For those who know financial planner Suze Orman’s work, it’s no surprise that her debut into startup life begins with the word secure. The personal finance thought leader has over 30 million copies of her book in print, does seminars all over the world, but as she most recently told TechCrunch, “the only thing that really transformed people’s lives, in my opinion, was the ‘Suze Orman Show.’” The 12-season show aired on NBC, where Orman doled out wisdom on personal finance and the importance of an emerging savings account.

“People would sit there and they would be entertained and they would understand,” Orman said. “People just want to be told what to do. They don’t even care why they’re doing it, I’m sorry to say.”

The idea of doing, and not just saying, got Orman on board to join the founding team of SecureSave, a fintech company built by repeat founders Devin Miller and Bassam Saliba, who spun the business out of Pioneer Square Labs in Seattle. SecureSave is building an easier way for employers to offer employees sponsored emergency savings accounts.

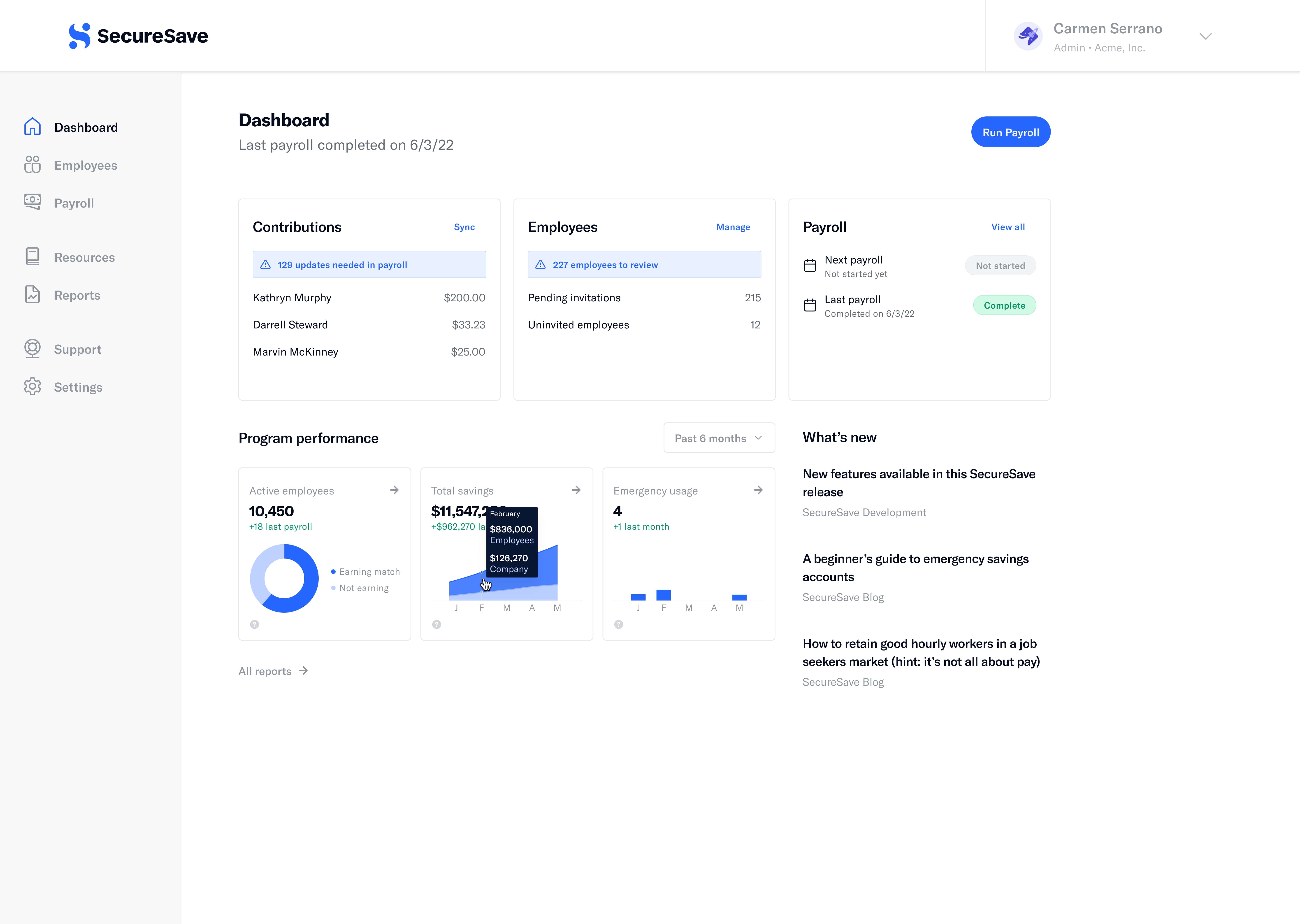

Today, SecureSave partners with companies to offer ESAs that can be automatically deducted from an employee’s payroll and deposited into an account; employers can also match contributions or appoint bonuses if employees hit saving targets. Unlike savings retirement accounts, ESAs allow employees to instantly access their accounts at any time.

After launching during the pandemic, SecureSave announced today that it has raised $11 million in a round led by Truist Ventures, the venture capital division of Truist Bank, with participation from Stearns Financial Services Inc. and crypto platform FTX.

The new round of funding follows a seed round in January 2021, although the co-founders do not view the tranche as either a seed add-on or a Series A round. When asked, Miller said that the latest round’s investors approached the company to invest “on favorable terms to the company in an additional seed round. So we put together new terms for these strategies, with all of our major investors participating as well.”

It’s unclear if the terms, or valuation at which SecureSave raised, was consistent with the seed or valued the company above or below its first round of financing — closed during a very different time in technology.

Notable semantics aside, it is fortuitous timing for the startup’s fundraise, given that the market is appearing to head into a downturn. (In a similar vein, Miller emphasized that “there’s no tie-in between what we’re doing and crypto; you’re not gonna save your emergency savings in crypto” despite FTX’s involvement in the round.)

It’s an echo of Orman’s philosophy, which is all about the importance of simple steps toward a healthier financial life.

Orman’s involvement was first hidden from the public, a choice the co-founders said they made as to shield the startup from mass attention until after the product had more legs. The co-founders said they had to prove Orman’s involvement was legitimate to investors when pitching. After all, she could have self-funded the startup.

“On our own, [Bassam] and I are a very fundable duo,” Miller said. “Bringing Suze in, we had to convince them that she was actually like, really deeply involved in the company.” Orman said she pushed back on a number of product roadmap suggestion from her other two co-founders, including making it look less like Mint, a personal finance platform adorned with graphs and data and more like a wallet that can inspire people to save.

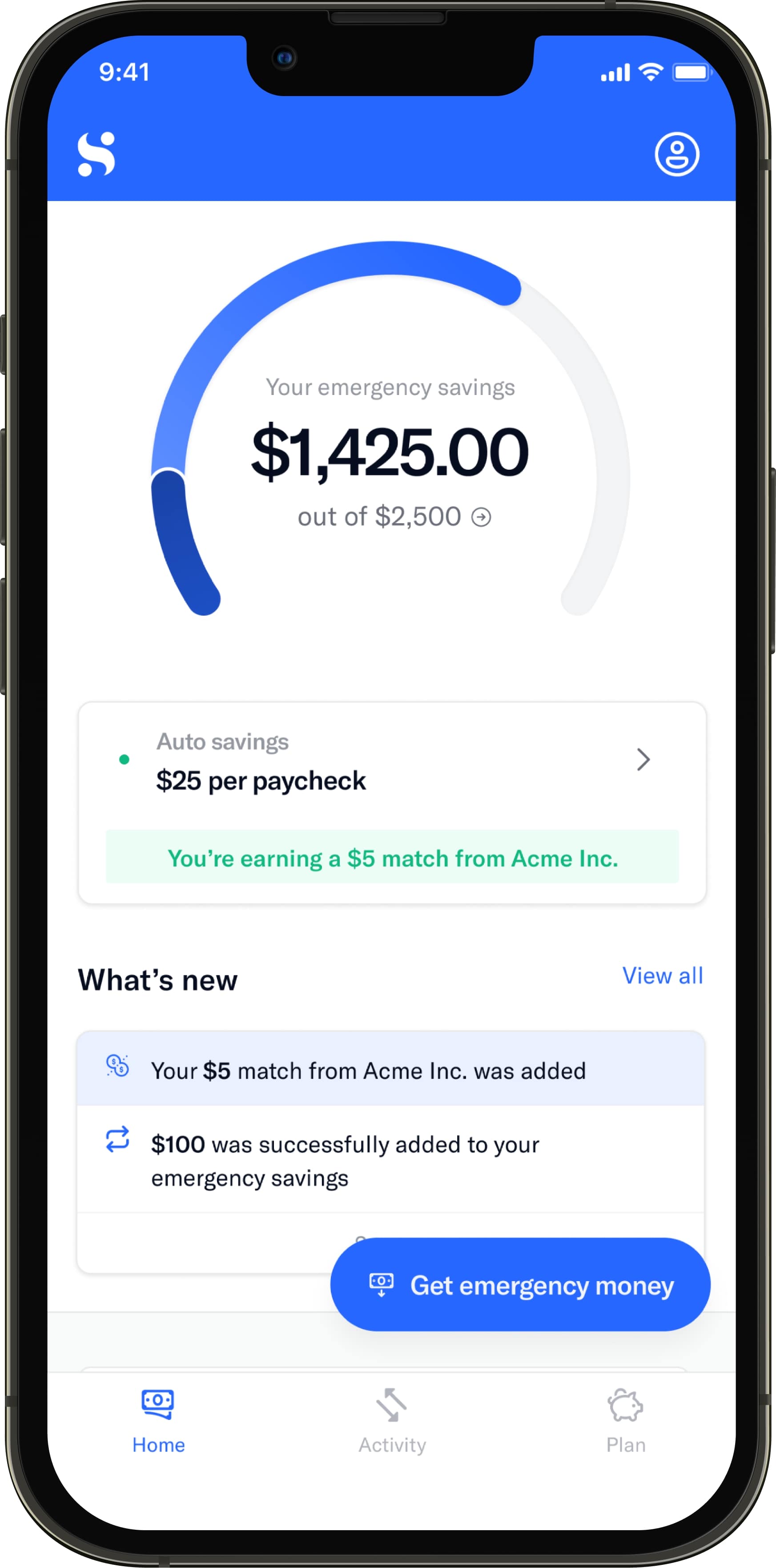

Orman’s early feedback, according to Saliba, impacted the design of the app so it just focused on telling people how much money is coming in and helping them get it when they have an emergency.

Image Credits: SecureSave

“Don’t get in the way of doing that, but don’t make it too simple,” he said. “We always use this analogy of, it’s a piggy bank and it’s your money, so if you have an emergency you’re able to get to that money but also if you have the hammer you’re about to smash it … we want to slow you down to make sure you really want to do that.”

The company declined to name specific names of customers or offer a total number of customers to date but did say that the dream would eventually be to serve larger businesses like Walmart and Chipotle, not just tech businesses with people who may already speak the language of neobanks and savings.

For employers to offer SecureSave, the price is typically $3 per employee per month. Most employers give around $125 per year in incentives, the startup says.

So far, the company says it is seeing nearly a 60% adoption rate, with employees saving on average over $100 per month, and over half of users checking their accounts each month. Over 90% of employees are still participating in the program six months after joining, which indicates a sort of stickiness that fintechs love.

Image Credits: SecureSave

One thing that fintechs love that SecureSave doesn’t, though, is the move to going horizontal. The co-founders said that they’re not going to use ESAs as a wedge to get into every other corner of an employee’s financial life; instead focusing on the vertical at large instead of a suite of different products.

“Everybody else is trying to land and expand, they’re trying to rationalize these ridiculous customer cost of acquisition prices,” Miller said. “But as a fintech trying to spend money to acquire and expand … we had a number of investors as far back as a year and a half ago saying [we] just don’t really want to fund those companies anymore … and I think now that’s just a dead proposition.”

He added: “Our bet is that emergency savings as a brand concept and as an industry vertical is big enough.”

English (US) ·

English (US) ·