Digital currencies remain indecisive, with Bitcoin trading below the $85K mark, hovering at $84,749.

Ripple’s XRP displays warning signals amidst the prevailing uncertainty.

XRP changes hands at $2.13 during this writing.

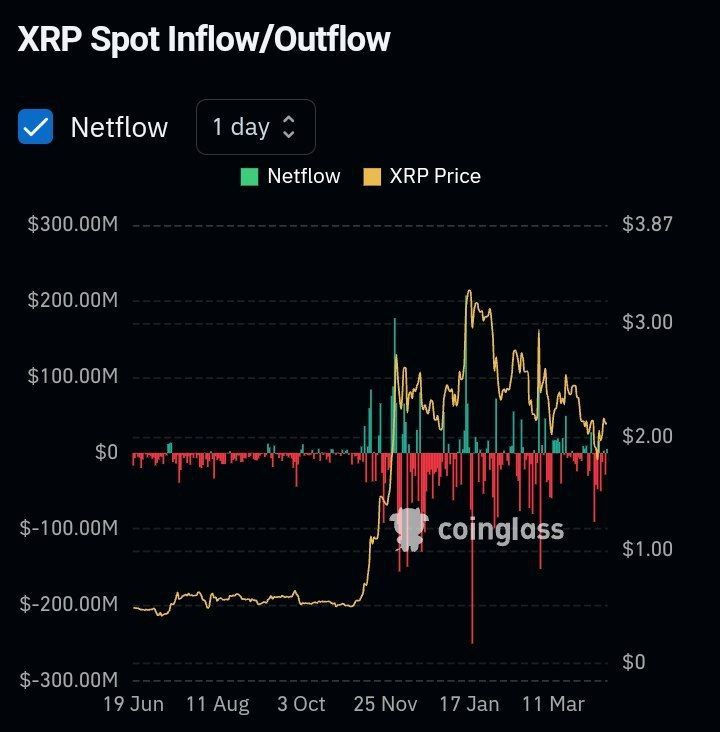

While steadying above the key $2 mark, a potential death cross on its price chart, coinciding with April outflows surpassing $300 million, hinted at bearish dominance.

XRP sentiments weaken as outflows dominate April

Coinglass data shows that XRP-linked investment products suffered massive outflows this month, with more than $300 million exiting the asset’s funds in April.

Source: Coinglass

Source: CoinglassThat represents the worst monthly performance in 2025.

Various factors contributed to the substantial outflows.

First and foremost, Ripple’s legal developments with the SEC continue to influence XRP’s performance.

While everything points to imminent resolution, uncertainty remains.

Experts seem against the perception that XRP will “moon” immediately after the SEC lawsuit officially ends.

Ripple enthusiast All Things XRP believes the market has already priced in the SEC case conclusion.

He urged participants to focus on what the remittance firm does next after the legal battle, including strategic collaborations and utility.

Source: X

Source: XThat could have discouraged new players who joined while anticipating solid rallies upon an official SEC-Ripple battle end.

Also, XRP has disappointed in utility growth.

While rivals like Solana and Ethereum witness real-world adoption, XRP hasn’t dominated its primary utility, facilitating cross-border transactions.

Also, intensifying competition as investors turn to cheaper and quicker alternatives has dented XRP’s outlook.

XRP price: the approaching death cross

The altcoin attracted optimism as its latest surge past the $2 psychological level indicated a potential breakout.

Meanwhile, weakening indicators are appearing following rejection at the 100-day EMA.

The altcoin displays a pre-death cross as the 50-day EMA crosses the 100-day EMA to the downside.

Source: TradingView

Source: TradingViewThat has amplified the bearish mood within the Ripple community.

Maintaining the current structure will likely lead to a death cross in the upcoming sessions.

That happens when the 50EMA crosses below the 200EMA.

Such a move will trigger extended price dips or consolidations as XRP loses the vital support barrier at $2.

On-chain metrics confirm XRP’s weakness.

For instance, the open interest has declined by over 10% to $3.17 billion (Coinglass data).

That shows traders refraining from opening new positions amid uncertainty.

XRP trades at $2.13 after losing over 1.7% in the past 24 hours.

The massive outflows threaten the alt’s stability, with the impending death cross suggesting a bearish performance in the upcoming sessions.

However, enhanced sentiments, like official resolutions of the SEC battle, could rescue XRP from the impending death cross and attract new buyers.

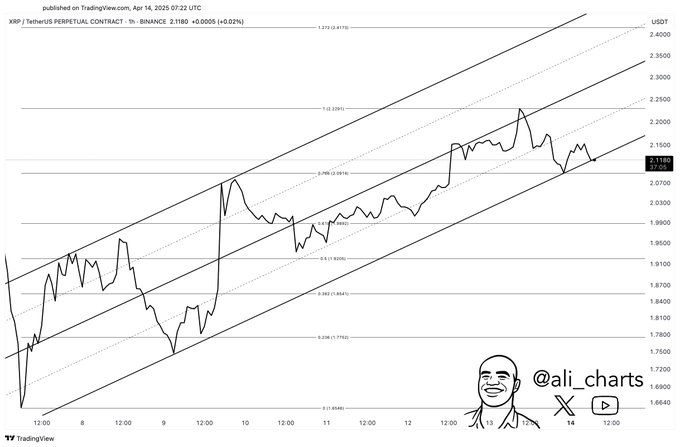

Crypto analyst Ali Martinez highlighted that XRP trades inside an ascending triangle, with a crucial resistance at $2.22.

Source: Ali on X

Source: Ali on XOvercoming the obstacle could trigger price surges to $2.40 and open the path to the sought-after $3.

The post XRP price forecast: will $300M outflows trigger a crash? appeared first on Invezz

English (US) ·

English (US) ·