Centralized crypto asset (virtual currency) exchanges have recently seen large amounts of Bitcoin withdrawn, as there is a growing belief that Bitcoin (BTC) will continue to rise to over $40,000 by the end of the year.

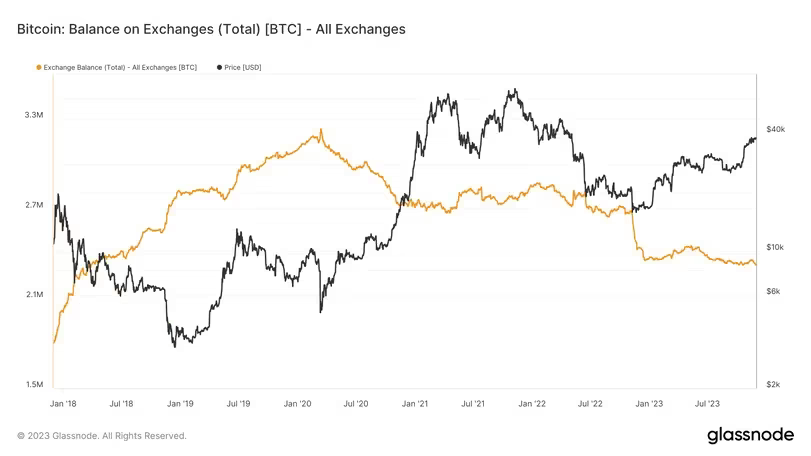

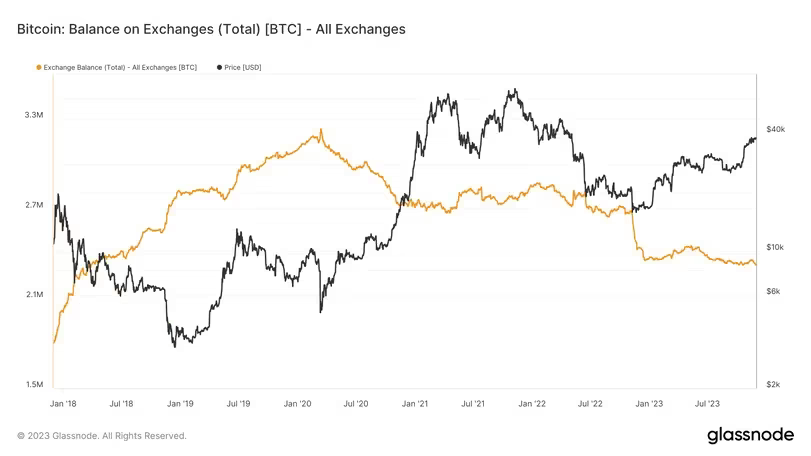

According to data from Glassnode, since November 17th, 37,000 BTC worth $1.4 billion (approximately 210 billion yen, at an exchange rate of 1 dollar = 150 yen) has been collected as proof that investors directly own the coin. is being withdrawn from the exchange.

While some of this may be due to Binance pleading guilty, the withdrawals likely represent a bias towards long-term holding strategies. With the expected launch of a Bitcoin exchange-traded fund (ETF) in the US, the long-term holding bias means strong market demand and less sell-side pressure.

Fund outflows from exchanges indicate that prices are currently at historically low levels, supporting expectations for price growth in the medium term.

Bitcoin withdrawals from centralized exchanges are typically inversely correlated with price. (Glassnode)

Bitcoin withdrawals from centralized exchanges are typically inversely correlated with price. (Glassnode)BTC traded above the $38,000 mark on December 1, leading to a rally across the crypto market, with some major tokens jumping as much as 5% in the past 24 hours.

Overall market capitalization rose to $1.5 trillion (about 225 trillion yen), a level last seen in May 2022, an increase of about $400 billion (about 60 trillion yen) since the beginning of October. did.

Some market watchers believe that the expected interest rate cuts by the US Federal Reserve (Fed) in the coming months will generally attract more capital to the market and reduce volatility in speculative markets like crypto assets. He says it is likely to increase.

“The Fed has paused its rate hike cycle and central banks around the world are following suit,” Anthony Rousseau, head of brokerage at TradeStation, told CoinDesk in an email. “It’s reasonable to think we’ve reached the top of the tightening cycle. We need to see a path forward, with lower interest rates and an end to quantitative tightening, if risk assets are to be auctioned off sustainably.”

“We could have a net positive liquidity opportunity for the market in 2024. Bitcoin is a pure reflection of the market’s net liquidity, supporting a substantial bullish move.” For that, we need positive liquidity,” Rousseau added.

Federal Reserve Director Chris Waller said recent data suggested a slowing economy and continued moderate inflation showed current policy was in the “right place.” , Bitcoin’s momentum started to rise from November 28th.

Waller also said there is a good case for cutting interest rates in the coming months if inflation continues to fall.

Interest rate decisions tend to move markets. When interest rates rise, risky assets such as stocks and cryptocurrencies typically suffer as investors may take profits and invest in bonds.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Shutterstock

|Original: Bitcoin Eyes $40K as $1B in BTC Withdrawals Suggests Bullish Mood

The post Withdrawal of $1 billion suggests bullish mood, Bitcoin aims for $40,000 | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

66

1 year ago

66

English (US) ·

English (US) ·