The post XRP Price Poised for 20% Rally as Whales Buy 60M Tokens appeared first on Coinpedia Fintech News

Amid the ongoing market uncertainty, XRP, the native token of Ripple Labs, appears to be gaining significant attention from crypto enthusiasts following the formation of bullish price action.

Whales Purchase 60 Million XRP Tokens

Today, February 17, 2025, a prominent crypto expert shared a post on X (previously Twitter) stating that crypto whales have purchased 60 million XRP tokens in the past 24 hours.

This substantial purchase by Whales didn’t have any impact on XRP’s price, as it is currently trading near $2.70 and has witnessed a 1% decline in the past 24 hours. However, during the same period, the bullish price action attracted notable participation from traders and investors, leading to a 22% increase in trading volume.

XRP Technical Analysis and Key Levels

According to expert technical analysis, XRP has formed a bullish cup and handle pattern on the four-hour timeframe and is currently on the verge of a breakout. Based on this pattern, if XRP breaks out and closes a four-hour candle above $2.80, there is a strong possibility it could soar by 20%, reaching the $3.20 level in the near future.

Source: Trading View

Source: Trading ViewCurrently, the asset is finding support at the 200 Exponential Moving Average (EMA) on the four-hour timeframe, indicating that it is in an uptrend.

Traders Bullish Perspective

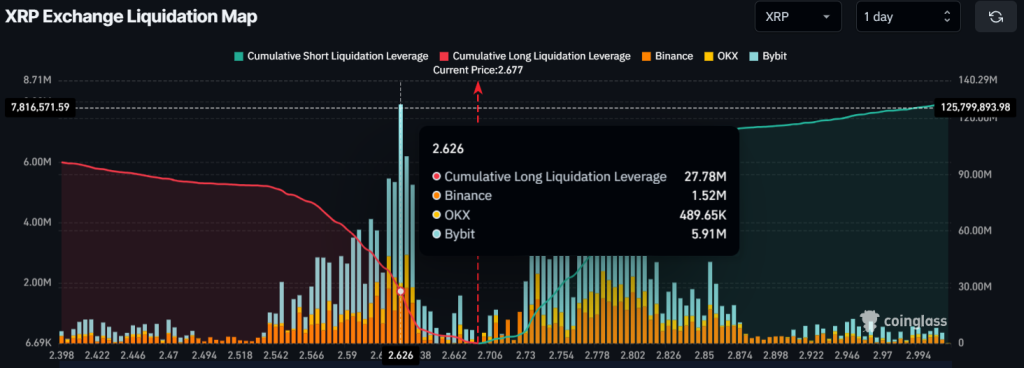

Looking at the bullish price action and recent whale accumulations, intraday traders and long-term holders are betting on the long side, as reported by the on-chain analytics firm Coinglass.

Source: Coinglass

Source: CoinglassAt press time, traders holding long positions are highly dominant, being overleveraged at $2.62 with $28 million worth of long positions. Meanwhile, $2.73 is another overleveraged level, where traders holding short positions have accumulated $12.66 million worth of short positions.

These on-chain metrics indicate that bulls are back to support the asset, and it may soon experience a notable price rebound.

3 months ago

30

3 months ago

30

English (US) ·

English (US) ·