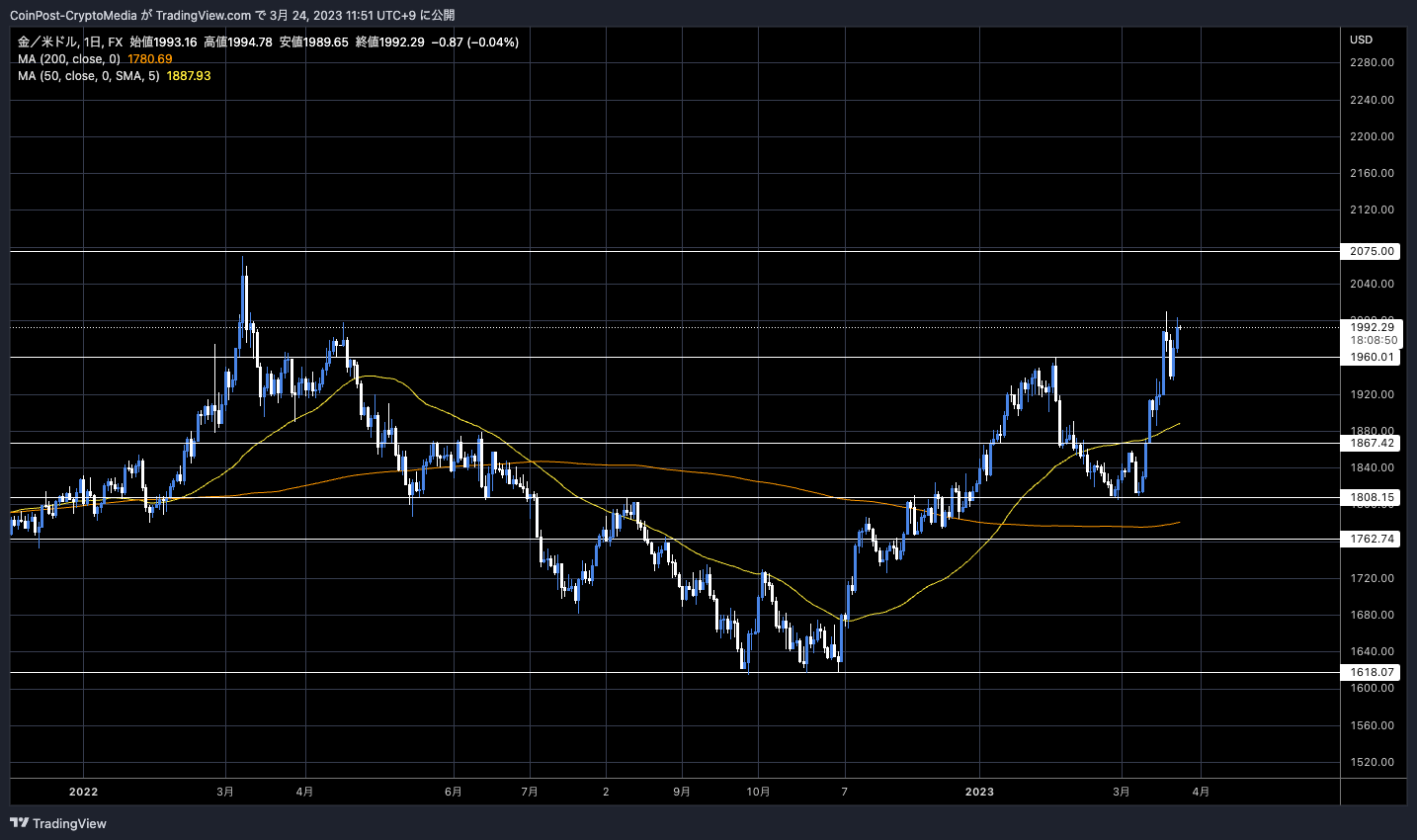

In the NY futures market, gold, which is considered a safe asset, soared, and 1 troy ounce was in the low $1,600 range in November last year.

XAU/USD daily

This is the highest level since April 2022, when Russia invaded Ukraine and geopolitical risks rose sharply.

Afterwards, the price fell temporarily due to a sense of achievement and overheating at a psychological milestone, but aggressive bargain buying led to a rebound to the $2,000 level.

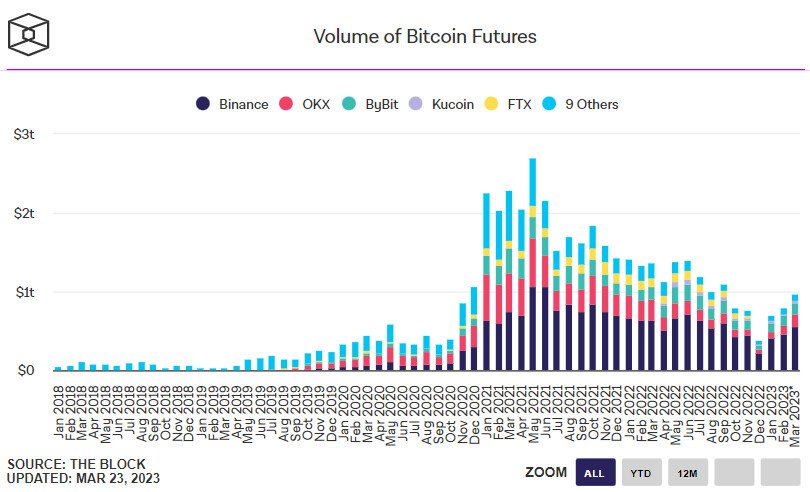

The high level of interest of large investors is beginning to appear in trading volume. Bitcoin’s weekly trading volume rose to $24 billion, the highest level since mid-2021, when the bull trend hit new all-time highs, according to data from TheBlock.

TheBlock1

Futures trading volume has risen to levels not seen since September 2022, reaching the $1 trillion level.

TheBlock2

Headwinds from stricter regulations

On the other hand, the aftermath of the major cryptocurrency exchange FTX, which went bankrupt in November last year, continues, and regulatory headwinds are blowing, especially in the United States.

On the 22nd, it was reported that the U.S. SEC (Securities and Exchange Commission) had issued a Wells notice to major U.S. exchange Coinbase on suspicion of violating securities laws. invited.

Earlier this month, U.S. exchange Kraken was sued for violating securities laws, forcing it to stop providing staking services to U.S. customers and pay a settlement. Staking is a mechanism in which a certain amount of virtual currency is deposited for a specified period of time, and income gain is obtained as compensation.

connection:SEC Investigates Coinbase for Securities Law Violations, Sends Wells Notice

The dynamics surrounding US regulators are also changing the balance of power for US dollar-linked stablecoins. The dominance of Tether (USDT), which had been declining for a while, is expanding again, exceeding the 50% level.

Stablecoin Dominance Transition

The background is the shrinking share of USDC and BUSD, which had grown to the second largest market capitalization after USDT.

In February of this year, the SEC issued a Wells notice alleging that the US dollar-backed stablecoin “Binance USD (BUSD)” was a security and the issuing company Paxos failed to register its securities with the SEC. The New York State Department of Financial Services (NYDFS) also ordered the suspension of new issuance of BUSD.

Furthermore, at the beginning of this month, Silicon Valley Bank (SVB) went bankrupt, and Circle, which issues the US dollar-linked stablecoin “USD Coin (USDC),” was unable to withdraw $3.3 billion (approximately 450 billion yen). This has led to a dipeg (downward divergence) from $1.00.

connection:US Circle puts transfer of $3.3 billion USDC reserves pending at Silicon Valley Bank

altcoin market

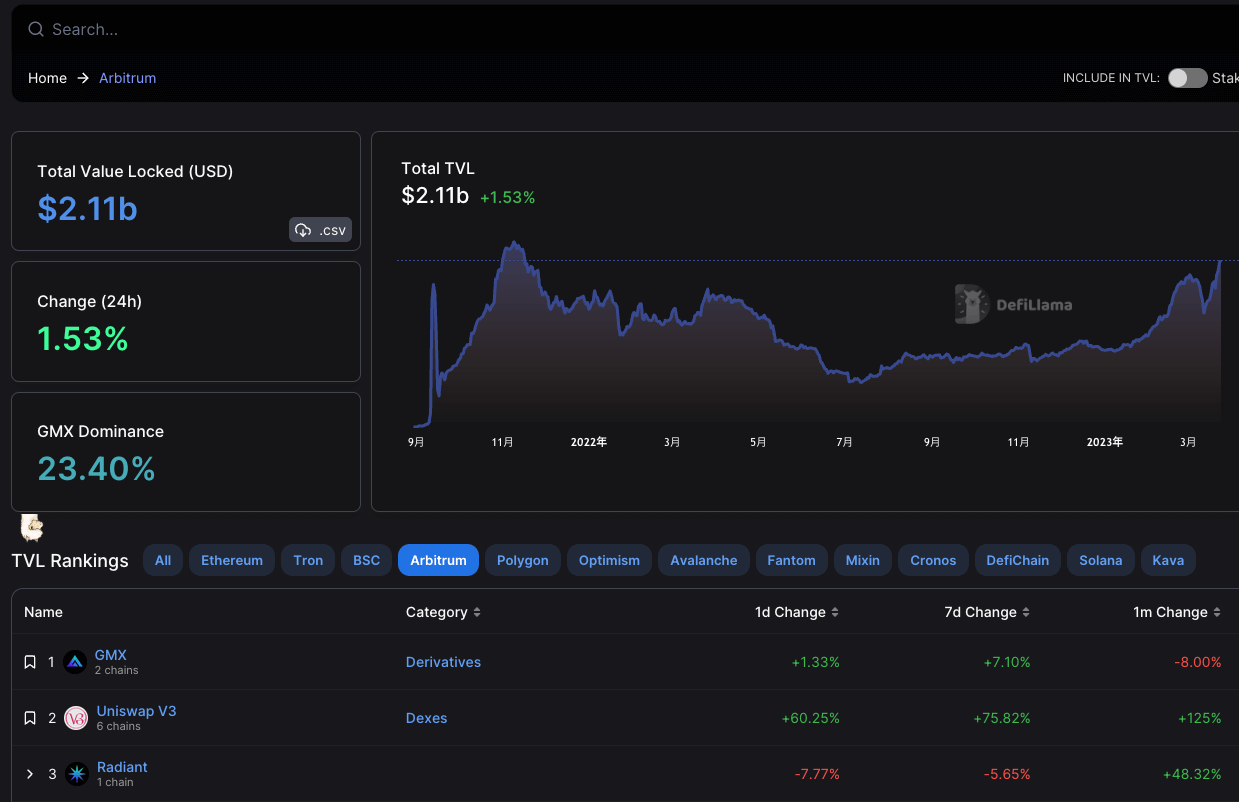

Among individual stocks on the Alt Market, an airdrop of Arbitrum (ARB), which uses Optimistic rollup technology on Ethereum’s largest Layer 2 blockchain, was held.

We understand there has been difficulty connecting to the foundation site and claiming tokens.

These issues are now resolved, and claiming is well underway.

We greatly appreciate everyone’s patience throughout these times of exceptionally high traffic.

Please read

pic.twitter.com/pdIyI2bumW

pic.twitter.com/pdIyI2bumW

— Arbitrum ( ,

,  ) (@arbitrum) March 23, 2023

) (@arbitrum) March 23, 2023

This AirDro represents 12.75% of the total supply of 10 billion cards and is targeted at Arbitrum One and Arbitrum Nova users.

Arbitrum’s official website went down, unable to bear the load of over 84,000 claims in the 30 minutes after the airdraw. ARB’s trading volume reached $388 million in 24 hours.

The top airdrops include the decentralized game ecosystem ‘Treasure_DAO’, the decentralized exchange ‘GMX’, and the decentralized exchange ‘Uniswap’. According to DefiLlama data, Total Value Locked (TVL), which indicates total deposits, was about twice as high as Optimism.

De fi Llama

connection:

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Willingness to buy Bitcoin is strong, to Arbitrum (ARB) airdrop, the largest L2 force appeared first on Our Bitcoin News.

2 years ago

147

2 years ago

147

English (US) ·

English (US) ·