Macroeconomics and financial markets

On the US NY stock market on the 5th of the previous weekend, the Dow Jones Industrial Average rebounded by $546 (1.7%) higher than the previous day. The Nasdaq Index closed 102 points (0.8%) lower.

Some believe that the short covering of overheated regional bank stocks pushed up the market.

On the other hand, according to the US employment statistics released on the 5th, both the number of employees and wages rose, greatly exceeding market expectations, reconfirming the firmness of the labor market. The speculation of halting interest rate hikes has receded.

connection:NY Dow rebounds sharply Buyback to US regional bank stocks, Coinbase +18% from the previous day | 6th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

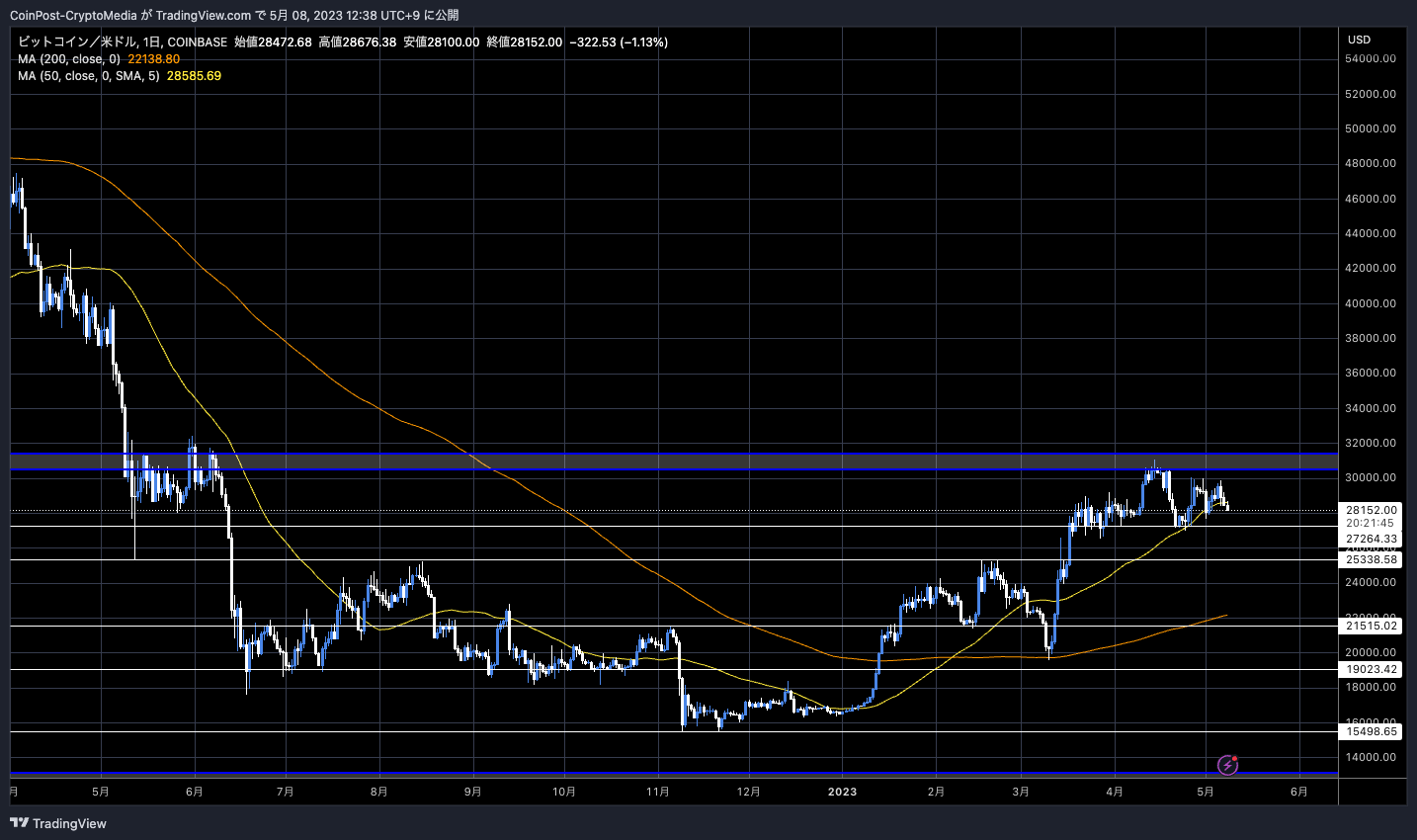

In the crypto asset (virtual currency) market, Bitcoin fell 1.96% from the previous day to $28,312.

BTC/USD daily

The number of transactions waiting for confirmation has reached about 500,000 in “mempool”, which is a temporary storage place for “unconfirmed transactions” that have not been incorporated into the Bitcoin blockchain.

As a result, Binance, the largest exchange, has temporarily suspended bitcoin remittances.

We’ve temporarily closed #BTC withdrawals due to the large volume of pending transactions.

Our team is currently working on a fix and will reopen $BTC Withdrawals as soon as possible.

Rest assured, funds are SAFU.

—Binance (@binance) May 8, 2023

Recently, with the resurgence of memecoins led by PEPE, it seems that interest in Ordinals (Inscription) and the experimental standard “BRC-20” token on the Bitcoin network has surged in the background.

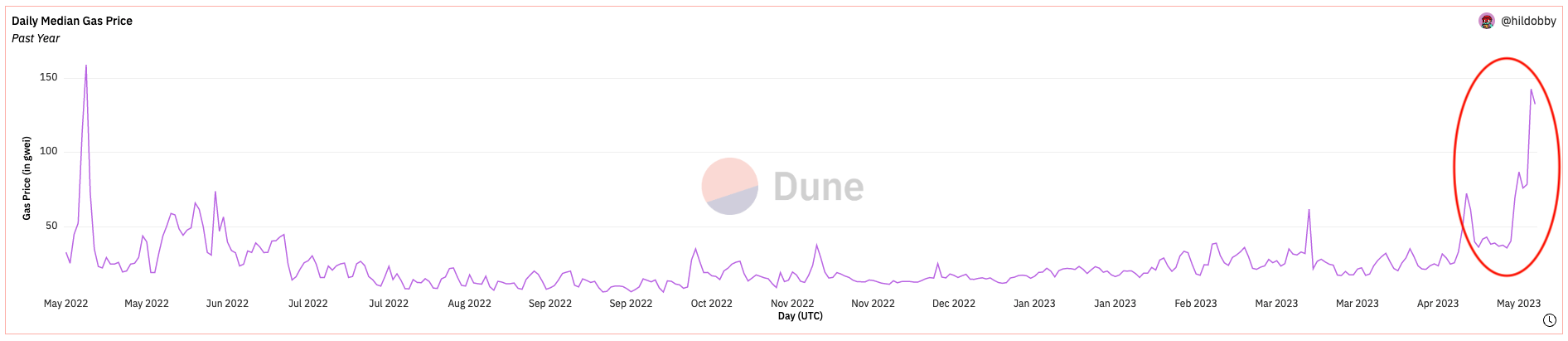

In PEPE-related transactions, UniSwap, a decentralized exchange, has processed more than 400,000 transactions, and Ethereum’s transaction fee (gas fee) has risen significantly. It reached the highest level since May last year.

Dune

While there are pros and cons, Kashif Raza, who is positive, said, “The Ordinals protocol was born with the major upgrade Taproot, and developers are exploring new possibilities. This is part of the open free market, BRC-20 “The growth of the token market means the exponential growth of Bitcoin.”

Some point out that the surge in transaction fees benefits miners and contributes to the robustness of security.

Ethereum Foundation ETH Sale?

It turned out that the Ethereum Foundation transferred ETH worth $ 30 million (4 billion yen) to the US exchange Kraken on the 6th of this month. A surge in inflow to exchanges suggests trading intent and selling pressure.

The Ethereum Foundation also sold in November 2021 when the ETH price hit a record high of $4,891.

$ETH

Friendly reminder that ETH foundation cashed out at the top (again). ETH down 40+% since then pic.twitter.com/Bp80hEDvK0

—Edward Morra (@edwardmorra_btc) January 21, 2022

In 2021, which was in the midst of a bull market, he also sold in March and May.

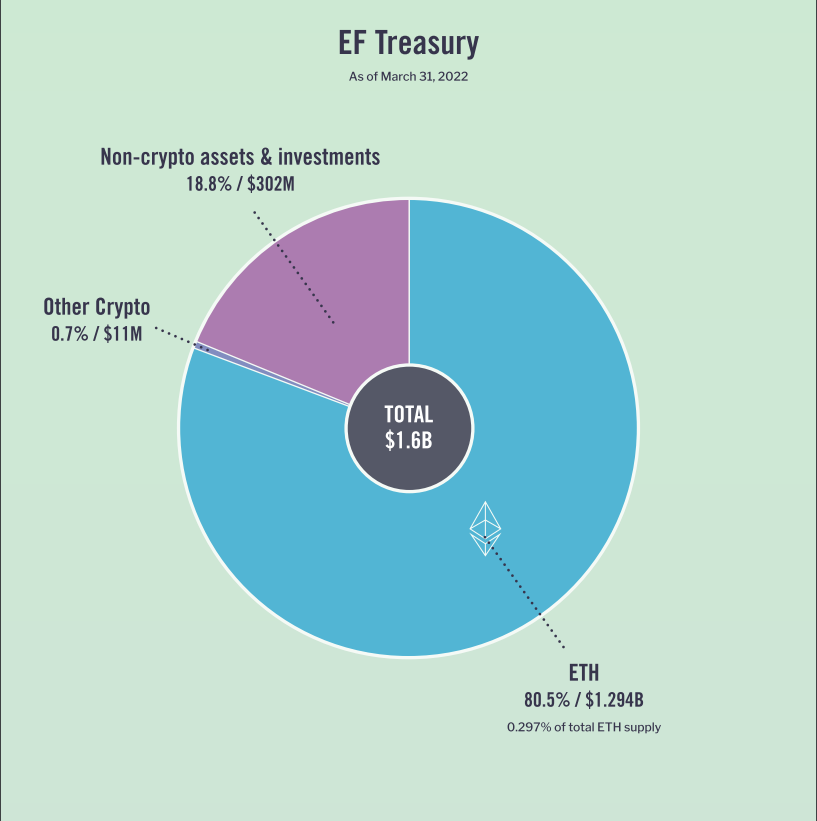

According to the foundation’s financial report released on March 31, 2022, it has assets of about $1.6 billion (215 billion yen).

Ethereum (ETH) accounts for about 80% of the portfolio, and non-cryptocurrencies such as cash are 18.8%, or about $300 million.

Through the Ethereum Ecosystem Support Program, the Ethereum Foundation provides “grant” and support to open source projects to strengthen their foundations. It has a particular focus on developer tools and infrastructure, as well as research and development.

In February 2023, we published a report on the ecosystem support program in the fourth quarter of 2022. Disclosed where about $4.4 million of funds will be allocated.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin remittance clogging becomes serious, Ethereum foundation sells ETH appeared first on Our Bitcoin News.

2 years ago

206

2 years ago

206

English (US) ·

English (US) ·