Zcash (ZEC), one of the earliest privacy-focused cryptocurrencies, has staged a dramatic comeback that has captured the attention of both retail traders and institutional investors.

After spending much of the past year trading quietly in the shadows, ZEC has surged by more than 140% in the last seven days, briefly touching a three-year high of $153.

Following the price surge, ZCash has far outpaced Bitcoin (BTC), which is experiencing a steadier but far more modest rally.

But the question in many traders’ minds is what has fueled this sudden explosion in ZEC’s price, and whether it signals a long-term revival for the coin.

Grayscale’s Zcash Trust

The catalyst behind the rally has been the launch of Grayscale’s Zcash Trust, which provides accredited investors with regulated exposure to ZEC.

The Trust has already attracted more than $46 million in assets under management, and its debut has been widely interpreted as a signal that institutional players are beginning to take privacy coins seriously.

Trading activity has surged in parallel, with ZEC’s derivatives market seeing open interest jump more than 200% in just 24 hours to over $120 million.

Funding rates have also flipped positive, highlighting a clear shift toward bullish sentiment.

This influx of institutional demand marks a departure from the speculative pumps Zcash has seen in the past.

It suggests that investors are no longer looking at ZEC as just another volatile altcoin, but as a project with renewed relevance in a market increasingly concerned about surveillance and transparency.

Privacy narrative finds new life

Notably, the timing of ZEC’s breakout has coincided with a broader debate around privacy in the digital age.

In recent months, governments have accelerated their push for central bank digital currencies, which critics argue could erode financial privacy.

Crypto voices such as Helius CEO Mert Mumtaz have argued that “a world where crypto succeeds but privacy doesn’t is a dystopian nightmare.”

look some of you are in the replies asking why I’ve been shilling Zcash for a while relatively simple i) three important missions in crypto: markets, store of value, privacy/freedom the last one has been slept on, and it’s about to make a comeback as CBDCs and centralized

Mumtaz’s comments echo the growing unease around the surveillance potential of CBDCs and the risks posed by fully transparent blockchains like Bitcoin.

Zcash, with its zero-knowledge proof technology that allows shielded transactions, offers an alternative. It is a coin that enables users to choose between transparent and private transactions, and that flexibility has become increasingly attractive as regulators tighten oversight.

Naval Ravikant, the AngelList co-founder and prominent investor, put it succinctly when he described Zcash as “insurance against Bitcoin,” just as Bitcoin is seen as insurance against fiat currency.

His endorsement has amplified ZEC’s narrative at a time when privacy is becoming a mainstream concern.

Technical analysis paints a bullish picture

The technical outlook for Zcash adds to the sense that this rally is more than just hype.

ZEC has broken above the 61.8% Fibonacci retracement level at $111, retraced from the May 2021 high of $372 down to its July 2024 low of $15.

Analysts argue that a decisive close above this level could set the stage for a run toward the next retracement zone at $189, with further upside potential extending to $280 or even $500 if momentum holds.

However, the rally has also pushed ZEC’s Relative Strength Index (RSI) into overbought territory, flashing at 90 on the daily chart.

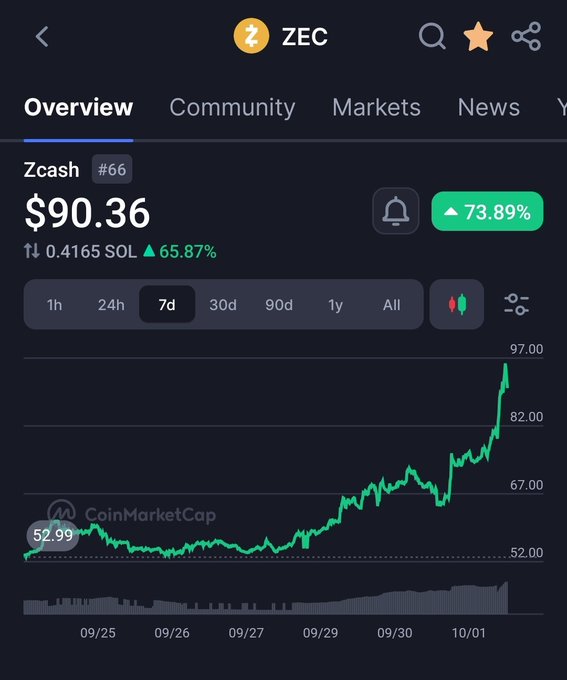

ZCash price chart | Source: CoinMarketCap

ZCash price chart | Source: CoinMarketCapWhile momentum indicators like the MACD remain firmly bullish, traders caution that a pullback or consolidation phase could be imminent.

Furthermore, the support levels at $111, $100, and $76 provide a cushion if profit-taking accelerates.

The post ZCash (ZEC) price is up 140%, but why is the privacy coin outperforming Bitcoin? appeared first on Invezz

English (US) ·

English (US) ·