XRP (XRP), a crypto asset (virtual currency) specializing in payments, surpassed Binance Coin (BNB) to become the fourth largest crypto asset in the world in terms of market capitalization.

At the time of writing, XRP’s market capitalization is at $41.44 billion, up 66% in the last 24 hours alone, according to CoinDesk data. Meanwhile, BNB’s market capitalization increased by 6.5% to $40.57 billion. The price of XRP soared from 47 cents to nearly 78 cents.

Ripple’s partial victory in a lengthy legal battle with the U.S. Securities and Exchange Commission (SEC) over the sale of XRP has helped the cryptocurrency soar.

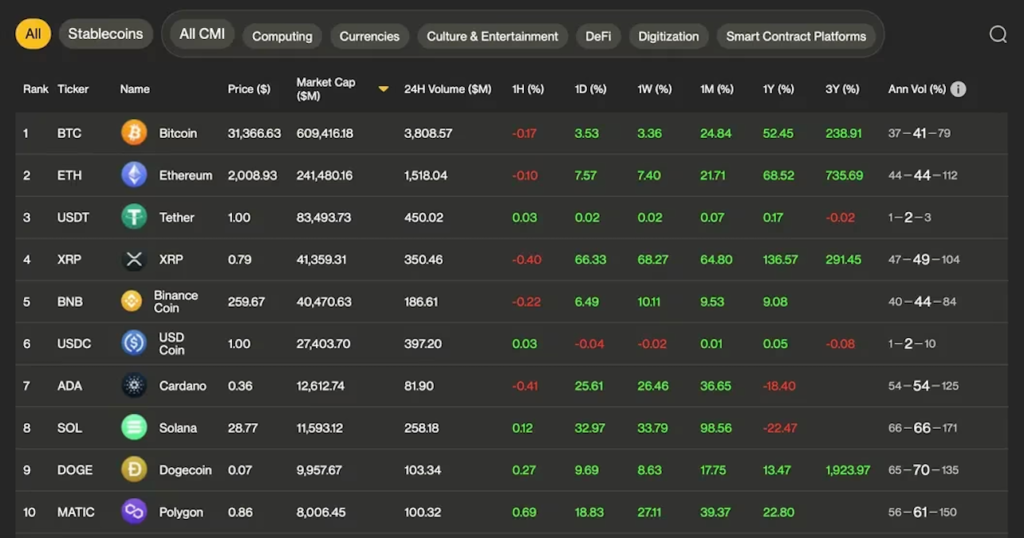

Top crypto assets by market capitalization (CoinDesk Indices)

Top crypto assets by market capitalization (CoinDesk Indices)On July 13, the US District Court for the Southern District of New York ruled that Ripple’s offer and sale of XRP on its cryptocurrency exchange did not constitute the offer and sale of investment contracts as alleged by the SEC.

However, the court ruled that Ripple’s direct sale of more than $700 million worth of XRP to institutional investors, hedge funds and others violated securities laws. In late 2020, the SEC sued Ripple for selling unregistered securities after the company sold $1.3 billion worth of XRP. The regulatory action forced several exchanges to delist XRP, leaving the cryptocurrency under pressure.

The first part of the ruling opened the door for relisting of XRP on centralized exchanges.Crypto.comhas already taken this step,Geminiseeks to list XRP in both spot and derivatives trading.

Meanwhile, in the second part of the ruling, XRP is a security, according to Townsend Lansing, chief product officer at asset manager CoinShares.

“The court ruled that Ripple violated securities laws, particularly with respect to direct sales to institutional investors. Therefore, not only is XRP considered a security, but the legality of its sale is also questionable. Regarding these sales, the court found that there was indeed a violation of the law, a sizable win for the Securities and Exchange Commission (SEC) and setting a precedent for legal action against other crypto assets.” said Lansing in an email.

“It is important to note that institutional investors who buy directly from Ripple may be subject to class action lawsuits as potential underwriters. We’ll have to wait and see,” Lansing added.

Traders have yet to pay attention to the second part of the judgment. This is evidenced by the surge in prices and the bullish positioning of the perpetual futures market.

Perpetual futures are like standard futures contracts with no expiration date or settlement date.

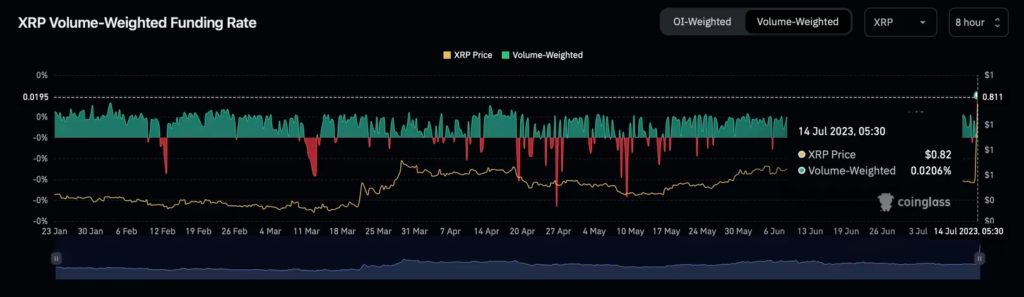

The perpetual futures market is skewed bullish as suggested by the positive funding rate. (Coinglass)

The perpetual futures market is skewed bullish as suggested by the positive funding rate. (Coinglass)The volume-weighted average funding rate for global perpetual futures has surged to its highest level since at least December, according to data from Coinglass. The open interest weighted average funding rate also rose to a four-month high.

Both suggest that the leverage is completely skewed to the bullish side.

The funding rate is the periodic asset payment between strong long position holders and bearish short position holders in the perpetual futures market. If this is positive, it means that longs are dominant and they are paying shorts to maintain their positions.

|Translation: CoinDesk JAPAN

|Editing: Toshihiko Inoue

| Image: CoinDesk Indices

|Original: XRP Overtakes BNB to Become 4th Largest Cryptocurrency; Funding Rates Surge

The post XRP, the 4th largest crypto asset by market capitalization ─ Funding rate soars | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

1 year ago

138

1 year ago

138

English (US) ·

English (US) ·