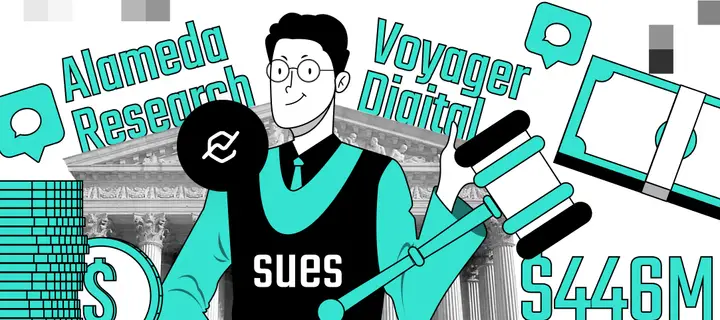

The defunct investment arm of Sam Bankman-Fried’s former FTX empire is trying to recover $446 million in loan repayments FTX made to Voyager in November.

Alameda filed a lawsuit against Voyager on Jan. 30. Although both companies had filed for Chapter 11 bankruptcy in 2022, Voyager filed in July, four months before FTX’s collapse. Under Chapter 11, Voyager demanded repayment of all outstanding loans to FTX and Alameda.

According to a new filing, some of the loans repaid to Voyager should be returned to Alameda because they were made so close to the time the company filed for bankruptcy in November. Some of the repayments, $445.8 million, were remitted after the bankruptcy case was opened and may be considered a priority to Alameda’s creditors.

The filing also goes:

The collapse of Alameda and its affiliates amid allegations that Alameda was secretly borrowing billions of FTX-exchange assets is widely known. Largely lost in the (justified) attention paid to the alleged misconduct of Alameda and its now-indicted former leadership has been the role played by Voyager and other cryptocurrency “lenders” who funded Alameda and fueled that alleged misconduct, either knowingly or recklessly.

Voyager had 10 loans with Alameda at the time it filed for bankruptcy. They claimed that the loans were backed by FTT and SRM tokens as well as various cryptocurrencies including bitcoin, dogecoin, ether, USDC, litecoin and more. Alameda paid back the loans with those same cryptocurrencies.

However, Alameda’s attorneys stated that they were unable to determine whether Voyager ever had a valid hold on the collateral or if it was even connected to Alameda’s debt.

Back in October, FTX planned to buy out Voyager Digital.

Related: FTX US Purchases Voyager Digital’s Assets for $1.4 Billion

2 years ago

142

2 years ago

142

English (US) ·

English (US) ·