The post XRP Price Set to Rally, On-Chain Metrics Signals Buy Opportunity appeared first on Coinpedia Fintech News

On September 28, 2024, Ripple’s native token XRP broke one of the most awaited consolidation zones and is now poised for a significant upside rally. Since Sept 12, XRP has been consolidating between 0.56 and $0.59 levels. However, following this breakout, the overall sentiment has shifted from a downtrend to an uptrend.

XRP Current Price Momentum

It appears that XRP’s bullish momentum has arrived later compared to major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Binance Coin (BNB).

At press time, while major cryptocurrencies are facing a price correction, XRP experienced a massive price surge of over 5.2% and is currently trading near $0.62. In addition to the price surge, it appears that investors and traders are showing significant interest in the token, leading to a 64% spike in trading volume during the same period.

XRP Technical Analysis and Upcoming Levels

According to expert technical analysis, despite gaining a massive price surge during a market correction, XRP is currently facing a strong resistance level of $0.647. Moreover, the token is in an uptrend as it trading above the 200 Exponential Moving Average (EMA) on a daily time frame.

Source: Trading View

Source: Trading ViewBased on recent performance, if XRP breaches the resistance level and closes a daily candle above the $0.65 level, there is a strong possibility that it could soar by 15% to reach the $0.75 level in the coming days.

Bullish On-Chain Metrics

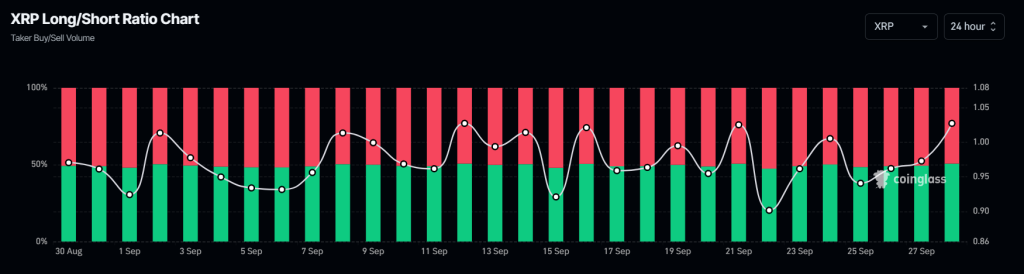

However, XRP’s bullish outlook is further supported by on-chain metrics. Coinglass’s Long/Short ratio currently stands at 1.027, indicating a strong bullish sentiment among traders.

Source: Coinglass

Source: CoinglassAdditionally, its future open interest has skyrocketed by 17.9% in the last 24 hours and 7.3% in the last four hours. This rising open interest indicates traders’ and investors’ sentiment and potentially they might be betting more on long positions than short positions.

Currently, 51.25% of top traders hold long positions, while 48.75% hold short positions. While combining all this on-chain data with technical analysis, it appears that bulls are dominating the XRP.

10 months ago

41

10 months ago

41

English (US) ·

English (US) ·