The post XRP Price Hit 3-Month Low as Whale Sell-off Surge – What Next For XRP Price ? appeared first on Coinpedia Fintech News

Lately, reports have indicated that major investors are moving investment away from Ripple (XRP). Due to the ongoing challenges such as legal issues and a decline in market confidence, ripple has witnessed a significant loss of its major investors, which indeed made XRP price to fall to 3 month low at $0.50 after reaching it’s all time high.

Whales Dumping XRP

Amidst the ongoing crypto slump, Whales’ choose to dump Ripple (XRP), formerly a significant holding in their portfolios, is the result of several variables coming together. Because of regulatory issues and ongoing market correction, investors act cautiously and raise doubts.

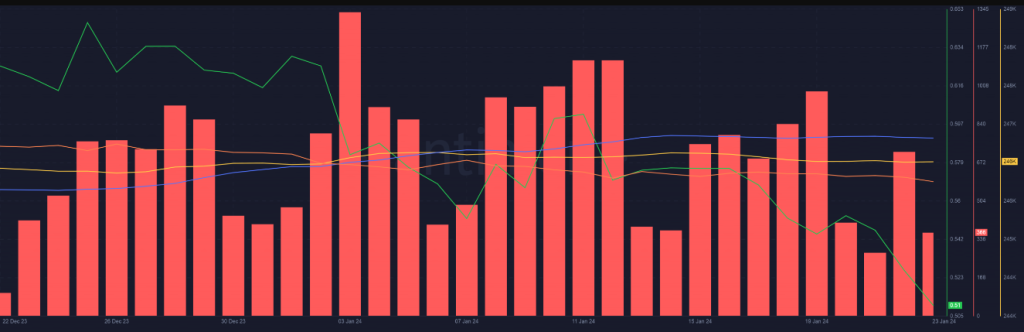

Recently, XRP experienced a significant drop to $0.50, plummeting more than 5% in 24 hours, marking its lowest point in three months. This decline raises concerns as it risks erasing all the gains achieved since the mid-October rally.

At the same time, there was an increase of 80% in the amount of XRP being sold, showing that many traders are deciding to sell off.

Tweet Impact on XRP’s Downturn

Many believe the downturn occurred shortly after the tweet of prominent chart analyst Ali Martinez. Who pointed out that the TD Sequential indicator has demonstrated its accuracy in forecasting XRP’s trends.

Notably, the indicator displays a buy signal on the 3-day, indicating that XRP might be preparing for a rebound. However, further analysis of XRP’s technical indicators reveals a more complex situation.

While examining the daily chart, the Relative Strength Index (RSI) indicated oversold conditions, typically signaling a bearish trend; such levels can trigger buy signals. Additionally, the Moving Average Convergence Divergence (MACD) moved below the signal line, reflecting a negative trend dominated by bearish forces.

Trader Incuring Huge Losses

The decline in XRP’s price not only impacted short-term traders but also affected the overall profitability of asset holders. According to Santiment’s data, most traders would incur losses of 5.61% at the current price if they decide to sell their coins.

These market conditions might discourage traders who prefer short-term investments in XRP. However experienced traders who believe in the coin’s future success might see this as a chance to buy XRP at a lower price and strengthen their positions.

Interestingly, even though the price dropped, there was a noticeable increase in transactions by big XRP holders (whales). However, there wasn’t a substantial rise in the number of new large XRP holders, but whales didn’t massively accumulate more XRP during this price decline.

1 year ago

113

1 year ago

113

English (US) ·

English (US) ·